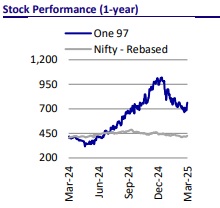

Neutral One 97 Communications Ltd For Target Rs. 870 by Motilal Oswal Financial Services Ltd

Merchant business gaining traction; EBITDA to achieve breakeven by FY27E

Contribution margin to remain steady at 57% by FY27E

* Paytm has successfully navigated through the regulatory challenges while retaining most of its merchant base. The company’s merchant base grew 9% YoY to 43m in 3QFY25, while the number of merchants with devices rose 10% YoY to 11.7m.

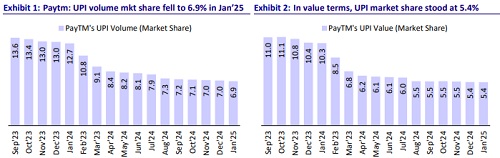

* With 85% of GMV coming from merchants, Paytm maintains a robust market share in merchant business, though its UPI market share has moderated. We estimate a 24% CAGR in GMV over FY25-27E.

* Leveraging its merchant network, Paytm is scaling up loan distribution through the first loss default guarantee (FLDG), with 18 lending partners on its platform. The financial services business is expected to contribute 27% of total revenue by FY28E (~20% in FY24), thus driving a 25% CAGR in total revenue.

* The reduction in capex and depreciation expenses, along with strong costcontrol, should help Paytm deliver positive adj. EBITDA by 4QFY25E and positive overall EBITDA by FY27E. We, thus, estimate Paytm to regain its strong hold on profitability in FY27E, with estimated PAT of INR12.1b.

* As per recent media reports the potential introduction of MDR on UPI will be a significant boost PayTM’s revenue and will incentivize the company to push for market share gains in the consumer payments.

* We remain watchful on the challenging macro-environment, traction in the financial distribution business and near-term UPI market share. Maintain Neutral rating with a revised TP of INR870 (based on 17.7xSep’26E EBITDA).

Merchant base retained; focusing on gaining market share

Paytm has navigated through the regulatory restrictions while retaining most of its merchant base, which grew 9% YoY to 43m merchants as of 3QFY25. The company has also increased the share of devices by 10% YoY to 11.7m. Moreover, Paytm has seen improvements in payments business revenue, which grew 13% in the last two quarters from the lows of 1QFY25. We expect a 26% CAGR in payment revenue over FY25-27E. With growing merchant market share, the company expects growth in subscription revenue and has an opportunity to grow stronger in the merchant loan product, which offers higher take rates.

GMV tracking well led by merchant business; estimate 24% CAGR in GMV from FY25-27E

Paytm has strengthened its focus on growing the more profitable merchant business, which forms ~85% of total GMV. The company has demonstrated healthy resilience in total GMV on the platform, which has recovered to the 3QFY24 levels (up 15% after adjusting discontinued businesses). We estimate a steady 24% CAGR in GMV over FY25-27E. The company expects the consumer business to gain traction as it looks to grow its customer base as it has secured NPCI approval for on-boarding new customers on UPI. In 3QFY25, Paytm’s average MTUs declined 30% YoY/1% QoQ to 70m, which inched up to 72m in Dec’24 from 69m in Oct’24.

FLDG to boost loan disbursements; expect 29% CAGR in FY25-27

Paytm has started offering FLDG loans to lending partners, which will help to speed up loan disbursements, thereby boosting financial services business growth. FLDG mitigates lender risk by covering initial losses and enabling faster approvals, thus boosting disbursement efficiency. We estimate a 29% CAGR in overall loan disbursements over FY25-27E. The FLDG structure also provides a better take rate, which will enable faster revenue growth of financial services business. The FLDG approach enhances business opportunities, allowing Paytm to efficiently leverage its vast merchant and customer base

Financial services to contribute 27% of total revenue by FY28E

Paytm is well poised to leverage its strong positioning in merchant business, thus driving healthy revenue growth in financial services. We estimate that the financial business, encompassing loan distribution and other services, will contribute ~27% of Paytm’s total revenue by FY28E vs. 20% in FY24. This shift is underpinned by the company’s growing merchant base, which serves as a strong moat despite setbacks in products like wallet and BNPL. The financial services arm currently earns 15-20% of revenue from non-lending activities such as equity broking and sales of financial products, which are also witnessing healthy traction. Paytm has partnered with 18 lenders on the platform, with the current count expected to be more than what it was prior to the RBI’s restrictions. This will drive healthy growth in financial business as market sentiment improves and personal loan business starts gaining traction.

Contribution margin to improve to ~58% by FY28E

* Paytm’s contribution margins are expected to rise to ~58% by FY28E (including UPI incentive), supported by efficient cost management and an improving mix of financial services business. We estimate a 25% CAGR in revenue over FY25-28E, while direct costs are expected to increase at a slower pace of 21% CAGR during the same period.

* A key driver of this growth is financial services revenue, which is anticipated to clock a robust 33% CAGR over FY25-28E, driven by strong loan disbursement momentum (~29% CAGR). With an estimated 23% CAGR in GMV from FY25-28E and payment processing charges under control, net payment margin (including subscription fees) is expected to be sustained at 12bp of GMV by FY28E.

Estimate PAT to break-even in FY26E and accelerate thereafter

Paytm is actively pursuing cost optimization strategies to improve underlying profitability while exerting strong control on capex, which has helped the company reduce the breakeven period on devices to 12-13 months. Depreciation expenses are likely to decline sharply, with refurbishing acting as a pivot; however, ESOP costs are expected to remain elevated. We anticipate Paytm to deliver positive adj. EBITDA by 4QFY25E and achieve overall EBITDA breakeven by FY27E, assuming no further disruptions. We, thus, estimate Paytm to regain its strong hold on profitability by FY27E, with estimated PAT of INR12.1b.

Valuation and view: Maintain Neutral with TP of INR870

Paytm’s strategic focus on financial services business and cost optimization should boost profitability, with the financial business contributing 27% of revenue by FY28E. Leveraging its merchant network, the company remains focused on scaling up its loan distribution, supported by strong lender partnerships. Cost reductions and an estimated revenue CAGR of 26% from FY25-27E (INR114b by FY27E) will enable Paytm to achieve EBITDA breakeven in FY27E. We expect the company to gain traction in new customer on-boarding and grow its MTU base, which will enable healthy cross-selling, while growth in the merchant business will remain the key profitability driver in the near term. The company’s exploration of global markets, albeit with limited capital commitment, and its strong cash position (INR128.5b in 3QFY25) further provide comfort. As per recent media reports the potential introduction of MDR on UPI will be a significant boost PayTM’s revenue and will incentivize the company to push for market share gains in the consumer payments. Additionally, the company may shift its focus towards expanding its market share in the consumer segment. The recent SEBI approval for Paytm Money to venture into investment insights and research services presents an opportunity to diversify into wealth management, potentially unlocking a new stream of fee-based income. We remain watchful on the challenging macro-environment, traction in the financial distribution business and near-term UPI market share. Maintain Neutral rating with a revised TP of INR870 (based on 17.7xSep’26E EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412