Neutral Bata India Ltd for the Target Rs. 985 by Motilal Oswal Financial Services Ltd

Disappointing performance continues

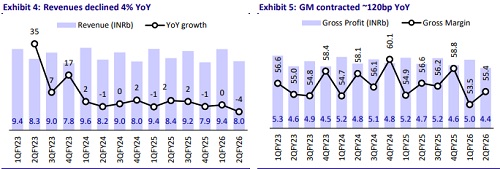

* Bata India’s (BATA) 2QFY26 revenue declined ~4% YoY, hurt by the deferment of purchases by channel partners and warehouse disruption.

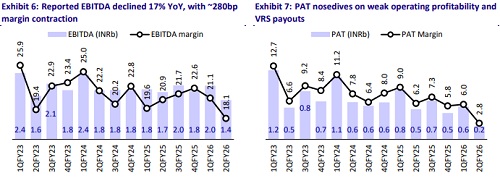

* Reported EBITDA declined 17% YoY, driven by weaker sales, gross margin contraction (higher markdowns for pre-festive inventory clearance), and higher marketing spends.

* 1HFY26 revenue declined 2% YoY, while pre-Ind AS EBITDA declined 28% to INR1.3b, with margins contracting to 7.5% (vs. 10.2% YoY), despite accounting changes that would have otherwise raised reported profitability.

* The value segment (~40% mix) is showing early signs of recovery, with GST pass-through and sharper pricing. Meanwhile, the premium (~20% mix) segment remains resilient, led by Hush Puppies and comfort-tech lines, supporting ASP accretion and mix improvement.

* Post-COVID, BATA accelerated its initiatives across distribution (expanding stores by ~30% via franchise), enhancing brand relevance and product mix (improving youth connect through new concepts like Floatz, Power, Sneaker Studios), and driving premiumization. However, these efforts have yet to translate into meaningful growth or margin recovery, with profitability still lagging pre-COVID levels.

* We cut our FY26-28E EBITDA by 7-10% due to continued challenges both on growth and profitability. We model a revenue/EBITDA/adj. PAT CAGR of 4%/9%/10% over FY26-28E. Reiterate Neutral with a revised TP of INR985.

Muted demand and GST transition drag performance

* Revenue declined 4% YoY to INR 8.0b (~7% miss), due to the deferment of trade and consumer purchases following the GST rate rationalization announcement and a temporary disruption in a key warehouse in July.

* BATA added 30 new (17 net) franchise stores during the quarter, maintaining its focus on asset-light expansion.

* Management indicated that 2Q ended on a positive note, with signs of recovery in the festive season.

* Gross margin contracted 122bp YoY to 55.4% (160bp miss), owing to higher markdowns for pre-festive inventory clearance.

* Consequently, gross profit declined 6% YoY (10% miss).

* Employee costs declined 2% YoY, while other expenses rose by a marginal 1% YoY.

* EBITDA declined 17% YoY (31% miss), led by weaker sales, gross margin contraction, and higher marketing spends. EBITDA margin contracted 280bp to 18.1% (610bp miss).

* Pre-IND AS EBITDA for 1HFY26 stood at INR1.3b (down 28% YoY), with margins contracting to 7.5% (vs. 10.2% YoY) despite a change in accounting for one of the brands, which would have resulted in optically higher margins.

* Profitability was further impacted by a VRS charge of INR83m.

* Reported PAT declined sharply by 73% YoY to INR139m due to weaker EBITDA, higher D&A (+16% YoY), and finance cost (+6% YoY).

* Inventory days improved to 83 days in 1HFY26 (vs 89 in 1HFY25), supported by better inventory clearance. Core working capital remained broadly steady at ~60 days.

* OCF (post leases) declined to INR525m (vs. INR2.1b YoY) due to subdued profitability and adverse WC changes. FCF was modest at INR273m (vs. INR1.8b/INR3.1b in 1HFY25/FY25).

* 1HFY26 revenue/EBITDA declined 2%/4% YoY, while profitability was significantly impacted. Based on our estimates, the implied growth rate for revenue/EBITDA/PAT in 2HFY26 stands at 5%/13%/16%.

Key takeaways from the management commentary

* Demand trends: The GST transition led to deferred purchases by customers as well as channel partners, leading to a temporary volume dip. However, demand picked up during the festive season. Management noted that, excluding the transitory GST impact, revenue growth would have been flat YoY.

* Outlook: Demand rebounded sharply following GST implementation, supported by strong footfalls and channel orders, though this was partly spilled over into October. The festive uplift, coupled with GST-led normalization, resulted in the best exit run-rate in recent quarters. Recovery is expected to strengthen from 3Q, as cleaner inventory, faster turns, and store/channel productivity gains flow through.

* The value segment, which accounts for ~40% of the mix, is stabilizing after prolonged pressure. GST benefit pass-through and price re-indexing are aiding volume recovery, supported by cleaner assortments and stronger full-price sellthroughs, with early traction visible across lower-price SKUs.

* The premium segment, which accounts for ~20% of the mix, remained resilient, led by Hush Puppies’ expansion and tech-driven comfort products like Power Easy Slide and Floats. This lifted ASPs, reinforcing premiumization focus and growing the lifestyle/comfort franchise.

* Inventory cleanup is nearly complete, with freshness improving ~7%, inventory declining 12% YoY, and turns rising to 2.5x. The adoption of zero-based merchandising has enabled sharper assortments and store refreshes.

Valuation and view

* Post-COVID, BATA accelerated its initiatives across distribution (expanding stores by ~30% via franchise), enhancing brand relevance and product mix (improving youth connect through new concepts like Floatz, Power, Sneaker Studios) and driving premiumization. However, these efforts have yet to translate into meaningful growth or margin recovery, with profitability still lagging pre-COVID levels.

* We cut our FY26-28E EBITDA by 7-10% due to continued challenges both on growth and profitability. We model a revenue/EBITDA/adj. PAT CAGR of 4%/9%/10% over FY26-28E.

* We reiterate our Neutral rating with a revised TP of INR985 (earlier INR1,070), premised on 40x Dec’27 P/E.

* With the recent GST cuts, we expect demand to pick up for organized players, especially in the value segment, which is expected to benefit BATA and prevent us from downgrading the stock to Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412