Neutral InterGlobe Aviation Ltd For Target Rs. 4,660 by Motilal Oswal Financial Services Ltd

Reiterates its strategic expansion, financial resilience, and sustainable growth

We attended IndiGo analyst day at its iFly Training Center in Gurugram on 19th Mar’25. Below are the key highlights:

India’s aviation growth amid market expansion and global connectivity

India’s aviation boom: The Indian aviation industry is witnessing a rapid expansion, with domestic air travel set to double by CY30. This growth will be driven by a rising middle class, increasing disposable incomes, and government-led infrastructure projects. IndiGo, as the market leader, is wellpositioned to capitalize on this trend by expanding its fleet and network.

* Global expansion: India is emerging as a key player in international travel, projected to be the 5th largest international outbound tourism market by CY27. With over 50 countries offering visa-free or visa-on-arrival access for Indian travelers, outbound tourism is increasing. IndiGo is strategically growing its international presence through new routes and partnerships with global airlines via codeshare agreements.

* Infrastructure and policy support: The Indian government is investing USD25b to expand and modernize airport infrastructure by CY27. With the number of airports doubling in the last decade, increased capacity will support IndiGo’s expansion plans. Additionally, favorable policies, such as incentives for domestic aircraft manufacturing and MRO (maintenance, repair, and overhaul) services, provide a strong foundation for future growth.

IndiGo’s strategic growth initiatives

* Fleet expansion: IndiGo has placed one of the largest aircraft orders in global aviation history, with 925 aircraft deliveries secured (pending) until CY35. This includes the A321 XLR for mid-haul and A350 wide-body aircraft for long-haul routes, enhancing its global connectivity and fleet flexibility.

* Internationalization in focus: IndiGo aims to increase its international capacity share to 40% by FY30, expanding beyond its traditionally strong domestic network. It is targeting underserved international routes through long-range aircraft and codeshare partnerships, positioning itself as a preferred airline for international travelers.

* Operational efficiency: IndiGo leads the industry with its best-in-class operational metrics, including on-time performance, high aircraft utilization, and cost efficiencies. Its fuel-efficient fleet and streamlined network optimization ensure profitability even in challenging market conditions.

Continued profitability after Covid

* Revenue and profitability: IndiGo posted INR795b in total income for the 12 months ending CY24, up 18% YoY growth. PAT stood at INR61b, showcasing strong cost discipline and revenue diversification despite global economic headwinds.

* Healthy cash reserves: IndiGo has built a robust balance sheet, with free cash reserves tripling since Mar’20. This financial strength provides a safety net against external shocks, supports fleet expansion, and enables continued reinvestment in operations and digital transformation.

* Diversified revenue streams: IndiGo is aggressively expanding its non-ticket revenue sources, including IndiGo Stretch (business class seating), BluChip (loyalty program), and a growing cargo division. These initiatives are aimed at increasing per-passenger revenue while enhancing customer experience.

Management working on future growth drivers

* Capacity expansion and fleet growth: IndiGo aims to double its size by CY30, targeting a fleet of 600+ aircraft and 200m passengers annually. The airline has begun operating its first damp-leased B787 in FY25, with plans to add three more by CY25-end. Future fleet expansion includes A350-900 aircraft deliveries starting CY27, ensuring long-term international growth.

* Changing distribution channels: IndiGo is shifting toward direct agent engagement to enhance customer reach and sales efficiency. The airline is leveraging its extensive domestic and international network to optimize distribution and improve passenger experience.

* Digital transformation: IndiGo is implementing AI-driven solutions like 6ESkai, 6E Digi Breathalyzer, and BagWatch to enhance customer experience, employee efficiency, and operational processes. These innovations are aimed at streamlining airline operations and improving service reliability.

* FY26 growth outlook: IndiGo expects early double-digit YoY capacity growth, supported by more than one aircraft delivery per week in CY25. Confidence in supply-side stability reinforces the company’s expansion plans.

Valuation and view

* IndiGo is striving to improve its international presence through strategic partnerships and loyalty programs. It served 106.7m customers in FY24, with a net increase of 63 aircraft. The company had eight strategic partners with a 27% international share in terms of available seat per kilometer (ASK) in FY24.

* Management has also taken several preemptive measures to increase its global brand awareness as it expects to capture a bigger share of growth in the international market over the coming years. IndiGo is further enhancing its international travel and working relentlessly to adjust schedules to reassure customers.

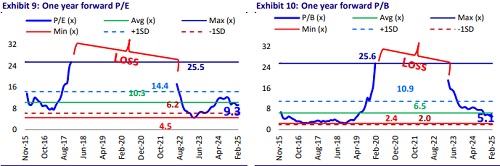

* The stock is trading at ~20x FY26E EPS of INR248.9 and ~10x FY26E EV/EBITDAR. We reiterate our Neutral rating on the stock with a TP of INR4,660, based on 8x FY27E EV/EBITDAR.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412