Buy JSW Steel Ltd for the Target Rs.1180 by Motilal Oswal Financial Services Ltd

Favorable macros to revive margins; long-term outlook remains robust

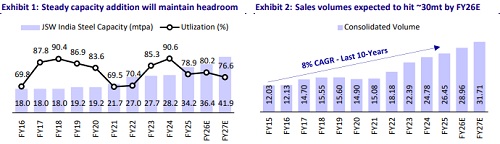

Driving volume growth through strategic capacity expansion

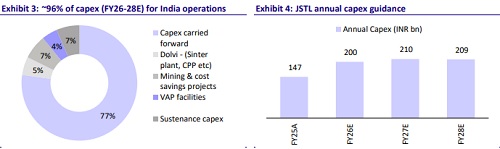

* JSTL is investing INR600b over the next three years to enhance steelmaking and downstream capacities, operational efficiency, and raw material resources.

* By Sep’27, Phase-I expansion will increase JSTL’s domestic crude steel capacity by 17% to 41.9mtpa. This phase includes major projects like Vijayanagar, BPSL and Dolvi.

* As of now, the 5mtpa JVML expansion has been completed, taking its total India capacity to 34mtpa. Further, a 7mtpa expansion is underway (2mtpa Vijayanagar + 5mpta Dolvi) and is targeted to be commissioned by Sep’27. Several debottlenecking projects are also planned (BPSL 0.5mtpa + Salem 0.2mtpa), which will altogether increase the capacity to 42mtpa by Sep’27.

* Additionally, Phase-II expansion (awaiting board approval) could increase the company’s total domestic capacity to 50mtpa by FY31.

* The ramp-up of newly added capacity will support ~10% volume CAGR over FY26-27E and will drive robust volume growth in the long run, with timely commissioning at steady intervals.

Cost leadership via resource optimization and raw material security

* JSTL focuses on reducing costs by enhancing raw material integration, logistics efficiency and higher renewable energy (RE) share.

* It currently meets ~37% of its iron ore needs via captive mines, which JSTL aims to increase to 50% by FY26 through expansions in Karnataka, Odisha, and Goa. On the coking coal front, JSW has secured domestic coal mines and overseas assets (like Illawarra and Mozambique) to reduce import dependency.

* Additionally, JSTL is building infrastructure like slurry pipelines, captive ports, and rail enhancements to cut freight costs.

* The company is also aggressively integrating RE, with 996 MW commissioned under Phase I and another 1,470 MW planned by FY27, to lower power costs and carbon footprint.

Premiumization through VASP portfolio enhancement

* To improve margins and diversify product portfolio, JSTL is expanding its highmargin value-added special product (VASP) segment, which comprised 62% of sales (excl. JVML) in FY25, with 100 new product grades introduced.

*The company is investing in new lines, including a 0.4mtpa automotive-grade CGL line at Vijayanagar and a CRGO JV with JFE.

* JSTL has downstream capacity of 13.5mtpa in India, supplying to auto, infra, and RE sectors. In the long run, JSTL aims to maintain over 50% share of VASP in its product mix, grow into new segments like defense and railways, and continue to strengthen its position in solar and wind applications.

Valuation and view

* JSTL’s EBITDA moderated to INR8,659/t in FY25 (from INR11,395/t in FY24), primarily due to the weak NSR caused by higher cheap imports in India. However, the muted input cost (especially coking coal) partially offset the impact.

* Going forward, we estimate double-digit revenue growth in FY26/FY27, driven by the ramp-up of new capacity and price recovery. Further, as input costs are expected to remain soft, we believe EBITDA margin would rebound to 18-19% in FY26/FY27 (~INR12,000/t in FY26E and ~INR13,500/t in FY27E) on account of domestic steel price recovery led by safeguard duty.

* Strong margins will enable JSTL to generate CFO of INR620b, which can be utilized to fund the expansion plans of INR350b (INR150-200b each) over FY26- 27E and any potential deleveraging efforts. JSTL’s net debt-to-EBITDA ratio declined to 3.34x as of 4QFY25, which we expect to decline to 1.7x by FY27E, supported by robust operating profit. At CMP, JSTL trades at 7.6x FY27E EV/EBITDA. We reiterate our BUY rating on the stock with a TP of INR1,180 (premised on 8.5x EV/EBITDA on FY27 estimate).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412