Buy KPIT Technology Ltd for the Target Rs. 1,500 by Motilal Oswal Financial Services Ltd

In transition; margins intact

Growth to re-accelerate from 4QFY26

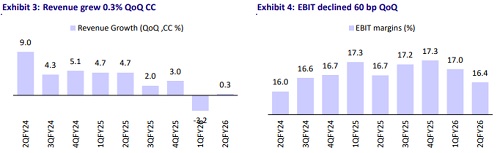

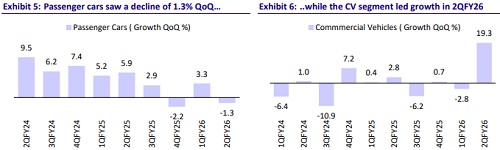

* KPIT Technologies (KPIT) reported revenue of USD181m in 2QFY26, up 0.3% QoQ in CC terms vs. our estimate of flat growth. Growth was led by the commercial vehicles segment, up 19.3% QoQ, while the passenger car segment declined 1.3% QoQ. EBIT margin was 16.4% (down 60bp QoQ), below our estimate of 17.0%. PAT was down 1.6%/17.0% QoQ /YoY to INR1,691m (below our est. of INR2,051m).

* For 1HFY26, revenue/EBIT grew 10.2%/8.3% and PAT declined 16.4% YoY in INR terms compared to 1HFY25. We expect revenue/EBIT/PAT to grow 13.3%/6.0%/13.1% in 2HFY26.

* With an EPS CAGR of 14% over FY25-28, outpacing most peers in the ER&D space, and continued leadership in the automotive software vertical, we reiterate a BUY rating and a TP of INR1,500 (26% upside).

Our view: Transition weighs on growth, not on margins

* KPIT transitioning from services to solutions: We believe KPIT is in the middle of a transition from a traditional services model to a solutions-led one, where it owns full program delivery. This now forms ~18% of revenue (2x YoY) and has temporarily cannibalized some legacy revenue streams, making near-term growth appear softer. Organic revenue declined 2.2% QoQ CC in 2QFY26 (vs. consensus est. of -3%), partly offset by the CareSoft consolidation. Management expects this transition phase to stabilize, with organic growth turning positive from 2H as large deal ramps kick in.

* Asia remains mixed; China emerging as a bright spot: We note that Asia has been relatively soft (declined 10% QoQ on the back of an 8% QoQ decline in 1Q), though management expects a gradual uptick led by India and China. Early traction in China with both local and global OEMs is encouraging, with initial revenue expected from 4QFY26, while Japan and Korea are expected to contribute more meaningfully from FY27 as new programs scale. We think Asia will recover gradually, with China likely remaining the key variable in the near term.

* Margins to remain steady despite integration and wage costs: EBITDA margin stood at 21.1%, broadly in line with expectations. Management reiterated its FY26 margin guidance of ~21%, despite wage hikes spread across 3Q and 4Q. We believe margins will hold steady through 2H, supported by a higher number of solution-led projects, productivity gains from AI-led automation, and continued pyramid optimization. Overall, we see margins holding near 21% through FY26, with a potential uptick in FY27 as large deals scale and synergy benefits from CareSoft start to flow through.

* FY26 a consolidation year: We think FY26 will remain a year of consolidation, with muted top line and resilient margins as KPIT absorbs its model shift and integrates CareSoft. We expect momentum to pick up from 4QFY26, supported by large deal ramp-ups and improving regional demand. In our view, FY27 is likely to mark a phase of gradual acceleration, as solution-led revenues scale, SDV programs mature, and contributions from Europe, India, and China broaden. Management remains confident of a steady and meaningful recovery through FY27, albeit not a sharp ‘hockey-stick’ rebound.

Valuations and changes to our estimates

* KPIT stands to benefit from OEMs’ transformation programs toward SDVs, driven by its strong software engineering capabilities. However, client reprioritization and delays in production development timelines for new architectures have weighed on momentum.

* KPIT’s transition from services to solutions should help it retain competitiveness in a challenging environment. Furthermore, the CareSoft acquisition is expected to support growth recovery in 2H.

* That said, due to higher depreciation linked to the CareSoft acquisition and a miss on other income, we cut our FY26 estimates by ~4%. Nevertheless, with an expected EPS CAGR of 14% over FY25–28, outpacing most peers in the ER&D space and continued leadership in the automotive software vertical, we reiterate our BUY rating with a TP of INR 1,500 (26% upside), valuing the stock at 38x Jun’27E EPS.

Beat on organic revenue but miss on margins; deal TCV up 12% YoY

* USD revenue came in at USD181m, up 0.3% QoQ in CC terms vs. our estimate of flat growth. Organic revenue declined 2.2% QoQ CC (vs. the consensus estimate of -3%).

* Growth was led by the commercial vehicles segment, up 19.3% QoQ, while the passenger car segment declined 1.3% QoQ.

* In terms of geographies, US and Asia declined 4.4%/10.2% QoQ in USD terms, while Europe rose 12.9%.

* EBIT margin was 16.4% (down 60bp QoQ), below our estimate of 17%.

* Deal TCV stood at USD232mn, up 12% YoY.

* PAT declined 1.6%/17.0% QoQ/YoY to INR1,691m (below our est. of INR2,051m). DSO at the end of 2QFY26 stood at 49 days.

* The net headcount increased 334 employees to 12,879 (up 2.6% QoQ) in 2QFY26.

Key highlights from the management commentary

* Client behavior is evolving as KPIT transitions from pure engineering services to end-to-end solution ownership. The solutions-led business—where KPIT takes complete ownership and delivery responsibility—has doubled YoY, driving both revenue visibility and margin expansion.

* Client discussions have turned more positive, with improving macro stability and tariff clarity. Specific areas of traction include Autonomous Systems, After-Sales Diagnostics, Cybersecurity, and SDV (Software Defined Vehicles), particularly across Europe, India, and China.

* EV-related impairments seen in select clients are not widespread—alternate powertrain programs (like hybrid and hydrogen) continue, while core revenue drivers remain Digital Cockpit, Middleware, and Validation services.

* Organic growth remained soft due to client program delays; however, strong ramp-ups expected from 4QFY26 will aid sequential improvement.

* Management guided for flat-to-modest growth in 3QFY26 (organic) and meaningful acceleration in 4QFY26 as large deal ramps kick in

* CareSoft Italy and N-Dream entities will be fully consolidated from 3QFY26, adding incremental revenue and strategic access to European OEM programs.

* Management reaffirmed its FY26 EBITDA margin guidance of ~21%, despite wage hikes spread across 3Q and 4Q.

Valuation and view

* KPIT remains well-placed to benefit from OEMs’ shift toward SDVs, supported by strong software engineering capabilities. We trim FY26 estimates by ~4% on higher depreciation from CareSoft and lower other income. With an expected EPS CAGR of 14% over FY25-28 and continued leadership in automotive software, we reiterate BUY with a TP of INR 1,500 (26% upside; 38x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412