Buy Mahindra & Mahindra Financial Ltd for the Target Rs.310 by Motilal Oswal Financial Services Ltd

Operationally weak quarter; growth outlook remains clouded

Earnings in line despite elevated credit costs; NIM rises ~10bp QoQ

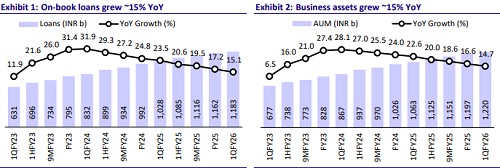

* Mahindra & Mahindra Financial’s (MMFS) 1QFY26 PAT rose ~3% YoY to ~INR5.3b (in line). NII in 1QFY26 stood at INR20.1b (in line) and grew ~13% YoY. Other income rose ~85% YoY to ~INR2.7b, driven by healthy fee income and dividend income of INR464m received during the quarter from Mahindra Insurance Brokers (MIBL; 100% subsidiary of MMFS).

* NIM (calc.) rose ~10bp QoQ to ~6.7%. Opex stood at ~INR9.3b (up ~17% YoY) and the cost-income ratio stood at ~41% (PQ: ~44% and PY: ~41%). PPoP stood at ~INR13.5b (in line) and grew ~19% YoY.

* Credit costs stood at ~INR6.6b (~9% higher than MOFSLe). Annualized credit costs stood at ~2.2% (PQ: ~1.6% and PY: ~1.7%). Collection efficiency improved marginally to ~95% (PY: 94%) in 1QFY26. CRAR stood at ~20.6% (Tier 1: 17.9%) as of Jun’25, after incorporating the Rights Issue concluded in the quarter.

* Management indicated that while the tractor segment continues to benefit from strong tailwinds, there is visible softness in entry-level PV and certain pockets of the CV segment. To support overall growth in FY26, the company plans to capitalize on opportunities in used vehicle and tractor financing.

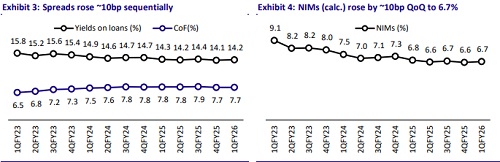

* MMFS shared that NIMs have bottomed out and will continue to exhibit gradual improvement, supported by a steady decline in the CoB. Additionally, a strategic shift in the product mix, particularly an increased focus on the Refinance segment, is expected to aid margin expansion on incremental disbursements.

* Given that the current cycle in Vehicle Finance is not particularly benign, management emphasized the need to maintain heightened collection intensity to manage asset quality proactively. We cut our FY26 PAT estimates by 5% to factor in higher credit costs and keep our FY27 estimates largely unchanged. We estimate a ~21% PAT CAGR over FY25- FY27E, with FY27E RoA/RoE of 2.2%/13%. Reiterate BUY with a TP of INR310 (based on 1.6x Mar’27E BVPS).

* Key risks: a) yield compression due to higher competitive intensity from banks, b) weakening of auto demand resulting in muted loan growth, and 3) any volatility in PCR and credit costs.

NIM rises ~10bp QoQ; sequential rise in yields by ~10bp

* Yields (calc.) rose ~10bp QoQ to ~14.2%, while CoF (calc.) was stable QoQ at 7.7%, leading to a ~10bp expansion in spreads. NIM (calc.) rose ~10bp QoQ to ~6.7%.

* We expect the company’s NIM to improve in the current declining interest rate environment, with an estimated expansion of ~10bp each in FY26/FY27 to ~6.8%/6.9%.

Key takeaways from the management commentary

* Management highlighted that competitive intensity remains high, with mainstream banks increasingly entering and intensifying competition in the vehicle finance segment.

* While SME disbursements witnessed a temporary slowdown due to the company’s recalibrated geographic strategy, the overall SME loan book registered a healthy growth. Management remains confident of a rebound in SME disbursements going forward.

* The company successfully raised INR30b through a rights Issue, boosting its Tier1 capital to 17.9%. With this strengthened capital position, MMFS is now wellequipped to pursue growth opportunities across its core segments.

Valuation and view

* MMFS reported an operationally soft quarter, marked by muted disbursements and loan growth. Asset quality exhibited seasonal deterioration, marked by elevated credit costs, higher slippages, and continued higher levels of write-offs. On a positive note, NIM expanded ~10bp QoQ, and management remains confident that NIM has bottomed out and is likely to expand going forward.

* MMFS currently trades at 1.3x FY27E P/BV. The outlook on loan growth and credit coststill remains partly clouded for MMFS. With a projected PAT CAGR of ~21% over FY25-FY27E and RoA/RoE of 2.2%/13% in FY27E, we reiterate our BUY rating with a TP of INR310 (based on 1.6x Mar’27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412