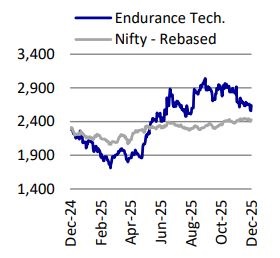

Buy Endurance Technologies Ltd for the Target Rs. 3,050 by Motilal Oswal Financial Services Ltd

New order wins to help sustain outperformance

We met with Endurance Technologies’ (ENDU) management to understand the outlook for its key segments. While the company awaits clarity from the government on its recommendation of mandatory ABS on all 2Ws, it is likely to continue outperforming industry growth on the back of the ramp-up of: 1) the new alloy wheel plant at Bidkin; 2) dual-channel ABS and the new brakes facility in Chennai; and 3) the inverted front forks business. Four-wheelers will be a key growth driver going forward, as the company continues to focus on increasing the segment’s contribution to 45% from the current 30%. It has already won orders in die castings, brakes, and transmissions, and is awaiting its first order win in suspensions. Beyond this, the company has developed competence in adjacent segments, with supplies expected to start soon for solar dampers, battery pack assembly, and aluminum forgings. With the Stoferle acquisition and healthy new order wins, we expect steady growth in its European business despite the adverse macro environment. We estimate a CAGR of ~16%/17%/16% in consolidated revenue/EBITDA/PAT over FY25-28. The stock trades at 33.6x/29x FY27E/FY28E consolidated EPS. We reiterate our BUY rating with a TP of INR3,050 (based on 36x Sep’27E consolidated EPS)

New order wins in 2Ws to continue driving outperformance

ENDU is likely to continue outperforming domestic 2W growth on the back of: 1) the new alloy wheel plant in Bidkin, which is likely to reach a run rate of INR6b on an annualized basis from 2QFY27E, 2) the commencement of dual-channel ABS supplies to two customers, along with the SOP of the new Chennai brakes facility from 2QFY27, 3) the ramp-up of inverted front forks for key customers.

4W to be a key growth driver Management continues to focus on increasing contribution from the 4W segment to 45% from the current 30%. Some of its order wins in this space include: 1) new die-casting orders from four OEMs totaling ~INR4b, 2) the first order for 4W drive shafts, with SOP expected in 4QFY26, along with orders for 4W drum brakes, 3) plans to enter 4W suspensions with a Korean technology partner.

Newer segments emerging as growth drivers

ENDU’s focus on diversification has helped it establish presence in adjacent product segments, which could evolve into key growth drivers. These include: 1) An initial order of INR3b in battery pack assembly, 2) the first order worth INR2b for solar dampers from a Spanish OEM, 3) a line of sight to achieve INR1.4b in revenue from aluminum forgings in FY27, 4) continued focus on ramping up its presence in the aftermarket.

Valuation and view

On the back of its healthy order backlog, we expect ENDU to outperform core industry growth, both in India and Europe. As a result, we estimate a CAGR of ~16%/17%/16% in consolidated revenue/EBITDA/PAT over FY25-28. The stock trades at 33.6x/29x FY27E/FY28E consolidated EPS. We reiterate our BUY rating with a TP of INR3,050 (based on 36x Sep’27E consolidated EPS)

New order wins in 2Ws to continue driving outperformance

Update on AURIC Bidkin alloy wheel plant

ENDU’s existing alloy wheel capacity of 5.5m units pa is currently fully utilized. Given the strong demand and pressure from customers to ramp up capacity, ENDU has set up a greenfield facility in AURIC Bidkin with an initial capacity of 150k sets per month and a maximum capacity of 300k sets per month. This facility will focus primarily on the two-wheeler alloy wheel segment and will deliver finished sets for motorcycles and scooters across both conventional ICE and EV platforms, with an aim of capturing market share through localized, high-volume production and close customer integration. This facility is also now fully booked with orders. Production at the facility started in Oct’25, with the first supplies to BAL and RE (INR680m) to commence from Dec’25, while supplies to Suzuki would commence from 1QFY27. In addition, in 2QFY26, ENDU won a new order for alloy wheels from Ather Energy worth INR310m. The company expects the plant to ramp up to annualized sales of ~INR6b by 2QFY27. Given the strong order pipeline, we expect the alloy wheels business to be a key growth driver for ENDU going forward.

Braking systems

In ABS, ENDU currently has a total capacity of 640k units pa. Of this, 400k units of single-channel ABS capacity is fully utilized. Of the balance 240k units pa, which is for dual-channel, the first OEM SOP has commenced in 3Q and the second OEM is likely to commence in 4QFY26. Given the government’s draft notification making ABS mandatory for all 2Ws from Jan’26, ENDU has already ordered 1.2m singlechannel capacity line, expected to be set up by Mar’26. To further expand into the business, the company is also backward integrating into steel-braided hoses, valves, and ECU assemblies.

However, 2W OEMs continue to be in discussion with the government for possible alternative options, and a final decision is yet to be notified. Meanwhile, in the traditional brakes business, ENDU has started civil work on a new plant in Chennai, which will manufacture disc brake systems, including master cylinders, calipers, brake discs, and brake hoses, with production slated to begin in 2QFY27. The Chennai facility will produce 3mn disc brake assembly systems and 4mn brake discs annually. This expansion will not only improve service to key OEM customers in South India, such as TVS, Yamaha, and Royal Enfield, due to its strategic proximity, but also free up space at the existing Waluj plant for ENDU’s growing ABS production capacity. As a result, the brakes division is expected to remain a key growth driver for ENDU in the coming years.

Inverted front forks

In the inverted front forks business, ENDU remains a clear market leader, with steady growth over the last few years driven by rising demand from multiple OEMs. It has recently started the supply of inverted front forks to TVS, while KTM has increased schedules, expected to cross 650k units in FY26. Further, SOP for HMCL is expected by Q4FY26, and for a Chinese OEM in 1QFY27. With this, ENDU will supply inverted front forks to six OEMs, thereby enhancing its competitive position in the industry.

Focus on ramping up 4W’s contribution to 45%

Following the acquisition of Stoferle, ENDU’s 4W segment contribution has increased to 30% from 25% earlier. Management continues to focus on further raising this mix to 45% in the coming years. Some of the major breakthroughs achieved so far are highlighted below.

Strong order wins in the die casting business

ENDU has been witnessing strong order wins in its die casting business, including: 1) An order from Valeo (for MM EV) to supply machined aluminum castings for an eaxle assembly, with peak annual revenue of INR730mn, 2) Die-casting orders from a US-based EV OEM and a European OEM (a new client for ENDU), 3) A recent order win from Yazaki. The total order wins from these four customers stand at INR3.9b.

Given the strong order inflow, ENDU has set up a greenfield die-casting facility in AURIC Shendra to serve both the 4W and non-automotive segments. This plant will feature higher tonnage capacity along with advanced finishing capability. SOP for this plant is scheduled for 4QFY26, while for the two global clients, it is scheduled for 1QFY27, with peak potential to be achieved in FY28. Moreover, SOP for the Yazaki order is 2QFY27. Given the improved value addition in these castings, these orders are expected to deliver improved margins.

Early inroads in drive shafts

While ENDU is currently supplying drive shafts to multiple 3W OEMs, it has recently secured its first order for 4W drive shafts. On-vehicle testing is currently underway at ENDU’s captive testing ground, and SOP is expected in 4QFY26. Given the strong demand from 3W as well as 4W OEMs for drive shafts, ENDU has decided to set up a separate 4W drive shaft assembly line in 3Q.

First order win in 4W brakes is encouraging

ENDU has been working with its technical partner BWI to develop 4W braking systems. Although a small start, the company has received its first-ever 4W braking order to supply drum brakes to TTMT, worth INR250m, with SOP scheduled for 4QFY26. It also plans to develop advanced braking systems, including ESP. While ENDU is cognizant of long lead times for braking systems, it remains fully committed to increasing its presence in the 4W braking systems in India going forward.

Looking to enter the 4W suspension market in India

While ENDU is a market leader in 2W suspensions in India, the company is now planning to enter the 4W suspension space. For this, it has entered into a technical tie-up with a Korean player that delivers about 100mn shock absorbers globally p.a. Engagements with leading Indian and global PV OEMs are ongoing, with three programs in advanced stages of discussion. Backed by a solid partner, ENDU aims to emerge as a tier-2 supplier for 4W suspensions in India.

Thus, the 4W business is expected to remain a key growth driver in the coming years. The company may also consider another inorganic opportunity in Europe to move closer to its target of 45% contribution.

New emerging product segments

While the focus remains on ENDU’s outperformance in 2Ws and the ramp-up of its 4W business, the company has recently secured orders from adjacent sectors that have the potential to scale into major growth drivers in the coming years. Below, we have highlighted such growth drivers for ENDU.

Battery Pack Assembly

ENDU has announced a greenfield lithium-ion battery-pack manufacturing facility in Pune with planned production capacity of 35k battery packs per month at full rampup. The company is investing INR473m for the capacity, funded via internal accruals, and the facility is expected to commence production from Jan’26. While the company is still in the early stages of the business, it has already won an order from a large 2W OEM worth INR3b per year for battery pack supplies. ENDU also plans to focus on battery packs in non-automotive applications such as inverters, telecom, and battery energy storage systems.

Solar Damper Besides suspensions for 2W/3W/4W vehicles, ENDU is also exploring nonautomotive damping as a part of a broader ‘electric and electronic business’ portfolio. The company has already sold its first set of solar dampers in the exports market in 2QFY26. It has won INR2b worth of order from a Spanish OEM to supply solar dampers. The company is building a new infrastructure at its Sanand plant to cater to this order, to be executed by FY27. While ENDU is in the process of finalizing business with another global client, management has indicated that this business has the potential to scale up to a major revenue stream in the coming years.

Aluminum Forgings Initially developed as a backward-integration solution for inverted front forks in technical collaboration with FGM Italy, aluminum forgings have evolved into a distinct, commercially viable product line with cross-segment use cases. Having gained a deeper understanding of this segment and identified opportunities, ENDU is now looking to offer this capability to prospective OEMs. So far, it has won an order from JLR worth INR270m (SOP 4QFY26), from a German OEM worth INR50m (SOP 1QFY28) and from RE worth INR120m (SOP 1QFY27). Management has also indicated a line of sight to ramp up this business to INR1.4b by FY27E. Its four aluminum presses are expected to be moved to a new facility by 1QFY27, with a fifth press being added to meet demand.

Aftermarket Expansion

Aftermarket is a strategic priority for ENDU. It is focusing on secondary demand generation with retailers and mechanics for the domestic business. The company has also appointed one new Domestic Head and another Head for the bought-out products. It has developed district action plans for 78 district clusters and defined unique value propositions for 39 countries. ENDU targets for this segment, which currently accounts for ~5% of standalone revenue, to reach 10% contribution by FY28, with an even more ambitious goal set through 2030. It is clear that each of these business segments has the potential to scale into key growth drivers for ENDU in the coming years.

Europe: Steady growth expected due to a healthy order wins

Demand in Europe continues to be tepid, and OEMs have been pushing discounts to drive volumes. ENDU’s Europe business is largely growing in line with the industry. While concerns have been raised about the European OEMs’ outlook due to the Nexperia issue, management has confirmed that they are not seeing any slowdown from their key OEMs (VW and Stellantis) due to this aspect. ENDU’s Europe order backlog stands at EUR242m, including new orders worth EUR207m, with peak revenue expected to be achieved in FY29. Of this EUR242m order won in the past five years, 41% of orders are for EV applications and another 45% from hybrid applications. Moreover, ICE end-use, which is currently at ~40% of ENDU’s Europe revenue, is expected to reduce to 25% in FY28. On the back of this healthy order backlog, we expect ENDU’s organic business to post steady growth despite a weak market outlook for the Europe PV industry. Beyond this, ENDU’s acquisition of Stoferle is expected to drive growth in FY26, having been integrated from 1QFY26. Stoferle's product line includes components such as crankcase lower sections, oil pans, control housings, torque converter housings, gearbox housings, and parts for hybrid and electric vehicle systems. These products are critical for both ICE and EV applications. The company also possesses machining capabilities for large castings, including the ability to manufacture its own machines, providing ENDU with strategic access to German OEMs. We expect ENDU to reap synergy benefits from this acquisition in the long run. Further, management has also indicated that, given the ongoing consolidation in Europe, it is exploring further inorganic growth opportunities in the region, which would help drive it closer to its target of 45% contribution from 4Ws.

Valuation and view

- Given ENDU’s strong positioning in the 2W segment, it is the best proxy to play the Indian 2W opportunity, taking into account the underlying trends of premiumization and an uptrend in scooters. Given the new customer wins (won orders worth INR46.7b since FY22, including new orders worth INR39.5b) and technology-led increase in content, we estimate ENDU to outperform the underlying 2W industry in India.

- The company features robust management, a diverse revenue profile, improved technological content, a high wallet share of customers, and financial discipline. It is one of the few auto-ancillary companies in India that boasts a truly diversified revenue base, both in terms of product lines as well as customer base, but still offers a consistently respectable RoE.

- As part of its diversification strategy, ENDU has now set itself an aggressive target to achieve 45% contribution from the 4W business from 30% currently. In line with this, it has now won new orders in die castings, brakes, and drive shafts, and is close to winning an order in suspensions as well.

- On the back of the growth drivers highlighted above, we estimate a CAGR of ~16%/17%/16% in consolidated revenue/EBITDA/PAT over FY25-28. The stock trades at 33.6x/29x FY27E/FY28E consolidated EPS. We reiterate our BUY rating with a TP of INR3,050 (based on 36x Sep’27E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)