Buy Home First Finance Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

Operationally healthy quarter; sequential NIM expansion

Asset quality stable even as bounce-rates inched up a little

* HomeFirst’s 4QFY25 PAT grew 25% YoY to INR1.05b (in line). FY25 PAT grew ~25% YoY to INR3.8b. 4Q NII grew 26% YoY to INR1.7b (in line). Other income jumped 52% YoY to INR533m, aided by higher assignment income of INR300m

* Opex grew 38% YoY to INR803m (in line). PPoP rose ~28% YoY to INR1.46b (in credit costs of ~25bp (PQ: ~34bp and PY: ~12bp).

* In Apr’25, HomeFirst successfully raised equity capital of INR12.5b via a QIP. After the capital raise, the proforma net worth stood at INR37.5b, leverage declined to ~3.3x and CRAR improved to ~51%.

* Reported NIMs rose ~20bp QoQ. Management stated that ~10bp of the NIM improvement was driven by lower surplus liquidity on the balance sheet, while the rest was due to mark-to-market adjustments. Additionally, the company is optimistic about getting a credit rating upgrade (to AA) within the next six months, which will further reduce its cost of borrowings.

* Management expects robust mortgage demand in FY26 and does not expect any major shifts in the competitive environment. It guided for AUM growth of ~27-30% for FY26 and reiterated its target of scaling up to ~INR350b in AUM by FY30.

* HOMEFIRST’s execution has been consistently better than its peers, and the company is well-positioned to capitalize on opportunities in the affordable housing segment. We estimate a CAGR of ~27%/~30% in AUM/PAT over FY25- FY27E. Asset quality is expected to remain range-bound at current levels and credit costs are likely to remain benign at ~27-30bp over the near-to-mediumterm. Reiterate BUY with a TP of INR1,500 (based on 3.2x Mar’27E BV).

Healthy AUM growth of ~31% YoY; BT-OUT rate inches up but lower YoY

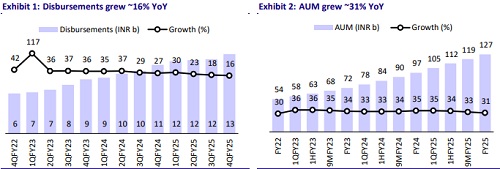

* Disbursements grew 16% YoY to ~INR12.7b (+7% QoQ), leading to AUM growth of 31% YoY to ~INR127b. Management guided for disbursement growth of ~20- 25% in FY26.

* The BT-OUT rate (annualized) in 4Q rose to 7.5% (PQ: ~7.3% and PY: ~8.3%) as competitive intensity tends to be higher in 4Q than in other quarters.

Reported NIM rose ~20bp QoQ; Minor spread compression

* Reported yield declined ~10bp QoQ to 13.5% and reported CoF was stable QoQ at 8.4%. Reported spreads (excl. co-lending) fell ~10bp QoQ to 5.1%. Management guided for spreads of ~5.0%-5.2% in FY26.

* Reported NIM rose ~20bp QoQ to 5.1%, driven by lower surplus liquidity on the balance sheet. Incremental CoF and origination yield in 4Q stood at 8.6% and 13.3%, respectively. We model an NIM of 6.2%/6.1% in FY26/FY27 (FY25: 5.7%). NIM expansion in FY26 will be driven by a decline in leverage after the equity capital raise.

Improvement in 1+dpd and 30+dpd; Minor increase in bounce rates

* GS3 and NS3 remained largely stable QoQ at 1.7% and 1.3%, respectively. PCR was stable at ~25%.

* 1+dpd declined ~30bp QoQ to 4.5%. Bounce rates rose ~40bp QoQ to ~16.4% in 4QFY25 (vs. ~16% in 3QFY25). In Apr’25, bounce rates declined to 16.2%.

Highlights from the management commentary

* HomeFirst's new partnership with PhonePe started a few months back. In all the digital partnerships, the arrangement is to focus on new acquisitions.

* The company is very well capitalized and does not foresee the need to raise equity capital for the next four years.

* Co-lending guidelines are still under discussion, and currently, there is no cap on ticket size, which is a positive. If co-lending Model 2 is eliminated, the process may become slightly more tedious. Under Co-lending Model 1 (currently being followed by HomeFirst), disbursements must be made simultaneously by both lending entities.

Valuation and view

* HomeFirst delivered a healthy performance in 4Q, aided by robust AUM growth and stable asset quality, leading to benign credit costs. Even as spreads saw minor compression, the company reported an improvement in NIMs, driven by lower surplus liquidity on the balance sheet.

* We estimate a CAGR of ~27%/~30% in AUM/PAT over FY25-FY27E. While there will be a temporary RoE compression (on the back of the recent equity raise), we expect HomeFirst to steadily keep improving its RoE in the subsequent quarters and deliver RoE of 15.6%/14.2% in FY26/FY27.

* Asset quality is expected to remain range-bound at current levels and credit costs are likely to remain benign at ~25-30bp over the near-to-medium-term. HomeFirst trades at 2.5x FY27E P/BV and we believe that it will sustain its premium valuations over peers because of the strong execution that it has demonstrated over the last four years. Reiterate our BUY rating on the stock with a TP of INR1,500 (premised on 3.2x Mar’27E BVPS).

* Key downside risks: a) a sharp contraction in spreads and margins to sustain the business momentum; b) higher BT-outs, leading to lower AUM growth; and c) deterioration in asset quality in its LAP product and self-employed customer segments, resulting in higher credit costs

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)