Buy Shriram Finance Ltd for the Target Rs. 860 by Motilal Oswal Financial Services Ltd

Robust quarter driven by NIM expansion and lower credit costs

Earnings beat; Stage 2 improves ~35bp QoQ

* Shriram Finance’s (SHFL) 2QFY26 PAT rose ~11% YoY to ~INR23b (~5% beat). PAT in 1HFY26 grew 10% YoY, and we expect PAT in 2HFY26 to grow 24% YoY. NII in 2QFY26 grew ~10% YoY to INR60.3b (in line). Credit costs stood at ~INR13.3b (~11% lower than est.) and translated into annualized credit costs of ~1.9% (PQ: 1.9% and PY: 2.1%). PPoP grew ~11% YoY to ~INR44.4b (in line).

* Other income grew ~57% YoY to INR3.6b (PQ: INR3.7b and PY: INR2.8b). The cost-to-income ratio stood at 30.5% (PY: 30.6% and PQ: 31.7%), and the opex was broadly flat sequentially. This was due to branch consolidation and a reduction in employee count as the company focused on improving both branch and employee productivity as well as operating efficiencies.

* Yields (calc.) were stable QoQ at 16.7%, while CoB rose ~20bp QoQ to 9.25%, resulting in spreads (calc.) declining by ~20bp QoQ to ~7.45%. Reported NIM rose ~8bp QoQ to ~8.2%. SHFL reduced excess liquidity on its balance sheet (towards the end of Sep’25) by pre-closing a few loans and limiting fresh borrowings. The benefits of this liquidity reduction will accrue in NIM in the subsequent quarters. Management guided for NIM to improve to ~8.5% in 4QFY26 and FY26 NIM at 8.2-8.3%. We model NIM of 8.2%/8.6% for FY26/FY27E.

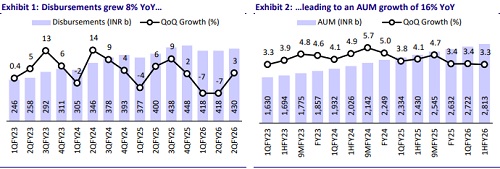

* AUM stood at INR2.81t and grew ~16% YOY/3.3% QoQ. While there was some deferment in customer demand during Aug-Sep’25, SHFL witnessed strong traction in Oct’25. Demand trends have remained healthy, and the company expects this positive momentum to be sustained through Nov’25, and it will target an AUM growth of 16-17% in 2HFY26.

* Management noted that repossessions have remained stable over the past two quarters, as there has been no major decline in the prices of new commercial vehicles. These were driven by a decline in OEM discounts and a better resale value of used vehicles than was earlier anticipated.

* The Board has approved the appointment of Mr. Parag Sharma as the MD & CEO w.e.f. 5 th Dec’25, upon completion of the term of Mr. Y S Chakravarti.

* We raise our FY26/FY27 estimates by 4%/3% to factor in higher NIM, lower opex, and credit costs. SHFL has positioned itself to capitalize on its diversified AUM mix, improved access to liabilities, and enhanced crossselling opportunities.

* SHFL is our Top Idea (refer to the report) in the NBFC sector for CY25, given its strong franchise and the potential to deliver a ~16%/~18% AUM/PAT CAGR over FY25-28E, along with an RoA/RoE of ~3.4%/17% by FY28. Further, if SHFL is able to identify a strategic partner who can infuse fresh equity into the company, it will both reinforce the balance sheet and also make SHFL’s case stronger for a credit rating upgrade. Reiterate BUY with a TP of INR860 (premised on 2x Sep’27E BVPS).

Stage 2 improves ~35bp QoQ; AUM rises ~16% YoY

* GS3 rose ~5bp QoQ to 4.57%, while NS3 improved 8bp QoQ to 2.5%. Net slippages stood at 1.6% (as a % of standard loans) (PY: 1.6% and PQ: 1.4%). PCR on Stage 3 rose ~240bp QoQ to ~46.7%. (PQ: ~44.3% and PY: ~51.7%). PCR on Stage 1 and Stage 2 was broadly stable QoQ at ~3.5%/8.2%, respectively.

* Stage 2 assets declined by ~35bp QoQ to 6.9%. (PQ: 7.3% and PY: 6.6%).

* Management guided credit costs (as % of assets) of 2% for FY26 despite lower credit costs in 1HFY26. We estimate credit costs of ~1.9%/2.0% (as a % of assets) in FY26/FY27.

Key highlights from the management commentary

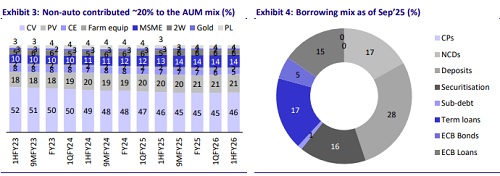

* SHFL aims to expand its new vehicle financing business as it expects meaningful benefits to its cost of funds. The company sees strong customer aspiration to upgrade to new vehicles and plans to deepen its existing OEM relationships to participate more actively across the entire vehicle ecosystem.

* The company plans to place special emphasis on its Gold Loan business, with one of the regional heads set to lead this vertical. It intends to roll out more small-format branches dedicated exclusively to gold loans, typically staffed by 3- 4 people and spread across compact spaces of about 200-250 sq. ft.

* Management shared that a key consideration in evaluating a potential strategic partner would be their ability to support SHFL in achieving a credit rating upgrade, which in turn could help lower the company’s cost of borrowings.

Valuation and view

* SHFL reported a strong operational quarter, with an earnings beat on account of lower credit costs and operating expenses. NIM improved sequentially, supported by a reduction in surplus liquidity, while S2 assets surprised positively with a 35bp QoQ improvement, which kept credit costs well contained.

* SHFL is effectively leveraging cross-selling opportunities to reach new customers and introduce new products, which will lead to improved operating metrics and a solid foundation for sustainable growth. The current valuation of ~1.9x FY27E P/BV is attractive for ~18% PAT CAGR over FY25-28E and RoA/RoE of ~3.4%/ 17% in FY28E. Reiterate BUY with a TP of INR860 (based on 2x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412