Buy Birla Corporation Ltd for the Target Rs. 1,600 by Motilal Oswal Financial Services Ltd

Earnings above estimate; near-term outlook challenging

Focus remains on higher trade share and premiumization

* Birla Corporation (BCORP)’s 2QFY26 EBITDA was above our estimates, led by lower-than-estimated opex/t and better performance in the Jute business. EBITDA increased ~72% YoY to INR3.0b (~31% beat). EBITDA/t grew ~61% YoY to INR717 (est. INR559). OPM expanded 4.7pp YoY to ~14% (est. ~11%). It reported a PAT of INR905m (~139% above our estimate, aided by higher other income and lower interest costs vs. our estimate).

* Management highlighted that 2Q profitability was hit by the overhang of the shutdown of the Maihar plant in 1QFY26, leading to continued clinker purchase. Further heavy rain disrupted operations at the Mukutban plant, leading to lower volume. The GST rate change in Sep’25 led to sharp price corrections in the nontrade segment; however, its limited exposure (<15%) helped contain the impact. Its strong focus on trade (B2C) sales, blended cement, and premium products continued to support profitability. Management remains cautious for 3Q due to subdued realization, and it expects realization to improve in 4QFY26.

* We retain our earnings estimates for FY26-28. BCORP trades attractively at 7x/6x FY27E/FY28E EV/EBITDA and USD52/USD50 EV/t. We value the stock at 8x Sep’27E EV/EBITDA to arrive at our TP of INR1,600. Reiterate BUY.

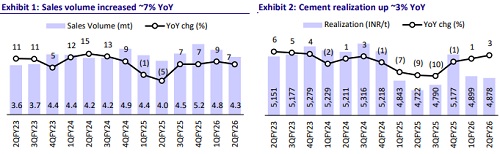

Volumes rise ~7% YoY; cement realization up ~3% YoY

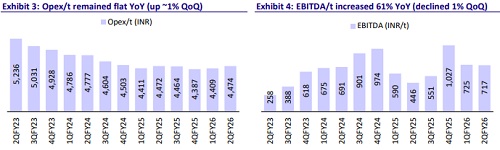

* Consolidated revenue/EBITDA stood at INR22.1b/INR3.0b (up ~13%/72% YoY and +3%/+31% vs. our estimates) in 2QFY26. PAT stood at INR905m (+139% vs estimates) vs. a loss of INR252m in 2QFY25. Sales volumes increased ~7% YoY to 4.3mt (in line). Cement realization was up ~3% YoY to INR4,878/t.

* Opex/t remained flat YoY (-2% vs. estimates), led by ~2%/1% dip in variable costs/other expenses. Freight cost/employee cost per ton increased ~4%/1% YoY. EBITDA/t increased ~61% YoY to INR717. Depreciation/interest costs dipped 7%/22% YoY, whereas other income increased 56% YoY. ETR stood at ~30.9% vs. 29.4% in 2QFY25.

* In 1HFY26, revenue/EBITDA/adj. PAT stood at INR46.6b/INR6.5b/INR2.1b (up ~12%/50%/28x YoY). OPM expanded 3.5pp to ~14%. Realization surged ~4% YoY to INR5,161, and Opex/t was flat YoY. EBITDA/t grew ~38% YoY to INR722. OCF stood at INR2.1b vs INR3.1b in 1HFY25. Capex stood at INR2.2b vs. INR2.1b. Net cash outflow was INR105m vs. FCF of INR1.0b in 1HFY25.

Highlights from the management commentary

* Management expects demand to recover in 2HFY26, with the north and west regions to drive recovery, while the south and east regions continue to face supply overhang. Healthy monsoon, higher disposable income, and continuing government-led capex for infrastructure to drive cement demand.

* The Kundanganj grinding unit is expected to commence operations by the end of 3QFY26 or the start of 4QFY26. BCORP reiterated that its overall capacity expansion plans remain on schedule in line with earlier guidance.

* The capex outlay for FY26 has been revised to INR8b (earlier guidance of INR9.0-10.0b).

Valuation and view

* BCORP’s 2QFY26 performance was above our estimates, driven by better cost control and improved performance in the Jute business. Cement realization was stable QoQ, in line with our estimates. The management gave a cautious nearterm view due to subdued pricing in the central region. It expects price improvement in 4QFY26. Further, progress on the company’s capacity expansion needs to be closely monitored, which would provide sustainable volume growth.

* We estimate BCORP’s revenue/EBITDA/PAT CAGR of ~8%/17%/31% over FY25- 28. Estimate EBITDA/t at INR758/INR833/INR879 in FY26/FY27/FY28E vs. INR672 in FY25. BCORP trades attractively at 7x/6x FY27E/FY28E EV/EBITDA and EV/t of USD52/USD50. We value the stock at 8x Sep’27E EV/EBITDA to arrive at our TP of INR1,600. Reiterate BUY

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412