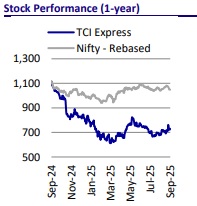

Neutral TCI Express Ltd for the Target Rs. 730 by Motilal Oswal Financial Services Ltd

Near-term outlook remains bleak due to elevated competition and weak volumes

* We maintain a neutral stance on TCI Express (TCIE) due to ongoing challenges in volume and profitability. TCIE is experiencing weak demand in certain industrial segments, including manufacturing, automobiles, and textiles, despite a healthy growth of ~22% YoY in e-way bill generation over Apr-Aug’25 and an 8.3% growth in the Index of Industrial Production (IIP) for manufacturing motor vehicles, trailers, and semi-trailers—a key segment for TCIE—during Apr-Jul’25. This weakness in demand indicates that intense competition has hit TCIE’s business performance and volume growth.

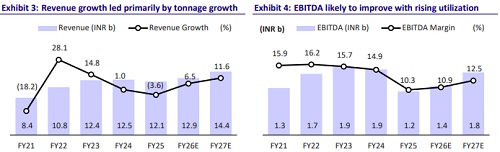

* While management expects an 8–9% tonnage (vs. a 1% volume dip in FY25) and 11–12% revenue growth in FY26, the margin improvement target could face challenges from persistent cost pressures, inflationary labor expenses, and relatively lower margins in international air express.

* TCIE has also planned a capex of INR2.8b over FY26-27, which would mainly be for sorting center automation and network expansion, as dependence on higher-margin multimodal segments could pose risks if demand recovery is slower than anticipated.

* While the long-term outlook for surface express services remains positive, near-to-medium-term headwinds such as heightened competition and elevated freight costs are likely to weigh on margins and volumes. We expect TCIE to achieve an 8%/9%/20% volume/revenue/EBITDA CAGR over FY25-27. We reiterate our Neutral rating with a TP of INR730 (based on 22x FY27 EPS).

Heightened competition dragging down margins and volume growth

* The B2B companies have experienced margin pressure amid intensifying competition, with EBITDA margins contracting from the peak of 16-18% in FY22 to 10-12% in FY25 and further to 8-10% in 1QFY26.

* While industry is pushing for volume growth through aggressive pricing, this strategy is weighing on profitability, leading to structurally thinner margins in the near to medium term.

* E-way bill and toll volumes jumped ~24% and ~23%, respectively, during Jul–Aug’25, indicating healthy festive season volume growth.

* Moreover, the IIP data for the manufacture of motor vehicles, trailers, and semi-trailers—a key segment for TCIE—remains positive, growing 7.3% YoY in Jul’25. This growth is expected to accelerate further due to a reduction in GST rates for the majority of auto segments, from 28% to 18%.

* However, it remains to be seen whether TCIE can convert these positives to volume growth, which has been muted in FY25/1QFY26, down 1% YoY in each period.

Branch expansion allows TCIE to extend its service network

* To facilitate its business growth, TCIE has successfully opened more than 500 new branches in the last five years, and its customer count has increased to more than 0.225m as of FY25 from 0.16m in Mar’17. Looking ahead, TCIE plans to open 50-75 branches annually, capitalizing on the upcoming manufacturing facilities and clusters of SMEs to further expand its presence.

* With this expansion, TCIE seeks to expand its footprint in emerging markets to meet the increasing demands of SME customers more effectively. This strategic move enables TCIE to offer customized logistics solutions tailored to the unique requirements of SMEs.

Asset-light model helps in minimizing idle capacity during any downturns

* TCIE does not have any fleet on its books. In the absence of any owned fleet, the business relies on ~5,500 containerized vehicles from attached business vendors and associates to meet its customer requirements.

* By relying on a model that minimizes asset ownership, TCIE can flexibly adjust its operations and adapt to changing market conditions. This flexibility enables the company to retain healthy profitability margins even in challenging times.

New value-added service offerings to augment growth

* Over the past two years, TCIE introduced Rail Express, Pharma Cold Chain, and C2C Express services as part of its strategic efforts to enhance its value proposition while adhering to an asset-light approach. These services have received significant attention and have contributed to the expansion of TCIE's customer base.

* Among newly launched services, the Rail Express offering is getting good traction from customers, and the company has successfully expanded its customer base from 250 to 5,000+ and its presence from 10 routes to 150 routes since its inception. These high-margin offerings are expected to contribute materially in the next few years.

Targets INR20b in revenue over the next few years

* TCIE aims to focus on expanding its customer base, aided by doubling branches and ramping up new value-added services (Cold Chain Express, C2C Express, Rail Express, and Air Express) to 22% of revenue (~18% contribution as of 1QFY26) and by owning sorting centers in major metro cities of India. With this, it expects to achieve revenues of INR20b in the next few years.

* TCIE’s large sorting centers at Chennai, Nagpur, Kolkata, and Mumbai are expected to streamline hub-to-hub movement and automation, improving operating efficiencies.

Valuation and view

* Volume growth was muted in FY25/1QFY26 (down 1% YoY in each period) as SME demand remains weak due to high inflation and interest rates. Management expects 8-9% tonnage and 11-12% revenue growth in FY26, but margin improvement could be constrained by persistent cost pressures, inflationary labor expenses, and lower margins in the international air express segment.

* We expect TCIE to clock an 8%/ 9%/20% volume/revenue/EBITDA CAGR over FY25-27. We reiterate our Neutral rating on the stock with a revised TP of INR730 (based on 22x FY27 EPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412