Neutral Shree Cement Ltd for the Target Rs. 30,030 by Motilal Oswal Financial Services Ltd

Slow growth in core market and limited scale cap upside Chasing premiumization, losing competitive edge

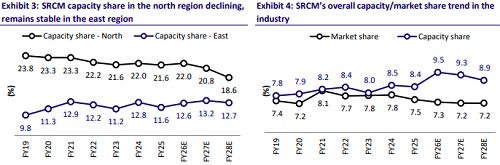

* Shree Cement (SRCM) has been comparatively slower than its peers in terms of capacity expansion in one of its core markets in the north region, which led to market share loss for SRCM and also risks its pricing strategy over the medium term. SRCM’s capacity share in the north region declined to ~22% in FY25 from the peak of ~24% in FY19, and it is further estimated to decline to ~19% by FY28E, given aggressive expansion by peers.

* We estimate the company’s capacity CAGR (based on capacity expansion announcements) at ~10% over FY25-28E, outpacing its estimated volume CAGR of ~6% during the same period. Its capacity utilization is trending below the optimum levels, even during the low capex phase (FY26-28), given the lack of regional diversification under new capacity and changes in its marketing strategies (focusing more on value).

* In the past two years, SRCM has taken several initiatives to restructure and strengthen its brand equity to increase realization and premium cement share. So far, its realization follows industry trends (Exhibit 6 & 7). Its premium cement share (as % of trade sales volume) has increased to ~21% in 2QFY26 from ~15% in 2QFY25 and ~9% in 1QFY24, though it is still lower than its peers’ share (UTCEM at ~37% and ACEM at ~35% in 2QFY26).

* We estimate a CAGR of ~8%/12%/13% in SRCM’s revenue/EBITDA/PAT over FY26-28. We estimate its blended EBITDA/t at INR1,320/INR1,385 for FY27/FY28 vs. INR1,250 for FY26E (avg. EBITDA/t was INR1,205 over FY21- 25). The stock trades fairly at 17x/15x FY27E/FY28E EV/EBITDA, given the moderate earnings growth, limited cost-saving levers and low return ratios (RoE/RoCE at ~10% in FY28E). We reiterate our Neutral rating and value SRCM at 18x Sep’27E EV/EBITDA to arrive at a TP of INR30,030.

Slower expansion in core market (north) weakens competitive edge

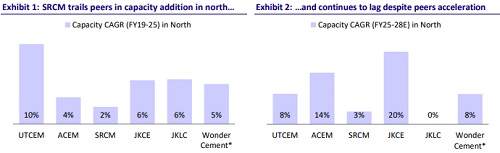

* SRCM has been comparatively slower than its peers in terms of capacity expansion in its core markets in the north region. Its north region capacity CAGR stood at ~2% over FY19-25 vs. peers’ range of ~4-10% during the same period. Going forward, the company’s capacity CAGR is estimated at ~3% over FY25-28E, significantly lower than its peers’ range of ~8-20% during the same period (Exhibit 1 & 2).

* The company’s capacity utilization is estimated to be below the optimum level, (~59-63%) even during the low capex phase (FY26-28E), because 1) its recent capacity expansions are largely concentrated at existing plants, restricting its ability to tap new regional markets and diversify its geographic footprint; and 2) due to changes in marketing strategies (focusing more in value). Its expansion strategy appears to be driven more by the anticipation of future demand rather than aligning with the current market needs. A majority of its capacity expansion is aimed at achieving long-term growth rather than immediate market share gains.

* The company has commissioned a 3.65mtpa clinker line (in Sep’25) and 3.0mtpa cement mill (in Nov’25) in Rajasthan. The 3.65mtpa clinker and 3.0mtpa cement capacity at Kodla, Karnataka (brownfield expansion), is estimated to be commissioned in 3QFY26 end. After these expansions, its domestic grey cement capacity will increase to 68.8mtpa. While the company maintains its capacity target of ~80mtpa by FY28E, this may be achieved by FY29E, depending on the capacity utilization ramp-up and demand trends. Further, it is yet to reveal plant locations of the remaining ~11mtpa capacity additions to reach its targeted 80mtpa capacity.

Limited cost optimization levers; peers bridging efficiency gap

* SRCM has limited opportunities for cost optimization due to several reasons: 1) operating at a higher green power share ~63% (1HFY26) limits any meaningful increase in green power share; 2) with a low capacity utilization (~59-63% over FY26-28E), it is unable to fully leverage operating efficiencies; and 3) recent increase in petcoke prices (Aug-Nov’25), up ~16% YoY and ~10% sequentially, putting pressure on SRCM’s cost-reduction measures. However, it is setting up railway sidings for most of the plants to optimize its logistics cost. Currently, its share of rail in outbound logistics stood at ~11%. Management targets to raise this share to ~20%. SRCM expects a saving of INR100/t from the higher rail mix.

* While its peers are targeting cost reductions in the range of INR150-250/t over the next two years, led by various cost-efficiency measures, including increasing green power/AFR share, logistics optimization, upgrade/modification works, and investing in digitization/automation to improve overall plant efficiency.

* In the past two years, the company has taken several initiatives to restructure and strengthen its brand equity for increasing realization and premium cement share. So far, the company’s realization follows industry trends (Exhibit 6 & 7). Its premium cement share (as % of trade sales volume) has increased to ~21% in 2QFY26 vs. ~15%/~9% in 2QFY25/1QFY24, which is still lower than its peers’ share (UTCEM at ~37% and ACEM at ~35% in 2QFY26). Management expects to maintain its premium share at this level in the coming quarters. We believe that the brand transformation journey will yield results gradually and help to improve EBITDA/t.

Valuation and view: Valuation discounted vs. historical; maintain Neutral

* We estimate SRCM to report a CAGR of ~8%/12%/13% in revenue/EBITDA/PAT over FY26-28. We estimate EBITDA/t at INR1,320/INR1,385 in FY27/FY28 vs. INR1,250 in FY26 (avg. EBITDA/t at INR1,205 over FY21-25). We estimate the company’s cumulative OCF at INR143b over FY26-28 vs. INR111b over FY23-25. Cumulative FCF is estimated at INR53b over FY26-28 vs. INR20b over FY23-25. The company’s net cash balance is estimated to increase to ~INR81b by FY28 vs. INR54b in FY25. However, ROE/ROCE at ~10% (each) in FY28E would be lower than the long-term historical average in mid-teens (~15%/14% ROE/ROCE over FY17-22).

* SRCM is trading at 17x/15x FY27E/FY28E EV/EBITDA (vs. its long-term average of 20x). On EV/t, it trades at USD136/USD127 (at a discount to its long-term average of USD200). We continue to believe that low-capacity utilization and limited regional diversification into new capacity addition constrain any capacity-led re-rating in the stock. We reiterate our Neutral rating and value SRCM at 18x Sep’27E EV/EBITDA to arrive at a TP of INR30,030.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412