Buy MTAR Technologies Ltd for the Target Rs. 2,900 by Motilal Oswal Financial Services Ltd

Weak 2Q but strong 2H visibility

Operating performance missed our estimates

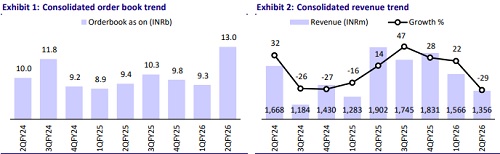

* MTAR Technologies (MTARTECH) witnessed a setback in its growth trajectory with a weak 2QFY26. Revenue/EBITDA declined 29%/54% YoY, as execution slowed across segments amid tariff-related negotiations.

* However, management boosted growth visibility for the near to medium term by raising its FY26 revenue growth guidance to 30-35% vs 25% earlier, while maintaining its EBITDA margin guidance at 21% (+/- 100bp). The company also guided for a closing order book of ~INR28b (up 2.9x vs FY25), indicating expectations of strong order inflow.

* Factoring in the strong outlook backed by robust orders in hand (as of Sep’25) and expectations of higher order inflows, we raise our FY27/FY28 earnings by 8%/18% while maintaining our FY26 earnings. We reiterate our BUY rating on the stock with a TP of INR2,900 (40x Sep’27E EPS translating into 0.9x PEG ratio).

Inventory buildup and tariff dynamics weigh on operating performance in 2Q

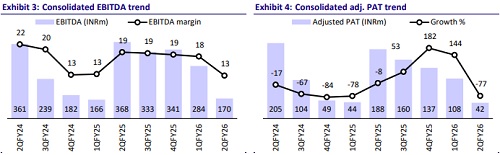

* Consolidated revenue declined 29% YoY to INR1.4b (est. INR1.5b). EBITDA declined 54% YoY to INR170m (est. INR283m). EBITDA margin contracted 680bp YoY to 12.5% (est. 18.6%), Gross margin stood at 51.2% (+370bp YoY), while employee expenses/other expenses as a % of sales stood at 24.6%/14.1% (+890bp /+170bp YoY), indicating a sharp operating deleverage due to lower revenue booking in 2Q.

* Revenue from Clean Energy - Nuclear/Clean Energy - Fuel Cell/Aerospace & Defense (A&D)/Product & Others declined 54%/8%/44%/62% YoY to INR54m/INR976m/INR163m/INR163m.

* The order book as of Sep’25 stood at INR12.9b, with inflows of ~INR5b in 2QFY26. The order book mix was ~56%/12%/25%/8% for Clean Energy – Fuel Cell/Clean Energy - Nuclear/A&D/Product & Others.

* NWC days surged to 274 as of Sep’25, from 267 in Jun’25, due to an increase in inventory days to 282 (vs.222). This was partly offset by a decrease in receivable days to 87 (vs.126) and an increase in payable days to 128 (vs. 87). The higher inventory levels were attributed to orders in hand and to support strong growth anticipated in 2H.

* For 1HFY26, Revenue/EBITDA/PAT declined by 8%/15%/35% to INR2.9b/INR454m/INR151m. For 2HFY26, implied Revenue/EBITDA/PAT growth is 67%/2.1x/2.9x on the back of strong execution from orders in hand.

Highlights from the management commentary

* Capex: The company is expanding capacity in hot boxes from the current 8,000 units to 20,000 by Mar’27 in a phased manner (i.e. adding 4,000 units every six months). Total capex envisaged for FY26 and FY27 is ~INR1.5b (including the hot boxes and oil & gas capacity expansion).

* Liquidity: MTARTECH aims to reduce its working capital days to ~220 in FY26, aided by improved payable cycles, with further reductions targeted at ~200 days in FY27 and ~180 days in FY28. The company plans to raise INR1.5-2b of debt to fund expansion in the oil & gas and fuel cell verticals, with overall debt levels capped at INR2.5b.

* Nuclear: The company expects a confirmed INR5b order from Kaiga Units 5 and 6 in the coming weeks, with execution over three years, and total orders of ~INR8b by FY26, including refurbishment projects. The nuclear power vertical is set for strong growth from FY27 onwards, with only minor capacity additions (~INR200m capex) needed to support execution.

Valuation and view

* With a strong order book of ~INR13b as of Sep’25, a healthy pipeline across the Clean Energy, A&D, and Nuclear sectors, and robust execution of various new products across all segments, we anticipate strong growth and margin expansion in the coming years. This will be supported by new product ramp-ups, strong execution of orders, operating leverage, and higher order forecasts from Bloom Energy.

* We estimate a CAGR of 35%/50%/71% in revenue/EBITDA/adj. PAT over FY25- FY28. We reiterate our BUY rating on the stock with a TP of INR2,900 (40x Sep’27E EPS translating into 0.9x PEG).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)