Buy Suzlon Energy Ltd for the Target Rs. 74 by Motilal Oswal Financial Services Ltd

Strong 2Q; on track to meet FY26 guidance

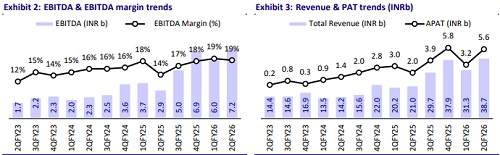

* Suzlon Energy's (SUEL) consolidated revenue came in at INR38.7b, exceeding our estimates by 39% (higher than expected deliveries), while EBITDA was 71% above our estimates at INR7.2b.

* SUEL delivered a strong 2QFY26 performance with deliveries coming in significantly above our and street expectations. Key positives for us from the conference call were: 1) management reiterated its confidence in a strong new order outlook, given the guidance of 6/8 GW of wind installations in India in FY26/27, 2) SUEL now has a tax shield for PBT up to INR50b (meaning no cash taxes at least until the end of FY27, on our estimates) and a potential to create additional deferred tax assets given the historical losses, and 3) SUEL outlined an execution pipeline of 1.8GW for FY26, which reaffirms its confidence in delivery guidance of 2.5 GW for FY26.

* Following the conference call, we raise our FY26 estimates by 8%, mainly to account for a lower tax rate in 1HFY26. We continue to build in deliveries of 2.5/3.4 GW in FY26/27, respectively (unchanged). We lower the valuation multiple to 30x (35x earlier), but reiterate BUY with a revised TP of INR74/share (based on FY28 EPS).

Strong beat driven by higher WTG deliveries and margin expansion

Financial performance:

* SUEL’s consolidated revenue came in at INR38.7b (+84% YoY, +24% QoQ), exceeding our estimates by 39% on account of higher-than-expected WTG deliveries of 565MW (~55% higher than our estimates).

* EBITDA was 71% above our estimates at INR7.2b (+145% YoY, +20% QoQ), driven by a higher-than-expected EBITDA margin of 19%.

* APAT exceeded our estimates by 182% and stood at INR5.6b (+179% YoY, +73% QoQ).

* SUEL’s reported PAT was INR12.7b, which includes a deferred tax asset creation of ~INR7b during the quarter.

Operational performance:

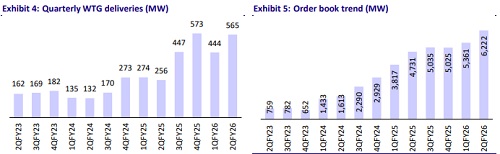

* The WTG order book stood at 6.2GW (20% EPC and 80% Non-EPC).

* The segment mix comprised 51% C&I/Captive/Retail, 34% Auctions, and 14% PSU orders.

* WTG deliveries reached 565MW in 2QFY26 (vs. 256MW in 2QFY25 and 444MW in 1QFY26).

* A total of 270MW of WTGs were installed during the quarter, with an additional 568MW erected, bringing the overall tally to 838MW.

* Renom’s AUM stood at 3,293MW as of 2QFY26.

* Net worth stands at INR78.6b.

Highlights of 2QFY26 performance

* SUEL achieved record deliveries of 565MW in 2QFY26, the highest quarterly deliveries in over 30 years of India's wind industry.

* The company’s 4.5GW manufacturing capacity is now fully operational and ramped up to support the current execution pipeline.

* SUEL commissioned 270MW in 1HFY26, supported by an execution pipeline of 1,865MW across 39 sites nationwide.

* The forging business reported a 53% YoY revenue growth in 1HFY26. EBITDA margin expanded to 19.5% in 1HFY26, almost doubling from 1HFY25, due to strong cost control measures.

* In 2QFY26, revenue reached INR38.7b (+75% YoY) for the quarter, while EBITDA came in at INR7.2b (+145% YoY, EBITDA margin at 18.6%).

* PBT stood at INR5.6b (+117% YoY). Addition of INR7.2b in DTA lifted PAT to INR12.8b. Cumulative DTA now totals INR12.3b, providing a tax shield of ~INR50b on future profits.

* The company reaffirmed its FY26 guidance of 60% YoY growth across revenue and EBITDA.

* The total order book exceeded 6GW by the end of 2QFY26, with more than 2GW of new orders secured in 1HFY26. The current OB remains unaffected by recent PPA cancellations.

* SUEL is focusing on acquiring land for projects (7.5GW of projects already acquired). This provides an edge in EPC contracts and greater control over execution. More EPC contracts are expected to be announced from 4QFY26 onwards.

* Current OB mix: 61% C&I, 14% PSU, and the remainder from bidding. The company aims to increase the share of the EPC business, targeting a shift from the current 20:80 mix to 50:50 by FY28.

* The company is exploring export opportunities, with its first export order expected early next year. Exports will be on a supply-only basis, and no EPC, due to associated risks. The O&M business manages over 15GW of assets with above 95% fleet availability. Renom is set for further expansion.

* EBITDA margin in the O&M segment is guided at 40% going forward.

* Management does not anticipate any visible risk from BESS projects, as maintaining an economic tariff of ~INR4.7/unit requires the inclusion of wind in an FDRE project, vs. INR6.5/unit in Solar + BESS only.

Valuation and view

* We arrive at our TP of INR74 by applying a target P/E of 30x to FY28E EPS. This is close to its historical average two-year fwd P/E of 27x

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412