Buy Persistent Systems Ltd for the Target Rs. 6,550 by Motilal Oswal Financial Services Ltd

In the pink of health

Healthy beat justifies premium valuations

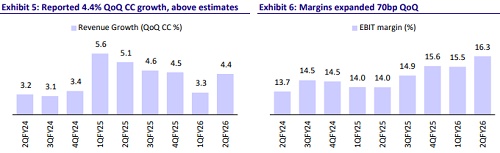

* Persistent Systems (PSYS) reported 2QFY26 revenue of USD406m (vs. est. USD404m), up 4.2% QoQ in USD terms and 4.4% in CC (est. +3.5%). EBIT margin stood at 16.3% (est. 15.7%).

* EBIT grew 12.7% QoQ/43.7% YoY to INR5.8b. Adj. PAT came in at INR4.7b (est. INR4.4b), up 11% QoQ/45% YoY. For 1HFY26, revenue/EBIT/PAT grew 22.7%/39.4%/42.0% YoY in INR terms.

* We expect revenue/EBIT/PAT to grow 22.1%/24.7%/25.5% YoY in 2HFY25. TTM TCV was USD609m, up 17% QoQ/15% YoY (1.5x book-tobill). Given its consistent execution and visibility on growth, we value PSYS at 43x Jun’27E EPS. Reiterate BUY with a TP of INR6,550.

Our view: Deal TCV improving even as demand remains uncertain.

* Growth came in above estimates; FY27 target intact: PSYS reported 4.4% QoQ CC growth in 2QFY26, coming in ahead of estimates, driven by traction in BFSI (+7.0% QoQ) and steady growth in Healthcare (+3.8% QoQ). At a CQGR of around 4.5% over the next couple of quarters, PSYS should comfortably deliver ~17.5% YoY CC growth in FY26E. While this is a slight moderation from FY25 levels, it remains healthy in the current demand environment. The company also reaffirmed its USD2b revenue target by FY27, implying ~18% CC CAGR over FY25-27.

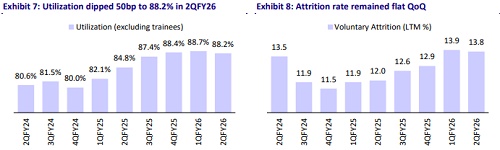

* Margin performance admirable: EBIT margin stood at 16.3%, up 80bp QoQ. The improvement was supported by a few one-offs and operational levers: +80bps from software license cost reversal for one client, +60bps from currency gain, and +30bps from offshoring ramp-up for a large healthcare client, partly offset by -50bps from higher doubtful debt provisions, -20bps from lower utilization, and -20bps from IT amortization and depreciation.

* We do expect some margin pullback in 3Q due to wage hikes. Utilization stands at 87% and key margin levers are now peaked out. SG&A leverage continues to be a key margin lever. Currency gains have been a broad positive this quarter; however, if the currency moves unfavorably, it could turn into a near-term risk. We factor in margin expansion of 100bps over FY26E (and another 50bps by FY27E), even as management guides for around 100bps improvement in FY27.

* Pipeline remains healthy, but conversion remains key: TTM TCV stood at USD609m, up 15% YoY, with a healthy 1.5x book-to-bill ratio. That said, net new deal TCV remains a bit soft. Conversion will remain the key monitorable in the near term. PSYS continues to chase larger deals and sharpen its focus on TCV-to-ACV conversion, supported by good traction in BFSI and growing adoption of AI-led programs.

Valuation and revisions to our estimates

* We project a 19% USD revenue CAGR over FY25-27 for PSYS, which, combined with margin expansion, could result in ~26% EPS CAGR. This places the company in a league of its own as a diversified product engineering and IT services player.

* We revise our FY27E estimates upward by 4%, reflecting continued revenue momentum and steady margin gains. We factor in margin expansion of 100bps over FY26E (and another 50bps by FY27E), while our FY25/FY26 estimates remain largely unchanged. Owing to its superior earnings growth trajectory, on a PEG basis, we believe the valuation still has room for upside. We value PSYS at 43x Jun’27E EPS. Reiterate BUY with a TP of INR6,550.

Beat on revenue and margins; deal TCV momentum returns

* 2QFY26 revenue stood at USD 406m, up 4.2% QoQ in USD terms (above our estimate of 3.7% QoQ). The company reported CC growth of 4.4% QoQ vs our estimate of 3.5% QoQ CC growth.

* Growth was led by BFSI (up 7.0% QoQ) and Healthcare (up 3.8% QoQ).

* EBIT margin at 16.3% was up 80bps QoQ and above our estimate of 15.7%.

* TCV was USD609m, up 17% QoQ/15% YoY (1.5x book-to-bill).

* Net new TCV was up 4% QoQ at USD350.8m. ACV stood at USD447m.

* Net headcount improved by 3.5% QoQ. Utilization dipped 50bp QoQ at 88.2%. TTM attrition was down 10bp QoQ at 13.8%.

* EBITDA grew 11.8% QoQ/42% YoY to INR6.8b. EBITDA margin came in at 19.1%, above our estimate of 18.4%.

* Adj. PAT stood at INR4.7b (up 11% QoQ/45% YoY), above our estimate of INR4.4b.

Key highlights from the management commentary

* The macro environment remains mixed; however, it is gradually stabilizing as stakeholders adapt to it. It remains confident in its ability to sustain a historical growth momentum.

* The industry is expected to continue reporting robust deal wins going forward.

* The company remains committed to strengthening its capabilities in AI.

* BFSI is expected to lead growth due to deal ramp-ups and a healthy pipeline, followed by Hi-Tech and Healthcare.

* It is still early for AI to have a significant impact on renewal deal revenues; however, the company is proactively integrating AI-led solutions with its top 100 customers (~82% of revenue).

* Offshoring ratio remains optimal at ~85%. The pricing structure is aligned with customer agreements to ensure a fair realization.

* Wage hikes effective from 1st Oct 2025 for all employees are expected to impact margins by 180bps in 3Q; however, ~80-100bp of this impact is expected to be offset through utilization, offshoring, and subcontractor rationalization.

* Healthcare & Life Sciences (HLS): Large deals are progressing through ramp-up, offshoring, and optimization cycles.

* SASVA streamlines SDLC and optimizes GPU infrastructure for scale. The company has filed 20 new patents, bringing the total SASVA patents to 75.

Valuation and view

* We project a 19% USD revenue CAGR over FY25-27 for PSYS, which, combined with margin expansion, could result in a ~26% EPS CAGR. This places the company in a league of its own as a diversified product engineering and IT services player.

* We revise our FY27E estimates upward by 4%, reflecting continued revenue momentum and steady margin gains. We factor in margin expansion of 100bps over FY26E (and another 50bps by FY27E), while our FY25/FY26 estimates remain largely unchanged. Owing to its superior earnings growth trajectory, on a PEG basis, we believe the valuation still has room for upside. We value PSYS at 43x Jun’27E EPS. Reiterate BUY with a TP of INR6,550.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)