Buy PNB Housing Ltd for the Target Rs. 1,230 by Motilal Oswal Financial Services Ltd

Building strength on solid foundations

Affordable momentum, prudent execution; NIM to be a key monitorable

* PNB Housing Finance (PNBHF) delivered a resilient and well-rounded performance in FY25, effectively navigating regional headwinds (in states like Karnataka and Telangana/AP) and yield pressures stemming from repo rate cuts. Despite aggressive competition in the affordable housing segment, PNBHF achieved strong growth in its affordable segment and remains confident of sustaining this momentum.

* PNBHF has strategically evolved from being primarily a prime housing lender to one with an expanding footprint in the emerging and affordable housing segments. Both these segments accounted for ~26% of the total loan book as of Mar’25, up from ~21% a year earlier, and are projected to reach ~40% by Mar’27. We believe this deliberate shift in the portfolio mix will drive a structural uplift in blended yields and, over time, support a meaningful expansion in PNBHF’s NIM profile.

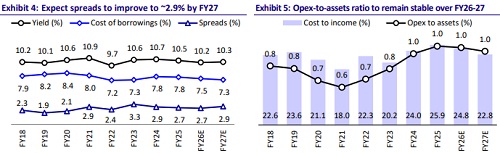

* PNBHF has positioned itself deftly to navigate the current declining interest rate environment. Near-term pressure on NIM will likely arise as asset yields reprice more quickly than liabilities amid heightened competitive intensity in the prime segment. However, we believe that this impact will be largely offset by a favorable shift in the product mix toward emerging and affordable housing, coupled with its resumption of corporate lending (which will remain <10% of the loan mix). Additionally, the company anticipates its next credit rating upgrade by the end of FY26, which will further reduce its cost of borrowing and benefit its NIM.

* Asset quality improved in FY25, with GS3 declining to 1.1% as of Mar’25 (from ~1.5% in Mar’24). FY25 witnessed provision write-backs, driven by recoveries from the written-off pool. We expect these recoveries to continue and model credit costs of -10bp in FY26.

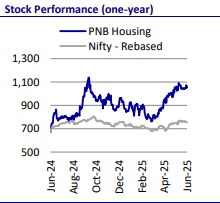

* We recently downgraded LICHF to Neutral and recommend PNBHF as the preferred play among large HFCs. PNBHF is better placed across all key metrics—loan growth, margins, and asset quality—whereas LICHF, in our view, is likely to face headwinds, particularly in loan growth and margins.

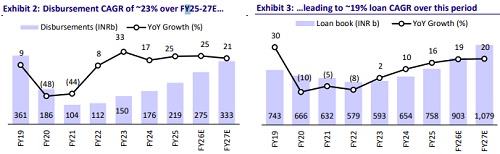

* The supply overhang from the exit of PE investors is now behind, and PNBHF will continue to function independently, run by a professional management team under the parentage of Punjab National Bank (PNB). We expect PNBHF to deliver a healthy ~19% CAGR in its total loan book and ~18% CAGR in PAT over FY25-27, along with RoA/RoE of 2.5%/13.3% in FY27. The stock currently trades at 1.3x FY27E and we reiterate BUY with a TP of INR1,230 (based on 1.5x Mar’27 P/BV).

* Key risks: 1) Sustained NIM contraction due to heightened competitive intensity from banks and other large HFCs; 2) any senior management exits; and 3) while not imminent, the RBI October 4 draft circular on bank ownership in group NBFCs may result in PNB further lowering its stake in PNBHF.

Strengthening foothold in emerging and affordable segments

* PNBHF is aggressively expanding its branch network in the emerging and affordable segments, positioning itself for strong growth. This distribution expansion will enhance the company's ability to deepen its presence in both existing and untapped geographies. The company will also leverage the Credit Linked Subsidy Scheme (CLSS) under the Pradhan Mantri Awas Yojana (PMAY) to drive stronger growth in its affordable segments.

* As of Mar’25, the emerging and affordable housing segments contributed ~19% and 7% to the overall loan mix, respectively. The affordable housing segment grew ~183% YoY, albeit on a smaller base, and reached ~INR50b, while the emerging segment posted a ~21% YoY growth.

* The company aims to expand its affordable housing portfolio to INR95b by Mar’26 and further to INR150b by Mar’27. Given its strong execution capabilities compared to peers, we expect the growth momentum to remain robust across both these segments. The company targets to increase the share of the emerging segment to ~22-25% and the affordable segment to ~12-15% of the overall loan mix by FY27.

Near-term volatility in NIM but potential for gradual improvement

* With ~50bp repo rate cuts by RBI and expectations of further cuts, PNBHF could experience some transitory NIM contraction as its assets reprice faster than its liabilities. However, we believe this impact can be mitigated by an improved product mix favoring the emerging and affordable housing segments, along with the gradual resumption of corporate lending.

* Incremental yields are higher by ~200bp and ~40bp in the affordable and emerging segments, respectively, which is expected to help the company reduce the impact of transitory NIM contraction in a declining interest rate environment.

* ~67% of the company’s borrowings (as of Mar’25), which are on floating rates, will benefit from and be repriced downwards in a declining rate environment. Within its floating borrowings, ~38% are bank term loans. Of these bank loans, ~40% are linked to repo rates (which are repriced almost immediately), while the balance is linked to banks’ MCLR (predominantly 1M and 3M MCLR). We model an NIM of 3.9%/4.0% in FY26E/FY27E (compared to ~3.9% in FY25).

Opex ratios to remain stable despite branch expansion

* PNBHF has significantly expanded its physical branch network over the past two years, growing from 189 branches as of Mar’23 to 356 as of Mar’25. Notably, the branch expansion has been largely focused on the affordable and emerging segments, where the number of branches has more than doubled to 260. Further, the company aims to expand to 500 branches by FY27 (including 300 branches dedicated to the affordable segment).

* Branch expansion and the foray into affordable housing finance have led to an increase in the opex to average assets ratio, from ~0.8% in FY23 to ~1.05% in FY25. While not a like-for-like comparison, PNBHF’s operational cost ratios in the affordable segment are substantially lower than those of most other affordable HFCs, which typically operate in the range of ~2.6% to ~4%. This is because PNBHF benefits from shared infrastructure and resources across its prime, emerging, and affordable segments, enabling it to maintain opex at a more efficient level of 1.0-1.1% of average assets.

* While branch expansions will continue as planned, opex ratios are expected to remain range-bound, driven by improved employee/branch productivity and operating efficiencies. We expect the cost-to-income ratio to decline to ~23% by FY27 (FY25: ~26%)

Expect recoveries to sustain in FY26; GS3 and NS3 at lowest levels in five years

* PNBHF has exhibited continuous improvement in asset quality over the past few years. GS3/NS3 ratios have declined from their peaks of ~8.2%/5.6% as of Dec’21 to ~1.1%/0.7% as of Mar’25.

* Despite shifting to higher-yielding and riskier segments—such as selfemployed/informal salaried customers—and increasing the proportion of nonhousing loans in its overall product mix, the company is confident of maintaining credit costs at ~25bp on a steady state basis (excluding any recoveries from the written-off pool). Furthermore, bounce rates and early warning indicators in the affordable housing segment have been very encouraging, with GNPA in this segment at just ~0.2% as of Mar’25.

* PNBHF is well-equipped to deliver best-in-class asset quality by leveraging its robust underwriting and collections infrastructure. It has significantly strengthened its collections team and is effectively leveraging legal mechanisms to resolve NPA accounts. In addition, the company regularly conducts large-scale property auction fairs, which have contributed to better recovery outcomes.

* The company has a written-off pool of ~INR10b in the corporate segment and ~INR4b in the retail segment. Sustained recoveries from this pool are expected to lead to continued provision write-backs throughout FY26. We model credit costs of -10bp in FY26E and 20bp in FY27E.

Valuation and view

* PNBHF has strengthened its housing finance franchise over the last 2-3 years. The company is well-equipped to successfully navigate the potential near-term contraction in NIM and gradually mitigate it through a favorable product mix.

* We expect PNBHF to deliver a healthy ~19% CAGR in the loan book and ~18% CAGR in PAT over FY25-27, with an RoA/RoE of 2.5%/13.3% by FY27. The company trades at 1.3x FY27E P/BV and the risk-reward is favorable for a further re-rating in the valuation multiple as investors gain more confidence in its sustained execution in retail (both emerging and affordable segments). Reiterate BUY with a TP of INR1,230 (based on 1.5x Mar’27 P/BV).

* Key risks: 1) Sustained NIM contraction due to heightened competitive intensity from banks and other large HFCs, 2) any senior management exits, and 3) while not imminent, the RBI October 4 draft circular on bank ownership in group NBFCs may result in PNB further lowering its stake in PNBHF.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412