Sell Thermax Ltd for the Target Rs. 3,000 by Motilal Oswal Financial Services Ltd

Legacy projects impacted performance

Thermax’s (TMX) 2QFY26 results came in sharply below our expectations on lowerthan-expected order inflows, execution and margins. As highlighted earlier (link), we were concerned about the impact of legacy projects and US tariffs on the industrial infra and chemical segment’s margins and this impact was more severe than our expectations in 2QFY26. The order prospect pipeline remains strong across metals and mining, refineries, thermal and fertilizer, and TMX expects healthy inflow ramp-up in 2HFY26. We do expect TMX to benefit from its strong product portfolio and improved margins in industrial product division. However, the lingering impact of legacy margins can continue to impact performance for the next 2-3 quarters. We cut our estimates by 9%/10%/9% for FY26/27/28 and revise our SoTP-based TP t

Weak set of results

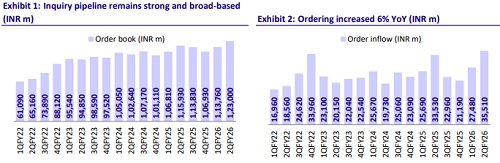

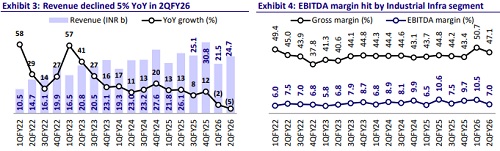

Revenue declined 5% YoY to INR24.7b (vs. our est. INR28.9b), primarily driven by a 24% YoY decline in the Industrial Infra segment. Gross margin expanded ~230bp YoY but contracted ~360bp QoQ to 47.1%. Lower margins in the Industrial Infra division led to an overall EBITDA margin contraction of ~360bp YoY to 7.0%, with EBITDA at INR1.7b (-38% YoY), missing our estimate by 38%. The decline in profitability was impacted by project cost overruns in the Industrial Infra segment and a higher-than-expected tax rate, resulting in an adjusted PAT of INR1.2b (-40% YoY, 33% below our estimate), while PAT margin contracted 280bp YoY to 4.8%. Order inflows for the quarter stood at INR35.5b, up 6% YoY, taking the total order book to INR123b, up 6% YoY. For 1HFY26, revenue/EBITDA/PAT declined 4%/5%/12% YoY to INR46.2b/INR4.0b/INR2.7b, with margins contracting marginally by 10bp YoY to 8.6%. For 1HFY26, OCF declined by 88% to INR0.6b and FCF outflow was INR3.3b vs. INR0.2b in 1HFY25.

Segment-wise performance led by the industrial product and green solutions division amid margin moderation

Among segments, industrial product/green solutions revenue grew 12%/10% YoY, while growth remained weak in the industrial infra and chemical segments. Industrial product EBIT margin stood at 9.9% (vs. 10.8% in 2QFY25). Industrial Infra margins decreased to -1.6% from 7.1% in 2QFY25, mainly due to project cost overruns and the absence of one-off PSI income. Chemical segment EBIT margins were weak at 9.8% (vs. 16.1% YoY), due to higher fixed costs compared to revenue growth, higher input costs, and a change in the product mix. Green Solutions PBT margin improved to 6.1% from 1.9% in 2QFY25, aided by operational efficiency and insurance claim proceeds received by one of its subsidiaries

Industrial Products: Strong outlook

During 2Q, the division witnessed inflow growth of 18% YoY. Growth was driven by strong traction in water desalination, environmental equipment, and heating solutions, along with emerging opportunities in data centers and clean air systems. Although margins softened to 9.9% (from 10.8% YoY) due to an unfavorable product mix, we expect revenue growth and margin trajectory to improve going forward. We bake in 16% revenue CAGR over FY25-28 and 11.5% EBIT margin each for FY26/27/28.

Industrial Infra drags down performance; margin pressure persists

Revenue declined 24% YoY for the quarter. The underperformance was driven by execution of legacy low-margin FGD and refinery projects, cost overruns, and subdued conversion of large project inquiries. Order inflows fell 16% YoY to INR14.6b, as the company focused on improving order quality by refraining from low-margin, long-duration government projects. While the backlog mix is gradually improving toward higher-margin international and private-sector orders, recovery is expected to be gradual. We expect 3% revenue CAGR over FY25-28 and EBIT margins of 3.0%/4.0%/5.0% for FY26/27/28, reflecting slow normalization in project execution and limited near-term margin levers.

Green Solutions gains traction; profitability improves YoY

During 2Q, the order inflows increased 418% YoY to INR3b, supported by growth in biomass-based energy solutions, hybrid renewable projects, and an accounting change at TOESL. Within the segment, FEPL continued the execution of two solar projects – one in ISDs and another in Gujarat - and is targeting break-even next year as part of its planned INR7.5b investment. Execution is also progressing well on key projects, including the 140 MW hybrid project at Jafrabad and wind installations in Tamil Nadu. With expanding capacity and improving profitability, we expect revenue CAGR of 9% over FY25-28 and EBIT margins of 18%/13%/13% each for FY26/27/28, reflecting gradual scaling and operational leverage benefits.

Chemicals: Gradual recovery; margins under pressure

Revenue was flat YoY for the quarter, with margins moderating to 9.8% from 16.1% in 2QFY25 due to higher input costs, elevated fixed expenses, and an unfavorable product mix. Demand was initially weak amid competitive pricing from Chinese suppliers but began recovering from Sep’25, supported by higher plant utilization and improving traction in construction chemicals and specialty resins. The order book stood at around INR2.0b, which is expected to rise to INR2.3-2.5b in 3Q, with profitability likely to revert to mid-teens as volumes normalize. We expect 19% revenue CAGR over FY25-28 and EBIT margins of 11%/13%/14% for FY26/27/28. We expect margins to remain impacted in the near term due to tariff issues.

Strong pipeline yet to reflect in order book

The order pipeline remains healthy, with broad-based demand across industries and geographies. The company continues to see a reasonable pipeline of good projects across segments, particularly in power, metals, refining, petrochemical, and fertilizers, along with emerging applications such as data centers. International opportunities remain encouraging, led by strong traction in HRSG and other process equipment orders from the Middle East. The company targets over 20% growth in order inflows for FY26, supported by improved project quality and disciplined bidding practices. We bake in a CAGR of 16% in order inflows over FY25-28.

Financial outlook

We expect a CAGR of 10%/19%/15% in revenue/EBITDA/PAT over FY25-28. We build in 1) 16% CAGR in order inflows, 2) a gradual recovery in EBIT margins of the Industrial Infra and chemical divisions to 5.0% and 14.0%, respectively, by FY28E, and 3) control over working capital and NWC (at 10 days).

Valuation and view

The stock is currently trading at 49.2x/42.4x/35.4x on FY26E/FY27E/FY28E EPS. We reiterate our Sell rating with a revised TP of INR3,000, based on 38x two-year forward EPS for the core business. Slightly lower multiple bakes in impact of legacy orders and weak inflow growth for the company. With the value of investments in subsidiaries, we believe that stock is currently factoring in a possible revival in order inflows as well as margin improvement.

Key risks and concerns

A slowdown in order inflows, a spike in commodity prices, a slower-than-expected revival in private sector capex, and increased competition are the key risks to our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412