Buy Amber Enterprises Ltd for the Target Rs. 8,400 by Motilal Oswal Financial Services Ltd

Weak demand impacts performance

Amber Enterprises (AMBER) posted a weak performance in 2QFY26. Weakness was driven by the consumer durable segment, which was impacted by lower demand and delayed purchases owing to GST 2.0. The company has still outperformed the RAC industry in 2QFY26, with a decline of 18% YoY vs the industry decline of 30-33% YoY for the quarter. The electronics division was also impacted by weak demand in the consumer durable segment. We expect this demand to revive in 2HFY26, and the company to outperform the RAC industry for FY26. We expect the electronics division’s performance to be driven by growth in both PCBA and PCB segments, along with recent acquisitions of Powerone and Unitronics despite a slight delay in the commissioning of the Ascent facility. This momentum is expected to be further supported by the commissioning of the company’s capacity in JV with Korea Circuit, which we expect to commence from FY28. We expect the railway segment’s performance to remain subdued in the near term. We cut our PAT estimates by 19%/10%/11% each for FY26/27/28 to factor in 2QFY26 performance and also incorporate the recent fund raise of INR10b. Reiterate BUY with a revised TP of INR8,400 (INR9,000 earlier).

Weaker-than-expected results

AMBER reported a weak set of numbers. 2Q is usually the weakest quarter for AMBER, mainly due to monsoons. Consolidated revenue growth was broadly flat YoY at INR16.5b vs our expectation of 20% growth, mainly due to lower-thanexpected demand in the consumer durables segment impacted by the monsoon and delayed purchases following GST 2.0. Gross margin expanded 40bp YoY to 20.5% vs our estimate of 18.0%. Absolute EBITDA declined 20% YoY to INR913m, indicating a miss to our estimates by 37%, while margins contracted 130bp YoY to 5.5% vs our estimate of 7.2%, mainly due to weakness in the consumer durables segment. The company reported a net loss of INR329m vs our estimate of a net profit of INR264m. For 1HFY26, revenue/EBITDA increased 25%/12% YoY, while PAT declined 23% YoY and EBITDA margin contracted 80bp YoY. For 1HF26, the company reported a net operating cash outflow of INR7.7b vs an outflow of INR2b last year, mainly due to an increase in working capital.

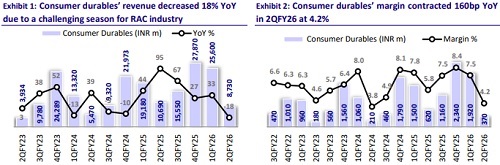

Consumer durables segment revival expected in coming quarters

The segment’s revenue declined 18% YoY to INR8.7b in 2QFY26 (outperforming the industry’s 30-35% volume drop), driven by unfavorable weather and deferred purchases ahead of the GST rate cut implementation. Management remains confident of 13-15% growth in FY26, aided by a likely rebound in 4Q and an expanded product portfolio that now includes a full CAC range up to 17.5 tons. The company’s continued focus on scaling its component business, deepening OEM partnerships, and launching new CAC models in Nov-Dec’25 should help it gain share as demand normalizes. Inventory build-up from the weak summer is expected to normalize by 4QFY26, improving working capital and utilization levels. Margins contracted 160bps YoY to 4.3% due to lower plant utilization, though this pressure is purely cyclical, with recovery expected in the seasonally strong 4QFY26. We expect the segment to post a revenue CAGR of 16% over FY25-28, with margins stabilizing at around 8.0%.

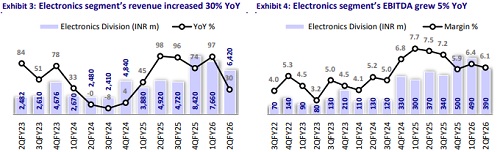

Electronics segment scaling towards a full-stack EMS ecosystem

The electronics division continued to deliver strong growth, with revenue up 30% YoY in 2QFY26, driven by strong performance across both PCBA and bare PCB verticals. Margins were temporarily impacted by higher copper-clad laminate and gold prices, but management expects recovery to 8-9% by FY26-end, and anticipates reaching double digits in FY27, as these costs are passed on to customers with a one-quarter lag. Near-term growth will be supported by sustained demand from the consumer durables sector and incremental contributions from Power-One Microsystems, which expands AMBER’s presence in solar inverters, EV chargers, and battery energy storage systems. Over the medium-to-long term, AMBER is transitioning into a full-stack EMS provider across PCBA, bare PCBs, and complete box-build products for industrial automation and power electronics. The upcoming Ascent Circuits and Korea Circuit JV facilities will enhance its scale, self-reliance, and ability to offer end-to-end solutions. The company targets USD1b revenue in the next three years. We expect a revenue CAGR of 38% over FY25-28, with margins expanding to double digits by FY28, aided by a shift in the mix to higher-margin businesses such as Power-One (15-18%), Unitronics (25-28%), and bare PCBs (17- 19%)

Railways segment to revive in FY27

The railways segment recorded 7% YoY growth in revenue in 2QFY26, driven by higher metro project offtake and gradual execution of new orders. Despite the soft quarter, management remains confident of doubling revenue over the next two years, backed by a strong INR26b order book and expected inflows of another INR4b-5b. Near-term momentum will come from: 1) Sidwal’s greenfield HVAC facility trials beginning in 3QFY26 with commercial operations in 4QFY26, 2) Yujin Machinery JV for pantographs, brakes, and couplers to start production in 1HFY27. While the near-term focus remains on execution ramp-up and cost discipline as new facilities commercialize, the medium-to-long term growth will be led by large infrastructure programs such as Vande Bharat, metro rail expansions, and defense cooling systems, which are gaining traction and expected to contribute materially in the coming years. We expect railways division to clock a revenue CAGR of 23% over FY25-28, with margin to sustain around 18.5% for FY27/28.

Building capacities for the next growth cycle

AMBER has planned out a gross capex of INR7b-8.5b in FY26, excluding subsidies. For FY27, ~INR3b will go toward consumer durables, while the bulk of the investment will support the electronics vertical, from the planned INR6.5b for Ascent Circuits and INR12b for the Korea Circuit JV, largely spread over FY26-FY27. Management expects trial production at Ascent to start by Sep’26 and commercial operations in 3QFY27. Korea Circuit’s construction will begin by Jan’26, with completion expected in one year and revenue contribution anticipated from FY28 onwards. Additionally, the company expects to receive PLI and other subsidies by FY28-FY29, which should help partially fund expansion and enhance returns on capital employed. We have factored in a capex of INR8b-8.5b each over FY26-28.

Strengthening balance sheet amid acquisitions

The quarter marked significant progress on strategic acquisitions and balance sheet improvement for AMBER. ILJIN completed the acquisition of a 60% stake in PowerOne Microsystems, expanding AMBER’s footprint into high-growth energy storage and EV charging solutions, and acquired a 40.2% controlling stake in Unitronics (Israel), a leader in industrial automation systems. These acquisitions will not only add to topline growth but also improve blended margins, given their higher margin profiles. The company raised INR10b via QIP and INR17.5b at ILJIN from marquee investors, strengthening its financial flexibility. Management expects to be net cash positive by FY26-end, with interest costs reducing to INR200m-250m in 2HFY26. The company’s capital discipline amid expansion indicates strong balance sheet management, which should support sustainable growth in the coming years.

Financial outlook

We cut our PAT estimates by 19%/10%/11% each for FY26/27/28 to factor in 2QFY26 performance and also incorporate recent fund raise of INR10b. We, thus, expect revenue/EBITDA/PAT CAGR of 22%/29%/48% over FY25-28 for AMBER

Valuation and recommendation

.The stock currently trades at 80.0x/45.8x/32.2x P/E on FY26/27E/28E earnings. We cut our estimates and reiterate our BUY rating on the stock with a revised DCFbased TP of INR8,400 (earlier INR9,000).

Key risks and concerns

Key risks and concerns include lower-than-expected demand growth in the RAC industry; change in BEE norms making products costlier; change in announced capex policy; and increased competition across the RAC, mobility, and electronics segments.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412