Buy Mahindra & Mahindra Financial Ltd for the Target Rs. 400 by Motilal Oswal Financial Services Ltd

Defending the core, powering the adjacent

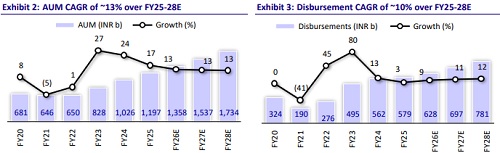

Aspirational target to deliver an 18-20% AUM CAGR and RoA of 2.2%-2.5% We attended the Mahindra Group’s Investor Day, where MMFS outlined its strategic roadmap, detailing its growth ambitions, credit cost trajectory, RoA targets, and the key business segments and focus areas that will anchor its next phase of expansion.

* MMFS shared its long-term aspiration to position itself as the most trusted financial services partner for Bharat, leveraging its over three-decade operating history, deep rural presence across 500k villages, and a 12m strong customer base. This ambition is anchored by a target of scaling the loan book to ~INR3t by 2030.

* Management highlighted the meaningful progress achieved during the 2022-2025 rebuild phase, following earlier periods of high-growth but volatile asset quality. Over the last three years, MMFS has strengthened its underwriting architecture, institutionalized AI-driven collections, enhanced risk governance, and consistently maintained GS3 below 4%.

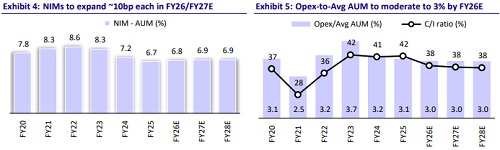

* The strategic agenda for the next five years is centered on fortifying its leadership in the vehicle finance franchise; expanding adjacencies across housing finance, LAP, insurance, and investment distribution; and accelerating AI integration across underwriting and collections. These initiatives are designed to unlock scale while sustaining operating cost ratios within the 2.5%-2.7% band.

* The financial roadmap remains constructive, with management guiding for 18-20% loan growth, structurally lower credit costs of ~1.3–1.7% through a cycle, and a calibrated improvement in ROA toward 2.2% (and further to 2.2%-2.5%). MMFS believes its largely secured portfolio and enhanced execution capabilities provide a credible foundation for a durable, longterm value creation.

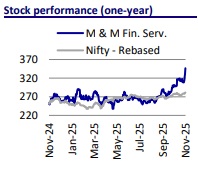

* MMFS currently trades at 1.8x FY27E P/BV and 14x FY27E P/E. With a projected PAT CAGR of ~19% over FY25-FY28E and RoA/RoE of 2.2%/14% in FY28E, we reiterate our BUY rating with a TP of INR400 (based on 2x Sep’27E BV).

Current organizational strengths and strategic agendas

* MMFS has four key organizational strengths: 1) It has exceptional distribution, with branches present in every state or UT, serving ~95% of the country, 2) Asset quality management is driven not just by strong collections, but by using best-in-category, AI-driven underwriting scoring models, 3) Customer engagement is focused on partnering with customers based on their digital maturity, rather than imposing digital adoption, and 4) MMFS has always been a powerhouse of talent, possessing leaders who deeply understand rural India, while also successfully integrating new talent for capabilities in underwriting, technology, and diversification.

* MMFS’s strategy for the next five years is structured around three main themes: defending the vehicle lending moat, diversification, and accelerating AI.

Defending the vehicle lending moat (core business)

* A key position of MMFS’s strength is the tractor financing business, and the company holds the number one financer position among both NBFCs and banks combined. Its strategy involves protecting and growing market share while also actively partnering with dealers to grow markets and creating new emerging regions where agricultural machinery has not been sold before.

* MMFS is also the number one financer for used tractors. This business is a significant pivot for growth, focused on accelerating the use of agri-machinery (especially implements, where the company is currently under-indexed) through partnerships, including with the M&M Group.

* In the PV and CV segments, MMFS is committed to maintaining its leadership position. It currently hovers between the third and fourth largest financers in the PV and CV businesses across all lenders.

* MMFS is navigating the challenge of balancing growth and margins in a market undergoing significant premiumization in PV and facing much higher competition in CV. The company has begun using co-lending playbooks with big bank balance sheets, leveraging its distribution network in scenarios where it cannot commit its own balance sheet.

Strategic diversification in adjacent businesses

MMFS aims to be a trusted, holistic financial player, extending beyond vehicle lending:

* Housing Finance and Secured Lending: The HFC business, which previously faced asset quality challenges, has demonstrated a significant turnaround, with GNPA now <3% and NNPA at ~1%. With strengthened leadership, the plan is to scale the affordable housing business and establish a profitable prime mortgage business. The adjacent SME business, focused on LAP (and not unsecured lending), has tripled its loan book in the last three years to INR70b.

* Insurance and Investment Pools: MMFS is addressing deep revenue pools in financial services through insurance and investment distribution. Insurance: MMFS has two strong entities: an insurance broking arm (100% subsidiary) positioned among the top five insurance broking entities, and a recently acquired corporate agency license. These entities augment fee income, and with the recent foray of its parent M&M into life insurance manufacturing, MMFS expects to gain a decent share from its insurance distribution.

* Investments: The mutual fund company has crossed ~INR300b in AUM and is one of the country's fastest-growing AMCs, climbing from 40th to 24th position on the leaderboard. Further, MMFS is among the few deposit-taking franchises in the country, holding a core deposit license that serves as a key liability instrument.

Role of technology and AI in MMFS’s operations

* Accelerating AI as a specific toolkit is a fundamental agenda, ensuring that AI enhances the core business model. The primary applications of AI are in underwriting and collections.

* In underwriting, AI supports eight vernacular agent workflows, ensuring empathetic underwriting. For collections, agent AI is used to drive multi-lingual, respectful conversations with customers, moving away from the use of traditional callers. These technological efficiencies play a significant role in keeping the company’s opex ratios within the 2.5%-2.7% range.

Valuation and view

* MMFS underscored the substantial progress achieved over the past three to four years during its rebuilding phase, particularly in underwriting, collections, and technology, which has translated into materially improved and wellcontained asset quality. The company also outlined its medium-term aspirations of 18-20% AUM growth, through cycle credit costs of 1.5%-1.7% and RoA of 2.2%-2.5%. We have not made any changes to our estimates and will instead wait for early proof of execution before upgrading our estimates on AUM growth.

* MMFS currently trades at 1.8x FY27E P/BV and 14x FY27E P/E. With a projected PAT CAGR of ~19% over FY25-FY28E and RoA/RoE of 2.2%/14% in FY28E, we reiterate our BUY rating with a TP of INR400 (based on 2x Sep’27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)