Buy PNB Housing Ltd for the Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Tracking well on guidance; stable NIM a positive

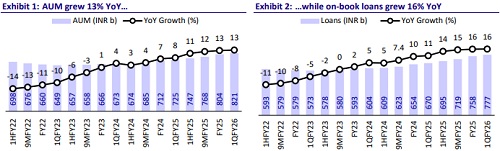

Retail loan growth of ~18% YoY; NIM guidance revised upward to ~3.7%.

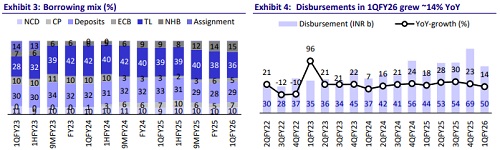

* PNB Housing (PNBHF) kicked off FY26 on a strong note with a well-rounded performance, marked by: 1) a healthy retail loan growth of ~18% YoY, 2) stable NIM of ~3.74% in a declining rate environment, 3) minor improvement in asset quality despite a weak seasonality in 1Q, and 4) sustained recoveries from its retail and corporate written-off pool, which resulted in continued provision write-backs. PNBHF’s 1QFY26 PAT grew 23% YoY to ~INR5.3b (~5% beat).

* NII in 1QFY26 rose ~16% YoY to ~INR7.5b (in line). Other income grew 9% YoY to INR1b. Opex rose ~12% YoY/2% QoQ to ~INR2.2b (in line). PPOP grew ~17% YoY to INR6.3b (in line). Credit costs, net of recoveries, resulted in a write-back of ~INR562m (vs. estimated write-backs of INR162m), which led to net credit costs of -30bp (PQ: -35bp and PY: -7bp).

* PNBHF is steadily shifting towards higher-yielding products by moderating growth in the prime segment and intensifying focus on affordable and emerging segments. The company also revised its NIM guidance upward to ~3.7% (from 3.6-3.65% earlier). It remains focused on keeping NIM steady (in the near term), with subsequent expansion to 4.0-4.1% in FY27. Management also anticipates a credit rating upgrade to AAA over the next 4- 5 quarters.

* Total GNPA/NNPA stood at ~1.06%/0.7% (% of loan assets) and exhibited a minor improvement despite a weak seasonality in the first quarter of the fiscal year. Retail GNPA also exhibited a minor improvement to 1.07%, while corporate GNPA has been NIL for the past five quarters.

* We continue to believe in our thesis of a transformation at PNBHF and in the management’s ability to drive profitability improvement, supported by: 1) healthy retail loan CAGR of 18%; 2) NIM expansion from FY27 onwards; and 3) benign credit costs on the back of sustained recoveries from the writtenoff pool. We expect PNBHF to resume corporate disbursments later this year, which will also provide some support to yields and NIM.

* We expect PNBHF to post a CAGR of 19%/17% in loans/PAT over FY25-27 and ~2.5%/13.2% RoA/RoE in FY27. Reiterate BUY with an unchanged TP of INR1,300 (based on 1.6x Mar’27E BVPS).

Highlights from the management commentary

* The affordable portfolio is maturing well and outperforming industry benchmarks. In steady state, management has guided for credit costs in the affordable segment at around ~25bp, with minimal variation between credit costs in the prime (19-20bps) and emerging (20-23bps) segments.

* Management highlighted that a dedicated NHL team has been established across 10 key markets to drive growth in NHL, with management guiding for quarterly disbursements of INR1.0-1.5b going forward.

* The company implemented a 10bp reduction in its PLR, effective Jul’25.

* PNBHF targets to reach ~14% RoE in the next three years, supported by a rising share of high-margin products.

Valuation and view

* PNBHF reported a strong all-round performance in 1QFY26, supported by solid execution that translated into healthy loan growth, minor improvement in asset quality, stable margin, and robust profitability. PNBHF is strategically focused on maintaining profitability through disciplined margin management, driven by a strategic shift toward higher-yielding affordable and emerging housing segments, coupled with a cautious resumption of corporate disbursements. Its commitment to controlled growth and prudent asset quality management has positioned it favorably for sustained execution. .

* The stock trades at 1.3x FY27E P/BV, with a favorable risk-reward profile that could support a re-rating in the valuation multiple as investor confidence grows in the company’s consistent execution in the Retail segment (across emerging and affordable segments). Reiterate BUY with a TP of INR1,300 (based on 1.6x Mar’27E BVPS).

* Key risks: a) the inability to drive NIM expansion in FY27 amid aggressive competition in mortgages, b) subsequent seasoning in the affordable/emerging loan book leading to asset quality deterioration and elevated credit costs, and c) while not imminent, RBI’s October 4 draft circular on bank ownership in group NBFCs could potentially lead to a further reduction in PNB’s stake in PNBHF.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412