Neutral TATA Motors Ltd for the Target Rs. 690 by Motilal Oswal Financial Services Ltd

Outlook marred by multiple headwinds

Demand outlook remains weak across its business segments

* TTMT 4QFY25 performance was in line with our estimates, with consol EBITDA margin at 13.9%, down 30bp YoY. While JLR and PV business margins were in line, CV segment margins missed estimates due to higher employee and product development costs.

* JLR is facing multiple headwinds, which include: 1) tariff-led uncertainty for exports to the US, 2) demand weakness in key regions like Europe and China, and 3) rising VME, warranty and emission costs. As a result, we expect margin pressure to persist for JLR and factor in a 100bp margin decline over FY25-27E. Even in India, both CV and PV businesses are seeing moderation in demand. Given these headwinds, we have lowered our earnings estimates for TTMT by 12%/5% for FY26/FY27. For the lack of any triggers, we reiterate Neutral with FY27E SOTP-based TP of INR690.

4Q performance in line; facing multiple headwinds

* Consolidated business: TTMT 4QFY25 performance was in line with our estimates, with consol. EBITDA margin at 13.9%, down 30bp YoY. Consolidated PAT came in at INR89b vs. our estimate of INR84b.

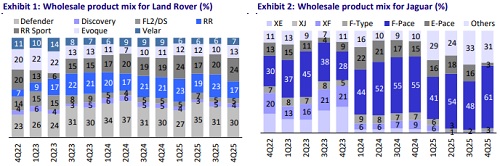

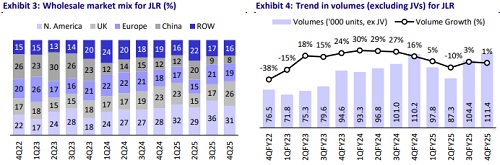

* JLR: JLR 4Q operational performance was largely in line with our estimates, with EBITDA margin at 15.3% vs. our estimate of 15%. In fact, EBITDA was 5% below our estimates due to a miss on revenue. For FY25, JLR margins declined 160bp YoY to 14.3%. Margins were down YoY despite a strong product mix due to higher VME and warranty costs. JLR delivered FCF of GBP1.5b in FY25 (post capex of GBP3.8b). FY25 RoCE fell 190bp YoY to 19.4%.

* TTMT CV business: CV segment margins remained stable YoY in 4Q at 12.2% but were below our estimate of 12.8%. CV margins remained stable QoQ despite 10% volume growth. Margins were impacted by higher employee costs and higher product development expenses. For FY25, CV segment margins improved 100bp to 11.8%. Margin improvement was driven by pricing discipline and 20bp benefit received from PLI incentives.

* TTMT PV business: TTMT’s PV segment margins have remained stable QoQ in 4Q at 7.9%, in line with our estimate. For FY25, PV segment margins improved 40bp YoY to 6.9%. Full-year margins were boosted (+70bp) by INR2.5b worth of PLI incentives. For FY25, PV ICE margins declined 70bp YoY to 8.1%, while EV margins improved to 1.2% (from -7.1%) YoY.

Highlights from the management commentary

* JLR: JLR is currently facing significant uncertainty due to the tariffs levied by the US globally on automobiles. While the US-UK FTA has been a welcome agreement and helps to lower tariffs, the tariff on JLR made vehicles exported to the US is expected to still rise to 10% from the current 2.5%. Further, in the absence of any trade deal between Europe and the US, JLR cars produced in Slovakia (Defender and Discovery) could face 27.5% duty when exported to the US. Given the multiple headwinds, management has refrained from giving any guidance for JLR for FY26 and beyond.

* Indian CV: Given favorable demand indicators, management expects the CV industry to post single-digit growth in FY26. Within this, management expects MHCV and bus segments to do better than ILCVs and SCVs.

* Indian PV: Industry demand for FY26 is likely to remain moderate, as in FY25. TTMT would target to outperform the industry on the back of its new launches, which include: 1) mid-cycle upgrade of Altroz to be launched this month and the recently launched upgrade of Tiago; 2) full-year ramp-up of Curvv and Nexon CNG; 3) Safari and Harrier with multi-powertrain options, including gasoline; 4) Sierra ICE launch; and 5) Harrier + Sierra EV launch.

* The demerger of PV and CV businesses is on track with the appointed date for the same as 1st Jul’25, subject to all approvals.

Valuation and view

* JLR is facing multiple headwinds, which include: 1) tariff-led uncertainty for exports to the US; 2) demand weakness in key regions like Europe and China; and 3) rising VME, warranty and emission costs. As a result, management has refrained from giving any guidance for FY26 and beyond. We expect margin pressure to persist for JLR and factor in 100bp margin decline over FY25-27E.

* Even in India, both CV and PV businesses are seeing moderation in demand. Given these headwinds, we have lowered our earnings estimates for TTMT by 12%/5% over FY26/FY27. For the lack of any triggers, we reiterate Neutral with FY27E SOTP-based TP of INR690.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412