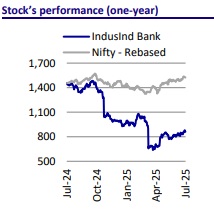

Neutral IndusInd Bank Ltd for the Target Rs. 800 by Motilal Oswal Financial Services Ltd

Operating performance to recover gradually; estimate ~1% RoA by FY28

* Business growth to remain under pressure in the near term

* IndusInd Bank (IIB) has witnessed a steep decline in operating performance due to asset quality issues and accounting discrepancies. While the bank has recognized the due impact from these abnormalities, pressure on margins and elevated provisioning will continue to suppress near-term earnings.

* The continued unwind and ongoing challenges in the MFI business are likely to keep business growth muted in the near term. We expect a gradual recovery from 2QFY26 onwards, with momentum strengthening further into FY27. We, thus, estimate loan and deposit growth to remain tepid at ~6.5-7% YoY each for FY26E.

* The bank reported a normalized margin of 3.47% for 4QFY25. We expect NIMs to contract further, reflecting the transmission of rate cuts and a continued decline in the mix of high-yielding assets. However, NIMs are likely to stabilize from 2QFY26 onwards, as the SA rate cut takes full effect and the benefits of deposit repricing materialize amid a sharp decline in bulk deposit costs.

* IIB’s profitability has undergone a reset, with RoA expected to remain subdued at 0.5% in FY26 and gradually recover to ~1% by FY28, reflecting a slow and steady climb following the FY25 disruptions.

* According to media reports, the bank has submitted three names to the RBI for consideration: Mr. Rajiv Anand, Mr. Rahul Shukla, and Mr. Anup Saha (refer Exhibit 1 for a detailed overview). We await further clarity on the appointment of the new CEO and the strategic direction under their leadership, which will help provide better visibility on the bank’s growth outlook and overall strategy.

* Given the ongoing uncertainties and continued softness in operating performance, we reiterate our Neutral rating. However, we take off the bear case multiples previously attributed to the stock due to heightened irregularities and lack of confidence in the reported numbers, even as our earnings estimates remain broadly unchanged.

* We revise our TP to INR800 (vs INR650 earlier) based on 0.9x FY27E ABV.

Loan growth to remain modest; estimate 7% YoY growth in FY26

IIB reported a weak trend in loan growth as the focus remained on maintaining adequate liquidity amid the challenges posed by several accounting discrepancies. The bank, thus, reported a flattish trend in advances (0.5% YoY growth) over FY25, while the loan book declined 6% QoQ in 4QFY25. We estimate the loan book to contract further in the near term, led by ongoing challenges and a difficult business environment (MFI, moderation in vehicle business). In 4QFY25, the bank resorted to liquidating assets from its corporate book to bolster liquidity levels. This trend of corporate book liquidation is expected to continue into 1QFY26 as well. We anticipate a gradual recovery in loan growth thereafter, with FY26 loan growth estimated at ~7% YoY, subsequently recovering to a 12% CAGR over FY26-28. We remain cautious about the bank’s growth strategy and await further clarity on loan growth following the management change.

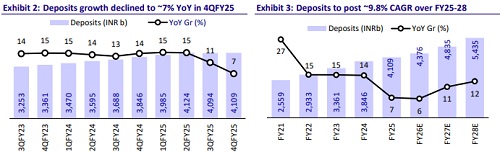

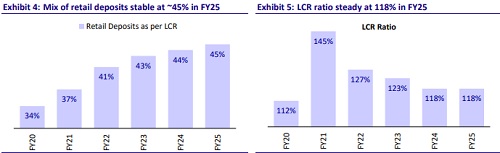

Bank to retire high-cost liabilities; near-term growth to remain muted

IIB faced significant challenges with its liability franchise, resulting in the bank raising a higher mix of bulk deposits and CDs. With advances growth remaining under pressure and interest rates moderating sharply, the bank aims to unwind some of its high-cost bulk deposits. It has also reduced TD/SA rates to manage overall funding costs. We, thus, estimate deposit growth to remain soft at 6.5% in FY26, recovering gradually to 10.5% by FY27. With an increased focus on mobilizing retail deposits, CASA growth is expected to outpace total deposits, growing at 9.4% in FY26 and ~12.5% in FY27, resulting in a stable mix of retail deposits.

Near-term NIMs to remain under pressure; recovery likely from 2H onwards

IIB’s margins are expected to remain under pressure in the near term, primarily due to the transmission of recent repo rate cuts, continued pressure in high-yielding segments (MFI), and moderation in vehicle business growth. Adjusted NIMs in 4QFY25 fell sharply to 3.47%, with reported figures at just 2.25% owing to several one-offs. We estimate a further 25bp contraction in margins during 1QFY26, with NIMs likely to settle at around 3.2-3.3%. We expect NIMs to stabilize from 2QFY26 onwards, as the savings account rate cuts implemented in June begin to reflect, along with the benefits of deposit repricing amid a sharp decline in bulk deposit costs. A clearer loan growth strategy and deployment of surplus liquidity may further support margin normalization in the second half. Thus, we estimate NII to grow at an 8.7% CAGR over FY25-28.

Credit costs to remain elevated; normalcy in MFI business to drive gradual easing

Credit costs are likely to remain elevated in the near term, driven by higher slippages, mainly from the MFI and select retail segments. In 4QFY25, total slippages surged to INR50.1b, with MFI alone contributing over INR35b, and this trend is expected to remain elevated in 1Q as well. The deterioration reflects industry-wide stress, inaccurate classification-related reversals, and specific challenges such as developments in Karnataka. While the Corporate and Vehicle Finance portfolios remain relatively stable, the bank expects MFI-related stress to persist through 1HFY26 before gradually tapering off. As a result, overall credit costs for FY26 are expected to remain elevated, despite stable trends outside the MFI book. We expect overall credit costs at 155bp/140bp over FY26/27.

Profitability undergoes reset; RoA to recover to 1% by FY28

FY25 marked a difficult year for IIB, as profitability was marred by several discrepancies. While the bank has already provided for the anomalies and recognized their due impacts in 4QFY25 results, the recovery hereon is expected to be gradual. The mix of high-yielding segments is likely to moderate further, and a cautious approach will result in measured business and revenue growth. Consequently, FY26 is expected to remain modest, with business growth lagging behind the system. RoA is, therefore, expected to remain suppressed at ~0.5% in FY26, gradually recovering to ~1% by FY28.

Valuation and view: Reiterate Neutral with a revised TP of INR800

IIB has witnessed a steep decline in operating performance due to asset quality issues and accounting discrepancies. While the bank has recognized the due impact from these abnormalities, near-term pressure on margins and elevated provisioning are likely to continue suppressing RoA recovery in the near term. The bank also utilized its contingent buffer during 4QFY25, while the upcoming implementation of ECL could add to credit cost pressures in the coming years. On a positive note, the names of three seasoned private sector bankers have been submitted to the RBI for consideration (according to media reports; refer to Exhibit 1). Clarity on the appointment of the new CEO and the strategic direction under their leadership will be key to providing better visibility on the bank’s growth outlook and overall strategy. Given ongoing uncertainties and continued softness in operating performance, we reiterate our Neutral rating. However, we take off the bear case multiples previously attributed to the stock due to heightened irregularities and lack of confidence in the reported numbers, even as our earnings estimates broadly remain unchanged. We revise our TP to INR800 (vs INR650 earlier) based on 0.9x FY27E ABV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412