Buy Laxmi Dental Ltd for the Target Rs. 410 by Motilal Oswal Financial Services Ltd

Mixed quarter; growth in Lab and Vedia offsets margin pressure

Global demand/network expansion to drive recovery/long-term growth

* Laxmi Dental (LAXMIDEN) delivered better-than-expected revenue in 2QFY26, whereas EBITDA and PAT came in lower than expectations. Profitability was impacted by US tariff related policy changes and increased competitive pressure in Bizdent segment.

* International lab business continues to witness improved traction, led by higher off-take of crown/bridges in new geographies.

* Likewise, the Vedia segment saw strong off-take of aligner/retainer materials and dental thermoforming machines, supporting 2Q growth.

* LAXMIDEN is working on increasing scanner sales to improve the visibility of its lab business.

* Having said this, the Bizdent business remains impacted by increased competition and the company’s focus on profitable growth.

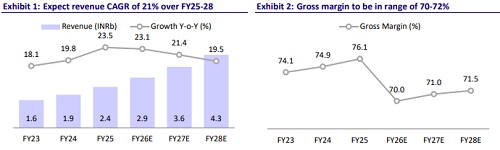

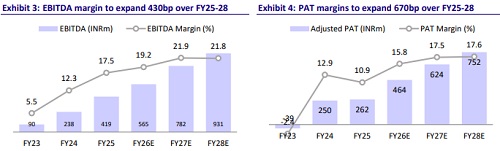

* We reduce our earnings estimates for FY26/FY27/FY28 by 6%/8%/11%, factoring in a prolonged impact of global policies, a gradual uptick in kidz-edental business, and a temporary slowdown in Bizdent business. We value LAXMIDEN at 33x 12M forward earnings to arrive at a TP of INR410.

* Though the company is facing near-term headwinds, the industry outlook remains promising in India and export markets. LAXMIDEN aims to outperform the industry and improve profitability by adding more dentists and increasing workflow from existing dentist network in focus markets. Maintain BUY

Strong revenue growth YoY, Product mix kept margins steady YoY

* 2Q revenue grew 26.5% YoY to INR723m (our est: INR697m).

* Lab business grew 30% YoY to INR410m. International lab business rose 39% YoY to INR185m. Domestic lab business was up 23.6% YoY at INR225m.

* Aligners business grew 5% YoY to INR200m. Vedia business rose 33% YoY to INR97m. Bizdent declined 12% YoY to INR103m.

* Scanner sales zoomed 95% YoY to INR89m for the quarter.

* EBITDA margin came in at 15.3% (our est: 19%), stable YoY. Despite improved sales growth, 2Q profitability was impacted by US tariff policy, annual salary increments and ESOP-related expenses, leading to flat EBITDA margin on YoY basis. EBITDA grew 26.3% YoY to INR110m (our est: INR129m).

* PAT increased by 44.8% YoY to INR65m (our est: INR 97m).

* In 1HFY26, revenue/EBITDA/PAT grew 18%/1%/2% YoY.

Highlights from the management commentary

* FY26 guidance: Revenue growth of 22-25% and PAT margin of 13-15%.

* 2Q scanner sales exceeded FY25 sales, and the company expects to sustain scanner sales to increase the reach and visibility of its lab business.

* Overall working capital days are ~65.

* Reduction in trade payables is largely due to payments related to IPO expenses.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)