Buy Suzlon Energy Ltd for the Target Rs.82 by Motilal Oswal Financial Services Ltd

Focus on execution, local content notification in 1HFY26

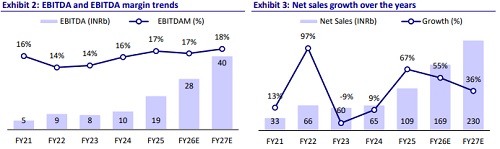

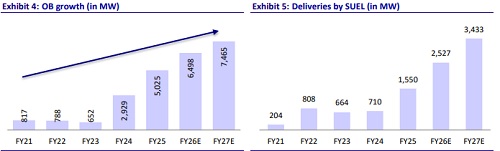

We reiterate our BUY rating on SUEL with a TP of INR82. Our positive outlook is driven by (i) expected adoption of the RLMM local content draft notification by 2QFY26, (ii) healthy order prospects, including ~1.5GW NTPC orders, where SUEL is a strong contender; (iii) estimated ~4GW of new orders in FY26, taking the closing order book to ~6.5GW; (iv) gradual phase-out of the ISTS waiver over the next four years, which should help to reduce congestion in certain states, supporting smoother project execution; and (v) an increase in EPC share in the order book to ~50%, thus improving execution visibility.

Remain hopeful of local content notification in 2QFY26

* According to our discussions with players in the wind industry, the Revised List of Models and Manufacturers (RLMM) notification mandating local content for key components in a wind turbine is likely to be formally adopted in 2QFY26.

* Power project developers have requested a delayed implementation of up to 1 year for the notification, thus providing ample time to the industry for preparation. However, overall, the policymaker’s intent to introduce local content in wind turbine manufacturing remains high.

New order outlook robust; NTPC bid awards likely in the next six months

* Overall, the new order outlook for Suzlon (SUEL) remains healthy. We are expecting contract awards on ~1.5GW of NTPC orders, where we believe SUEL remains a strong contender.

* We are modeling total new orders of ~4GW for SUEL in FY26, implying a robust closing order book (OB) of ~6.5GW (vs. the current all-time high OB of 5.6GW).

Execution concerns linger, but multiple small steps count

* According to our conversations with investors, execution has been highlighted as the key challenge in the sector. India’s wind capacity addition in FY25 at 4.2GW was lower than the previous installation high of 5.5 GW achieved in FY17. A higher turbine size, together with wind projects having expanded to multiple states (vs. only 3-4 states earlier), should aid in India crossing the previous installation high in the years to come.

* Installation pickup should also stem from wind OEMs assuming a more proactive role in EPC as OEM balance sheets continue to strengthen and the ability to invest capital has risen. Note that this was the case in the pre-Covid period, with wind OEMs investing in land acquisition at least a year in advance.

* Further, the industry transitioning to a land lease model vs. outright purchase (pre-Covid) should aid in the resolution of land acquisition-related bottlenecks. Finally, the phase-out of the ISTS waiver over the next four years should reduce congestion in a few states, thus aiding execution.

* For SUEL, we believe EPC share in the overall OB will likely rise from ~20% now to ~50% in the medium term, thereby improving execution visibility.

CCC improvement and leverage are the medium-term financial levers

* SUEL’s current cash conversion cycle (CCC) should improve by another 30-35 days in the next few years. Consequently, this will support free cash flow (FCF) generation.

* A moderation in growth rate, better inventory control (amid higher execution visibility as EPC share rises), and higher bargaining power vs. suppliers should aid CCC improvement in the coming years.

* Further, as the tax rate kicks in 2HFY27 onwards, we believe SUEL is likely to resort to debt for further capital requirements (mostly working capital related), thus improving balance sheet efficiency and sustaining RoEs.

Valuation and view

* We arrive at our TP of INR82 for SUEL by applying a target P/E of 35x to FY27E EPS. This is at a slight premium to its historical average two-year fwd P/E of 27x, given execution and earnings are just picking up for SUEL.

* SUEL stands to benefit from regulatory tailwinds mandating local content, a robust order book providing strong revenue visibility, and execution improvements through proactive land acquisition and EPC expansion initiatives.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412