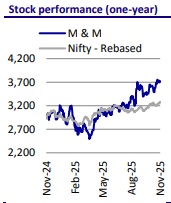

Buy Mahindra & Mahindra Ltd for the Target Rs. 4,275 by Motilal Oswal Financial Services Ltd

Bold targets set across segments for next five years…

We attended MM’s analyst meet in Mumbai on 20th Nov’25. The company has a clear long-term roadmap for each of its businesses: SUVs and LCVs – targets to deliver 8x growth over FY20-30; and Farm – 3x revenue growth over FY20-30. Some of MM’s growth gems are on a strong growth trajectory and include: 1) Last Mile Mobility – targets to deliver 6x revenue growth over FY20-30; 2) Trucks and Bus – to be among the top 3 in India’s ILCV truck and bus segment and have a focused play in HCVs in India; 3) Aerostructures – to be among the global top 10; 4) Mahindra Holidays – targets to deliver 3x keys, 3x revenue and 4x PAT growth over FY20-30; 5) Mahindra Lifespace – targets to deliver >14x sales growth in this decade. Depending on the progress of these growth gems, MM would look to unlock value in some of these segments in a couple of years. MM has also indicated that it would look to enter one new segment next year, provided it fits in the company’s guiding principles of delivering 18% RoE on a sustainable basis. Considering these long-term growth drivers, we maintain our BUY rating on MM with a TP of INR4,275 (valued at Sep’27E SoTP).

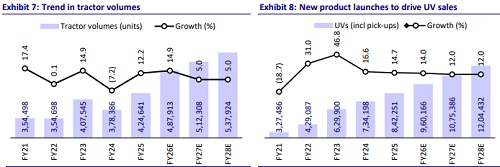

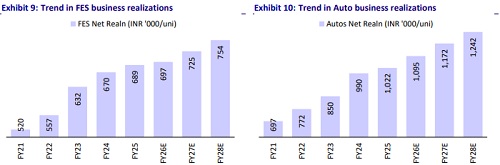

New model launches to drive healthy growth in auto segment.

* MM has set ambitious targets in autos, looking to deliver 8x growth in both SUVs and LCVs over FY20-30. This translates into about 20% revenue CAGR over FY26-30.

* It would look to drive this growth on the back of upcoming new launches in SUVs, which include XEV 9S e-SUV to be launched on 26th Nov.

* From 2027 onward, MM will introduce vehicles based on the new, highly versatile NU-IQ platform, with four new models already showcased in Aug.

* In LCVs, its growth aspiration would be supported by product expansion and deeper market penetration.

* Within the below-3.5T category, MM is targeting 1.6x volume growth, leveraging its leadership position and strong customer acceptance.

Strengthening presence in farm equipment segment

* The company has set a long-term aspiration in its farm equipment segment, achieving 3x revenue growth over FY20-30, which would translate into 12% revenue CAGR.

* On the back of positive rural sentiment, management has raised its longterm growth forecast for the tractor industry to 9% during FY25-30, compared to its earlier estimate of 7%.

* The industry is seeing a shift in the mix toward the 41-50HP segment. MM could emerge as one of the key beneficiaries of this trend as both MM and Swaraj are considered top brands in India in this segment and it has gained 140bp market share in the segment over the last three years to 42.5%.

* MM is focusing on penetrating key export markets, starting with Brazil, North America and ASEAN. It is also looking to drive strong growth in its farm machinery business, which is currently seeing healthy growth.

Value unlocking in growth gems:

* Some of MM’s growth gems are on a strong growth trajectory: 1) Last Mile Mobility: targets to deliver 6x revenue growth over FY20-30; 2) Truck and bus segment: aspires to be among the top 3 in India’s ILCV truck and bus segment and have a focused play in HCVs in India; 3) Aerostructures: aims to be among the global top 10; 4) Mahindra Holidays: targets to deliver 3x keys, 3x revenue and 4x PAT growth over FY20-30; 5) Mahindra Lifespace: targets to deliver >14x sales growth in this decade.

* For the growth gems, management has clearly indicated that MM would look to scale up each of these businesses over the next couple of years before taking a call on value unlocking depending upon their progress.

Valuation and view

* MM’s long-term growth targets in each business segment clearly highlight the firm’s visibility in the potential of each of these key segments going ahead.

* Management has also indicated that it would look to enter one new segment next year, provided it fits in MM’s guiding principles of delivering 18% RoE on a sustainable basis in the long run.

* Considering these long-term growth drivers, we maintain our BUY rating on MM with a TP of INR4,275 (valued at Sep’27E SoTP).

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412