Buy Punjab National Bank Ltd for the Target Rs. 135 by Motilal Oswal Financial Services Ltd

In-line earnings; lower opex offsets other income

Margin contracted 10bp QoQ

* Punjab National Bank (PNB) reported 2QFY26 PAT of INR49b (14% YoY growth, in line) amid lower-than-expected opex, partly offset by lower other income and higher-than-expected provisions.

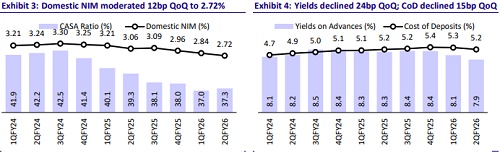

* NII remained broadly flat YoY/declined 1% QoQ to INR104.7b (inline), while NIMs contracted 10bp QoQ to 2.6%.

* Other income declined 5% YoY and 18% QoQ to INR43.4b (11% miss). Total revenue, thus, declined 2% YoY/7% QoQ to INR148.1b (4% miss).

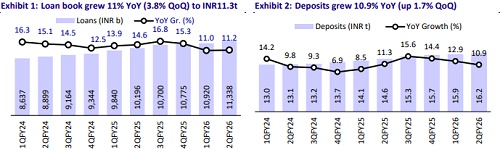

* Loan book grew 11% YoY (4% QoQ), while deposits grew 11% YoY (2% QoQ). As a result, the CD ratio increased to 70.1%.

* Slippages stood at INR19.6b vs INR18.9b in 1QFY26. GNPA/NNPA ratios improved 33bp/2bp to 3.45%/0.36%. PCR ratio stood at 90%.

* We fine-tune our earnings estimates and expect RoA/RoE at 1.03%/15.4% in FY27E. Reiterate BUY with a TP of INR135 (1.0x FY27E ABV).

Advances growth healthy; asset quality improves further

* PNB reported a PAT of INR49b (14% YoY growth, in line).

* NII remained broadly flat YoY/ down 1% QoQ to INR104.7b (in line), while NIMs declined 10bp QoQ to 2.6%. Management expects NIMs to remain at ~2.8-2.9% in FY26.

* Other income declined 5% YoY and 18% QoQ to INR43.4b (11% miss). Treasury income stood at INR16b in 2QFY26.

* Opex declined 8% YoY/ 13% QoQ to INR75.8b (10% lower than MOFSLe), led by cost optimization. C/I ratio moderated 400bp QoQ to 51.2%.

* PPoP, thus, grew 5% YoY/2% QoQ to INR72.3b (4% beat). Provisions increased 123% YoY/ 99% QoQ to INR6.4b (11% higher than MOFSLe).

* Loan book grew 11.2% YoY (3.8% QoQ) to INR11.3t, led by better growth in MSME advances (5.8% QoQ). Retail grew 3.8% QoQ and corporate grew 3% QoQ. The bank expects credit growth of ~11-12% in FY26.

* Deposits grew 10.9% YoY/1.7% QoQ to INR16.2t. CASA ratio stood at 37.3% (up 30bp QoQ). CD ratio increased to 70.1%.

* On the asset quality front, slippages stood at INR19.6b vs INR18.9b in 1QFY26. GNPA/NNPA ratios improved 33bp/2bp to 3.45%/0.36%. PCR ratio stood at 90%. SMA-2 (above INR50m) stood at 0.17% of loans vs 0.15% in 1QFY26.

Highlights from the management commentary

* Guidance has been maintained to keep the slippage rate at <1%.

* RoA – The bank aims for 1.1% of RoA in 3Q and 4Q. Gross NPA ratio shall be below 3%. Net NPA ratio is expected at 0.35%.

* On a conservative basis, 5bp improvement will occur in 3Q and 10bp improvement in 4Q in NIMs (on the minimum side).

* Under the ECL draft framework, Stage-1 carries the same provision as a standard asset. Stage 3 poses no challenge, as the bank has a PCR of 96%. Stage 2 is expected to have some impact, translating to ~75-80bp effect on CRAR.

* Other provision has seen some increase as there was an ILFS account that has seen reduction from NPA provision and moved to the other provision account. This account will see a reversal in 3Q and 4Q.

Valuation and view: Reiterate BUY with a TP of INR135

PNB reported an in-line quarter, as lower opex has been offset by lower other income and higher provisions. NIMs contracted 10bp QoQ, though the bank expects improvement from 3Q onwards. Business growth remained healthy, with management guiding for 11-12% growth for FY26. Asset quality showed an improvement, with annualized slippage ratio maintained at 0.7%, against the bank’s guidance of 1%. The SMA-2 book (with loans over INR50m) remains steady at 0.17% of domestic loans. We fine-tune our earnings estimates and expect RoA/RoE at 1.03%/15.4% in FY27. Reiterate BUY with a TP of INR135 (1.0x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412