Buy Suzlon Energy Ltd for the Target Rs. 75 by Motilal Oswal Financial Services Ltd

Improving execution and higher local content key positives

* Draft RLMM notification mandating local content a key driver: The recent draft Revised List of Models and Manufacturers of Wind Turbines (RLMM) notification mandating local content in wind turbine manufacturing is a key medium-/long-term positive for Suzlon Energy (SUEL). According to our channel checks, power project developers will likely request the government for delayed implementation of the draft notification, though there is widespread consensus that the notification being formally adopted is highly likely.

* Lower competitive intensity, potentially higher market share post-RLMM notification: We see two key implications from the recent draft RLMM notification: 1) should the draft receive regulatory approval, we see competitive intensity moderating in the medium term, and 2) there is scope for further market share expansion for SUEL given Indian OEMs account for barely 50-60% of new orders and SUEL’s integrated domestic manufacturing capabilities across all key components.

* Rising EPC share in order-book and letup in transmission issues are key positives: SUEL is focused on raising its share of EPC contracts in the overall order book (20% now to 50% in the medium term), which will be key in providing greater visibility and control in terms of deliveries. Further, Indian OEMs are now exploring export opportunities that may emerge as a medium-term catalyst. While transmission issues have been a bottleneck, recent channel checks suggest some of the delayed sub-stations are now coming up, thus aiding deliveries.

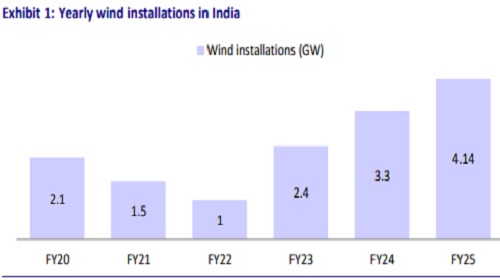

* Strong earnings momentum ahead: We model an FY26 delivery of 2.4GW, implying a quarterly run rate of 600MW, which we believe is reasonable (3QFY25 delivery: 447MW). Our estimates imply SUEL’s revenue/adj. PAT to clock a 46%/58% CAGR over FY25-27. As per our understanding, key orders slated for FY26 already have substantial land acquisitions completed and have high power evacuation visibility.

* Valuations attractive: We reiterate our BUY rating on SUEL with a TP of INR75 (based on 32x FY27E EPS). SUEL is currently trading at 24x FY27E PE, which we believe is attractive after the recent correction.

RLMM can be a multi-year tailwind for Indian OEMs

* RLMM notification can be a long-term positive: The Ministry of New and Renewable Energy (MNRE), recently released a draft notification proposing amendments to the procedure for inclusion/updating of wind turbine models in the RLMM, which mandates local sourcing of key components, thus providing a strong fillip to prospects of Indian OEMs.

* Key components to be manufactured domestically: The draft amendment mandates domestic manufacturing of key components—blades, towers, gearboxes, and generators—with a one-year exemption allowing limited imports (lower of up to 50 turbines or 200 MW). Local manufacturing of gearboxes and generators will become compulsory six months after the rules take effect. The framework requires submission of valid type certificates, IS/ISO certifications, and details of technical collaborations.

* Additionally, all operational data must be stored within India, with real-time cross-border transfers prohibited, and operational control centers must be India-based. To promote innovation, OEMs are also required to set up R&D centers in India within six months of the notification.

* Market share, margin concerns mitigated: The draft, if finalized, also goes a long way in alleviating concerns regarding competition from Chinese OEMs and potential loss of market share and pressure on marg

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412