Buy EPL Ltd for the Target Rs. 280 by Motilal Oswal Financial Services Ltd

Planned leadership transition ensures stability

EPL hosted a call to discuss the leadership transition with the appointment of Mr. Hemant Bakshi and retirement of Mr. Anand Kripalu as MD and Global CEO of the company. Here are the key takeaways from the discussion:

* Mr. Kripalu will retire as MD and Global CEO in Dec’25. He will continue to serve as an additional director until Mar’26 end to ensure a smooth transition. During his tenure, he focused on achieving sustainability, expanding the customer base, improving operating margins, and strengthening talent standards. He also unified company culture across geographies, laying a strong foundation for EPL’s robust growth.

* EPL has appointed Mr. Bakshi as the new CEO-designate, effective 13th Oct’25, who will take over as MD and Global CEO from 1st Jan’26. With over 30 years of FMCG experience, including senior leadership roles at Unilever and founding GroNext Technologies, he brings strong operational and global expertise.

* With Indorama’s 24.9% stake, the company has successfully leveraged its support to start the Thailand plant in a record time. Blackstone continues to provide strong engagement and see potential value unlocking in the future.

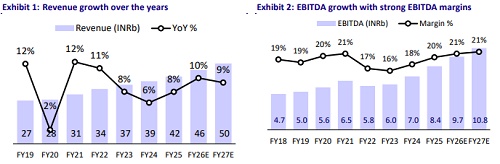

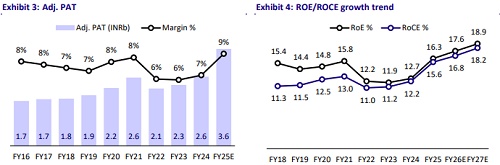

* We continue to estimate a CAGR of 9%/12%/20% in sales/EBITDA/adj. PAT over FY25-28E, led by improved operational efficiency and focus on improving market share across geographies in the BNC segment. We reiterate our BUY rating with a TP of INR280, valuing the stock at 17x FY27E EPS of INR16.7.

Smooth transition to support next phase of growth

* Mr. Kripalu has decided to retire from the position of MD and Global CEO, with effect from Dec’25. However, to ensure a smooth transition, he will continue to serve as an additional director until 31st Mar’26.

* When joined in Aug’21, he had set up a specific vision to make EPL the most sustainable company in the world. Under his leadership, EPL implemented cost intervention strategies to bring back the operating margins to 20% (FY25).

* EPL has appointed Mr. Bakshi as the CEO-designate, with effect from 13th Oct’25. He will be appointed as an additional director with effect from 1st Jan’26, to be MD and Global CEO of the company.

* Mr. Bakshi has over 30 years of experience in the FMCG industry. He spent three decades at Unilever in senior leadership roles across India and Indonesia, including as CEO of Unilever Indonesia and later as Nonexecutive Chairman of Unilever Indonesia.

* He also founded and led GroNext Technologies, a Unilever-funded venture building a B2B marketplace for traditional trade stores, scaling it to 12 markets across Latin America, Asia, and Turkey with over USD1b in GMV.

* Mr. Bakshi received his Bachelor of Technology in Chemical Engineering from IIT, Mumbai, and holds an MBA from IIM, Ahmedabad.

Support from key investors fortifies EPL’s position

* With Indorama’s 24.9% stake purchase, EPL has been able to leverage its support fully. The Thailand plant was started in record time, which could not have been possible without Indorama’s support, said management.

* Management also noted that, as far as Blackstone is concerned, its engagement and support for EPL remains strong as before. Since it is a private equity firm, it may exit the company sometime in the future. However, Blackstone still feels that there is potential for value unlocking in EPL, said management.

* Overall, after the structural and leadership changes, the company is in a better position to lead the next phase of growth.

Valuation and view

* We continue to estimate a CAGR of 9%/12%/20% in sales/EBITDA/adj. PAT over FY25-28E, led by improved operational efficiency and focus on improving market share across geographies in the BNC segment.

* We reiterate our BUY rating with a TP of INR280, valuing the stock at 17x FY27E EPS of INR16.7.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412