Buy Indian Hotels Ltd for the Target Rs.900 by Motilal Oswal Financial Services Ltd

Industry tailwinds continue to drive performance

Operating performance in line with our estimate

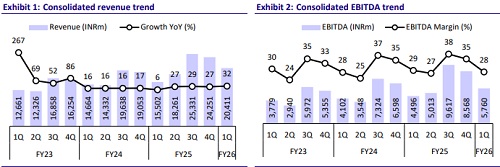

* Indian Hotels (IH) reported strong consolidated revenue growth of 32% YoY in 1QFY26, led by healthy RevPAR growth of 11% (ARR up 12% and OR down 90bp YoY) in its standalone business. Like-for-like consol hotel revenue/TajSATS grew ~13%/20% YoY. Management contract revenue rose 17% YoY to INR1.3b.

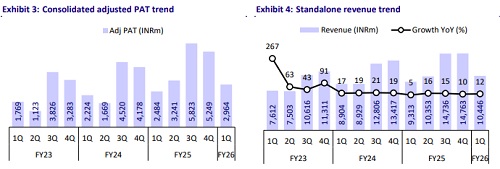

* IH maintains its double-digit revenue guidance for FY26, supported by strong MICE activity, favorable demand-supply dynamics, and growth in spiritual tourism. The company is adding ~500 greenfield keys in FY26 and plans to invest ~INR12b during the year toward its current and future pipelines. We expect IH’s performance to continue its uptrend, with revenue/EBITDA/adj. PAT CAGR of 16%/20%/17% over FY25-27, largely led by room addition and ARR growth, while OR is likely to inch up marginally.

* We broadly maintain our FY26/FY27/FY28 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR900.

Healthy ARR growth aids revenue growth

* 1Q consolidated revenue/EBITDA/adj. PAT grew 32%/28%/19% YoY to INR20.4b/INR5.8b/INR2.9b (all in line with estimates).

* Standalone revenue/EBITDA rose 12%/11% YoY to INR10.4b/INR3.6b, aided by an increase in ARR (up 12% YoY to INR14,552), while OR declined 90bp to 74.3%. F&B/other services/management fee incomes grew 18%/17%/16% YoY.

* For subsidiaries (consol. less standalone; including TajSATS), sales/EBITDA grew 61%/74% YoY to INR9.9b/INR2.1b. TajSATS revenue/EBITDA grew ~22%/20% YoY.

* International hotels performed better this quarter, with UOH/St. James’ revenue growing 16%/20% YoY, while EBITDA was up 90%/9%, respectively.

* IH’s new business verticals, comprising Ginger, Qmin, and amã Stays & Trails, grew 25% YoY to INR2b in 1QFY26.

Highlights from the management commentary

* International business: St. James is expected to witness strong doubledigit growth in the coming quarters, driven by events like Wimbledon and the India-England tour. In the US, RevPAR grew 18%, led by San Francisco’s ~50% recovery and healthy performance of The Pier (continues to gain market share) with steady mid-to-high teens RevPAR growth.

* Outlook and demand: Despite a high base in July, driven by five wedding nights last year, the 2QFY26 outlook remains strong. Management anticipates robust performance in August and September. The company expects double-digit revenue growth in FY26 for its hotels segment, driven by MICE activity and continued inflow of high-profile international delegates.

* Capex: Management plans to incur capex of INR12b in FY26 for assets under construction, renovation, expansion, and digital initiatives. The company has revised its capex strategy, shifting to benchmarking annual free cash flow vs depreciation earlier to align it with the high-growth phase of the industry.

Valuation and view

* The outlook continues to remain strong for IH, led by healthy traction in both the core business as well as new and reimagined businesses.

* We expect the strong momentum to continue in the medium term, led by: 1) a strong room addition pipeline in owned/management hotels (3,770/16,430 rooms), 2) continued favorable demand-supply dynamics, and 3) increasing MICE activities in India.

* We broadly maintain our FY26/FY27 EBITDA estimates and reiterate BUY with our SoTP-based TP of INR900

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412