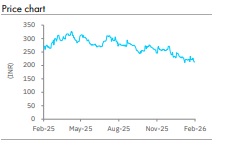

Buy Mrs Bectors Food Specialities Ltd For Target Rs. 300 By Elara Capital

Growth outlook improving in FY27

Mrs. Bectors Food Specialities (BECTORS IN) delivered 8.4% revenue growth in Q3FY26. The Biscuits segment grew by 5.5%, with closer to double-digit growth in the domestic business but partially offset by weak exports due to tariff-led disruptions. The Bakery segment grew by 13% YoY, led by high teens growth in English Oven. BECTORS expects double-digit topline growth, aiming to achieving 14% EBITDA margin in FY27. We cut our earnings estimates by 4.1%/4.7% for FY27E/28E to factor in lower EBITDA margin. Given the improving revenue growth outlook, we maintain Buy with a lower TP of INR 300 from INR 314 on 45x P/E (unchanged) on Sept ’27E EPS

Broad-based growth across Biscuits and Bakery: In Q3, net sales rose 8.4% YoY to INR 5.3bn (2.9% below our estimates). Sales growth was led by 13.1% growth in Bakery and 5.5% growth in Biscuits. In Bakery, English Oven posted high teens growth, aided by distribution expansion and strong traction in quick-commerce (forms 33% of English Oven’s revenue), while growth in institutional/QSR & export business was muted. The frozen portfolio of the B2B business is growing well and now contributes 20% of revenues. BECTORS expects low teens growth from institutional bakery in FY27. In Biscuits, the domestic business grew closer to double-digits, but export business remained weak due to tariff headwinds. Management expects the domestic business to grow in low double-digits (led by Cremica) and the export business to pick up owing to the bilateral agreement between the US and India and the India-EU FTA (leading to new enquires and resumption of orders that were on hold).

Capacity additions and distribution expansion: Management reiterated focus on capacityled growth, particularly in the bakery vertical. The Khopoli (Maharashtra) plant (to be commissioned in the next few months) and a new Kolkata unit have been commissioned to strengthen its presence in the East. The Khopoli plant has a capacity of ~132,000 breads and ~1mn buns per day (doubling the existing buns capacity). Asset turns from this plant will reach 2-2.5x in the next three years. BECTORS will be aggressively expanding the Bakery business in Mumbai and other cities of Maharashtra with the onset of the Khopoli plant. These investments are margin accretive and aimed at positioning English Oven among the top pan-India bakery brands in the next 2-3 years. Distribution expansion continues, with direct reach now at 0.55mn biscuit outlets and ~40,000 bakery outlets.

Aims at 14% EBITDA margin in FY27: Q3 EBITDA margin improved 35bps YoY to 12.8% (inline with our estimates of 12.8%). Raw material costs were stable sequentially, and the management expects margin recovery in the next two quarters, led by operating leverage, higher bakery utilization, and logistics savings from Rajpura and Dhar plants. The company indicated that its EBITDA margin may reach 14% in FY27.

Reiterate Buy; with a lower TP of INR 300: We cut earnings estimates by 4.1%/4.7% for FY27E/28E to factor in lower revenue and EBITDA margin. Given the improved revenue growth outlook, we reiterate Buy with a lower TP of INR 300 from INR 314, on 45x P/E (unchanged) on Sept ’27E EPS..

Please refer disclaimer at Report

SEBI Registration number is INH000000933