Buy Campus Activewear Ltd for the Target Rs. 315 by Motilal Oswal Financial Services Ltd

Premiumization driving growth and margin expansion

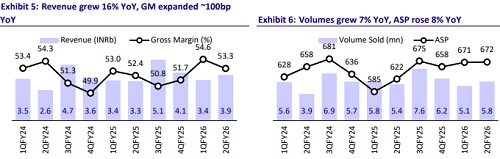

* Campus Activewear (Campus) delivered a strong 16% revenue growth, driven by strong traction in the premium segment (sneaker sales up 2x YoY, ASAP up by INR50 or 8% YoY).

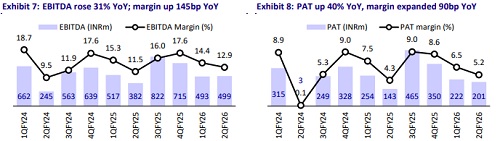

* Campus’ EBITDA grew 31% YoY to INR0.5b with margin expanding by ~145bp YoY to 12.9%, aided by improved mix and operating leverage. This was partially offset by higher A&P spending (~200bp) and Haridwar-2 ramp-up costs (~40bp). Adjusted for these transitory factors, its margin stood at ~16%, in line with guidance.

* Management sees strong underlying demand momentum and expects to sustain double-digit revenue growth with steady improvement in margins to the 17-19% range over the medium term.

* We trim our EBITDA estimates for FY27/FY28 by 1-2%, but higher leasehold expenses related to the new Pantnagar facility lead to ~6% cut in EPS.

* We model an 11%/19%/23% CAGR in revenue/EBITDA/PAT over FY25-28E, with the EBITDA margin improving to ~19% by FY28.

* Our EPS cut was offset by the roll-forward of our estimates to Dec’27, leading to an unchanged TP of INR315. Our TP is premised on 45x Dec’27E P/E; reiterate BUY.

Strong revenue growth; higher lease costs dent profitability

* Campus’ revenue at INR3.9b grew 16% YoY (vs. our est. of 13% YoY and 1% YoY in 1Q).

* Gross profit was up 18% YoY to INR2b (inline).

* Gross Margin (GM) expanded 100bp YoY to 53.3% (~35bp ahead).

* Employee costs rose 17% YoY (7% higher than our estimate), while other expenses were up 14% YoY (4% ahead).

* As a result, EBITDA grew 31% YoY to INR499m (in line), led by operating leverage.

* EBITDA margin expanded 145bp YoY to 12.9% (40bp miss).

* For 1HFY26, the pre-IND AS EBITDA stood at INR729m (up 2% YoY) with a margin of 10% (down 70bp YoY).

* Depreciation (+25% YoY) and finance costs (+39% YoY) surged.

* Resultantly, PAT came in at INR201m (10% miss), with PAT margin at 5.2% (up 90bp YoY, ~75bp miss).

Review of the 1HFY26 performance

* Campus’ revenue grew ~9% YoY to INR7.3b.

* Gross profit rose 11% YoY to INR3.9b as gross margin expanded ~80bp YoY to 53.9%.

* EBITDA at ~INR1b grew 10% YoY as margin expanded ~20bp YoY to 13.6%.

* The pre-IND AS EBITDA stood at INR729m (up 2% YoY), with the margin at 10% (down 70bp YoY).

* Reported PAT grew 7% YoY to INR423m as EBITDA growth and higher other income (~2x YoY) were offset by higher depreciation (+24% YoY) and finance cost (+37% YoY).

* As per our estimate, we build in 2HFY26 revenue/EBITDA/PAT growth of 11%/18%/23%.

Balance sheet and cash flow analysis

* Campus’ net working capital (NWC) days increased to 101 in 1HFY26 (from 93 YoY), driven mainly by higher inventory days (125 vs. 118 YoY).

* OCF (post interest and leases) outflow for 1HFY26 stood at INR545m (vs. inflow of INR220m YoY), due to adverse working capital movement.

* With capex rising to INR1b in 1HFY26 (vs. INR203m YoY), FCF (post-interest and leases) outflow stood at INR1.6b (vs. INR17m of FCF generation YoY).

Growth momentum sustained by distribution

* Trade distribution: Revenue surged 20% YoY to INR2b, driven by strong retail execution, repeat billing, and premium portfolio traction. The LFS channel delivered 35% growth, fueled by new door additions.

* Online: Revenue grew by a modest ~6% YoY to INR1.3b, hurt by a change in billing model, where platforms now charge freight directly to consumers.

* D2C (offline): Revenue grew 33% YoY to INR448m.

Key takeaways from the management commentary

* Demand: Management sees strong underlying demand momentum, supported by festive recovery, premium category growth, and expanding distribution reach. They expect sustained double-digit growth in H2FY26 as premium and D2C channels scale further.

* Premium portfolio share rose to 57.2% (from 45.2%), lifting ASP by INR50 to INR672. Growth was driven by ~100% YoY growth in sneakers and strong traction in the women’s range, reinforcing premiumization and brand strength across geographies.

* Margins: Rationalization of low-margin SKUs and a faster-growing sneakers portfolio improved margins. Gross margin expanded to 53.9% (up by ~100bp). EBITDA margin was 12.9%, hurt by front-loaded ad spending (~200bp) and temporary Haridwar-2 ramp-up costs (~40bp). The underlying margin was ~16%.

* The capex plan of INR2.3b over three years has focused on premiumization via the Pantnagar facility, adding 0.6mn pairs/month; Phase 1 (INR1.1b in FY26) builds uppers, with later phases adding assembly, ensuring full in-house integration and automation.

Valuation and view

* Campus’ innovative designs, color combinations, and attractive price points make it a market leader in the fast-growing Sports and Athleisure (S&A) category.

* The GST rate cut acts as a structural demand catalyst, improving affordability and fueling growth. Alongside expanding distribution and new sneaker-focused capacity, Campus is well poised to sustain double-digit revenue growth.

* We trim our EBITDA estimates for FY27/28E by 1-2%, but higher leasehold expenses related to the new Pantnagar facility lead to ~6% cut in our EPS.

* We model an 11%/19%/23% CAGR in revenue/EBITDA/PAT over FY25-28E, with EBITDA margin improving to ~19% by FY28.

* Our EPS cut was offset by the roll-forward of our estimates to Dec’27, leading to an unchanged TP of INR315. Our TP is based on 45x Dec’27E P/E; reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)