Buy Hindalco Ltd for the Target Rs. 800 by Motilal Oswal Financial Services Ltd

Novelis long-term outlook robust despite near-term challenges; India business maintains strong growth

* Capacity expansion plans: HNDL is undertaking a substantial capex plan for India and Novelis operations to expand aluminum and copper capacities. Indian operations focus on projects like Aditya Alumina Refinery (850kt), Aditya Aluminum FRP expansion (200kt), 180/300kt of aluminum/copper smelter and others. The Novelis expansion is targeting debottlenecking and the flagship Bay Minette facility of 600kt FRP capacity. These developments will be mostly commissioned over FY26-29E, with an aim of meeting rising domestic/global demand and enhancing operational efficiency.

* Coal and cost synergies and RE push: HNDL is accelerating its renewable energy (RE) push and coal backward integration. It plans to meet 30% of its energy requirements from RE and the rest via coal-based captive mines by FY30, supported by hybrid and solar installations and a strategic tie-up with Ayana Renewable Power. Simultaneously, HNDL is developing captive coal mines (Chakla and Meenakshi) to reduce cost volatility from e-auctions and imports. These initiatives are crucial for cost control, sustainability goals, and margin stability amid energy-intensive operations.

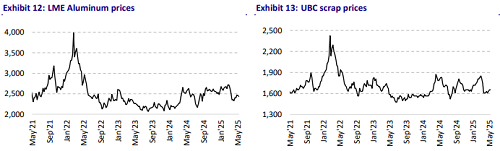

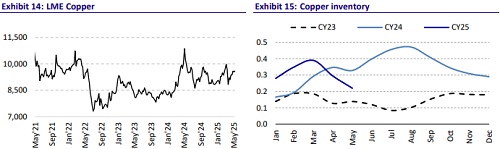

* Favorable pricing and demand; near-term uncertainty led by trade tension: HNDL is well-positioned to capitalize on favorable long-term demand and pricing trends in the aluminum and copper sectors. The strong demand growth will be driven by rising applications in EVs, electrification, packaging, transportation, RE systems and construction. The supply-demand mismatch will ensure pricing resilience in the near to medium term. Novelis’ near-term cash flow will be under pressure due to the US tariff hike. Though higher Midwest premiums may partially offset the impact, operational cuts are likely to continue. HNDL’s strategic shift toward value-added and premium products with higher recycled content would enhance its NSR and support the margins. We expect HNDL to sustain consol. EBITDA margins at ~13% over FY26-27E.

Valuation and view: Reiterate BUY

* HNDL’s Indian operation is net debt free and the company’s consolidated net debt-to-EBITDA ratio stood at 1.06x as of Mar’25 vs. 1.21x in Mar’24. The announced/ongoing expansion is set to position HNDL as the global leader, though any delay in the stated timeline and cost escalation might put pressure on the cash flow.

* Volume growth across geographies will remain stable for HNDL, and favorable pricing will limit cost pressure and maintain the margins in the medium term. The stock is trading at 5.5x FY27E EV/EBITDA and 1.2x FY27E P/B. We reiterate our BUY rating on HNDL with our SOTP-based TP of INR800.

* Key Risk: 1) delay in capex timeline and cost escalation, 2) rise in aluminum scarp price, 3) US tariff escalation.

Aggressive capacity expansion driving long-term growth

Indian business expansion strategy HNDL India has outlined a capex plan of INR450b aimed at expanding its aluminium and copper production capacities. Key initiatives include projects across aluminium upstream and downstream segments, copper upstream and downstream operations, and the expansion of specialty alumina. These investments are strategically focused on strengthening resource security via coal mine acquisitions and emphasizing value-added products and sustainability. By FY28-29E, these developments are expected to position HNDL as a market leader in India’s aluminium and copper sectors, leveraging robust domestic demand and improved operational efficiency.

* Aditya Alumina Refinery (Odisha): The 850KT greenfield expansion of Aditya Alumina Refinery in Rayagada is currently under construction, with a planned capital outlay of INR70-80b and a targeted commissioning in FY28E. This refinery is being built with infrastructure to support a future capacity of 3mtpa. The initial phase focuses on the production line-I, and based on future demand, the subsequent expansions will be planned. Its proximity to the existing Utkal refinery enables the use of shared infrastructure, thereby optimizing overall project costs.

* Aditya Aluminium Smelter Expansion: The company has planned 180KT aluminum smelter expansion at Aditya with an investment of INR95b to be deployed over FY26-28. Production volumes are expected to start reflecting from FY29 onward. Currently, the project is awaiting environmental clearance and other regulatory approvals. The expansion will be executed in phases, with the commissioning scheduled during FY28-29, and the smelter is anticipated to begin contributions in FY29.

* Downstream aluminum capacity expansion: The 200KT Aditya Aluminum FRP expansion project is progressing as scheduled and is expected to be completed by Jun’25. This expansion will raise the total downstream aluminum capacity to 600KT from 400KT, catering to high-growth segments such as packaging and consumer durables, where FRP demand in India is projected to rise sharply. Additional downstream projects—including a) coated AC fins, b) bicycle parts, and c) a battery foil mill—are slated for commissioning in FY26. Meanwhile, the extrusions capacity at Silvassa and battery enclosures facility at Pune have already been commissioned.

* Copper smelter expansion (Dahej): The company has planned a 300KT copper smelter expansion with a capex of ~INR95b to be spread across FY26-28, and the commissioning is expected in FY29. This expansion aims to significantly increase copper smelting capacity and cater to the rising demand in India, strengthening the company’s domestic market share.

* Copper recycling plant (upstream)/downstream expansion (Gujarat): For the copper business, the company has also planned other upstream/downstream capacity expansions:

* Upstream initiatives include: 1) a 50KT e-waste and copper scrap recycling plant with a planned capex of INR27b. Construction is underway, with the majority of spending expected in FY26. This facility will enhance the company’s VAP mix, catering to niche segments such as HVAC and industrial applications while reducing reliance on primary copper inputs through improved recycling capabilities; 2) A 300KT copper continuous cast rods (CCR) facility in Gujarat, with an estimated capex of INR5b, is scheduled for commissioning in FY26.

* Downstream developments include an 11.5kt copper battery foil facility in Gujarat, which is expected to be commissioned by FY28E. Additionally, the company has recently commissioned a 22.5KT greenfield inner grooved tubes plant in Vadodara, strengthening its presence in the VAP copper segment.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412