Neutral HDB Financial Services Ltd for the Target Rs. 820 by Motilal Oswal Financial Services Ltd

Weak quarter; guiding for recovery in 2H due to a pickup in retail

Loan growth was muted and credit costs remained elevated.

* HDB Finance (HDBFIN)’s 2QFY26 PAT declined ~2% YoY to INR5.8b (in line). PAT in 1HFY26 declined ~2% YoY, and we expect 2HFY26 PAT to grow ~45% YoY. NII in 2QFY26 grew ~20% YoY to ~INR21.9b (in line). Other income rose ~14% YoY to ~INR6.6b (in line).

* Opex grew ~12% YoY to ~INR13.2b (in line). The cost-to-income ratio in the lending business declined ~2pp QoQ to 40.7% (PQ and PY: 42.7%). PPoP stood at INR15.3b and grew 24% YoY (~5% beat).

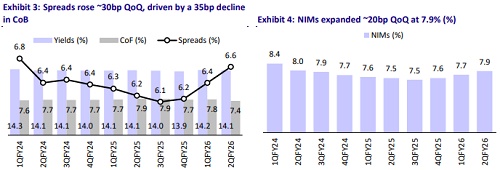

* Yields (calc.) declined ~10bp QoQ to ~14.1%, and CoF (calc.) dipped ~35bp QoQ to ~7.4%. Reported NIMs in 2QFY26 expanded ~20bp QoQ to ~7.9%. The company guided for NIM of 7.9-8.0% in the subsequent quarters. We expect HDBFIN’s NIM to expand ~30bp to 8.1% in FY26 (vs. ~7.8% in FY25).

* Management indicated that the elevated credit costs during the quarter were largely driven by higher slippages in the CV segment, along with some impact from the CE portfolio. The company highlighted that heavy monsoonled floods led to unusually high vehicle idling this year compared to prior years. Management guided for normalized credit costs of 2.2% over the medium to long term. We expect credit costs of 2.4%/2% in FY26/FY27.

* While demand remained subdued in 2Q due to heavy rainfall, flooding, and deferred purchases ahead of anticipated GST cuts, management expects a strong rebound in retail demand in 3Q and 4Q, and anticipates growth momentum to accelerate in 2HFY26. We estimate a CAGR of 12%/17%/24% in disbursement/AUM/PAT over FY25-28, with RoA/RoE of ~2.5%/15% in FY27. Reiterate Neutral with a TP of INR820 (premised on 2.6x Sep’27E BVPS).

* Key risks: 1) HDBFIN’s focus on low- to middle-income and self-employed segments exposes it to higher credit sensitivity during economic slowdowns, despite its secured portfolio mix; 2) execution risk remains in translating scale into sustained profitability, as operating efficiency metrics currently lag peers; 3) rising competition in semi-urban and rural lending and potential yield compression.

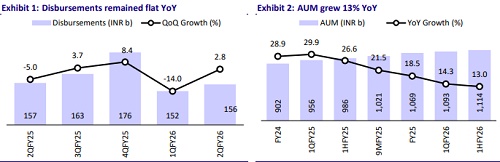

AUM rises ~13% YoY; disbursements remain flat YoY

* Business AUM grew 13% YoY/3% QoQ to INR1.11t. Enterprise lending grew 9% YoY/1% QoQ, asset finance grew 15% YoY/2% QoQ, and consumer finance grew 17% YoY/2% QoQ during the quarter.

* Total disbursements in 2QFY26 were flat YoY at ~INR156b. Enterprise lending disbursements declined ~5% YoY, asset finance disbursements declined 1% YoY, and consumer finance disbursements grew 3% YoY.

* Management shared that it remains optimistic about the retail segment, expecting the positive sentiment to translate into stronger growth momentum in 2HFY26. The company guided for AUM CAGR of 18-20% over the medium to long term. We model AUM CAGR of ~17% over FY25-28E.

Asset quality deterioration leads to sequentially higher credit costs

* Asset quality deteriorated, with GNPA rising ~25bp QoQ to ~2.8% and NS3 increasing ~15bp QoQ to ~1.3%. PCR declined ~2pp to ~54.7%.

* Credit costs stood at ~INR7.5b (~5% higher than MOFSLe). Annualized credit costs stood at ~2.7% (PQ: ~2.5% and PY: ~1.8%). Management guided for normalized credit costs of ~2.2% over the medium to long term. We estimate credit costs (as % of avg. loans) of ~2.4%/2.0% in FY26/FY27.

Key highlights from the management commentary

* Management expects strong momentum in Auto, 2W, and Consumer Durables segments, supported by government initiatives to stimulate consumption, healthy Kharif sowing, and improving farm incomes.

* The LAP portfolio continues to operate with minimal credit costs, while consumer durable loans entail relatively higher credit costs. The company aims to optimize overall credit costs across its diversified product portfolio and expects them to moderate further in the coming quarters.

* HDBFIN expects growth momentum to strengthen across all product categories, with the business loans segment showing signs of stabilization and likely to return to a growth trajectory in the coming quarters.

Valuation and view

* HDBFIN reported a muted quarter, with modest loan growth and disbursement activity impacted by factors such as heavy rainfall and demand deferment ahead of anticipated GST rate cuts. Asset quality weakened further, resulting in sequentially higher credit costs. The only positive was a ~20bp expansion in NIM during the quarter, driven by a decline in the cost of borrowings.

* HDBFIN offers a play on India’s high-growth, underpenetrated retail lending market. With an AUM of ~INR1.11t and ~21m customers, the company has built a granular, largely secured loan portfolio (~73% secured) and demonstrated credit discipline. With strong governance, in-house collections, and a differentiated sourcing model, the company has the foundations for sustainable value creation.

* HDBFIN currently trades at 2.5x FY27E P/BV. We estimate a CAGR of 12%/17%/24% in disbursement/AUM/PAT over FY25-28, with RoA/RoE of ~2.5%/15% in FY27. Reiterate Neutral with a TP of INR820 (premised on 2.6x Sep’27E BVPS). With valuations largely factoring in medium-term growth potential, we will look for clearer evidence of stronger execution on loan growth, the ability to better navigate industry/product cycles, and structural (not just cyclical) improvement in return ratios.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)