Buy L&T Finance Ltd for the Target Rs. 320 by Motilal Oswal Financial Services Ltd

Healthy quarter; Growth bias intact, profitability improving

Asset quality stable; credit costs (before utilization) declined QoQ

* L&T Finance’s (LTF) 2QFY26 PAT grew 5% YoY to INR7.3b (in line). PAT in 1HFY26 grew ~4% YoY, and we expect 2HFY26 PAT to grow ~30% YoY.

* NII in 2QFY26 grew ~10% YoY to INR24b (in line). Opex grew ~12% YoY to ~INR10.7b (in line). Cost-to-income ratio declined ~40bp QoQ to ~39.5% (PQ: ~40%). PPoP grew ~3% YoY to ~INR16.8b (in line).

* Credit costs stood at INR6.4b (~9% lower than MOFSLe), translating into annualized credit costs of ~2.5% (PQ: ~2.5% and PY: 2.85%). The company utilized macro prudential provisions of INR1.5b in 2QFY26 on account of residual forward flows. Before macro prudential provision utilization, credit costs for the quarter stood at ~3% (PQ: 3.4%). The company now has unutilized macro provisions of ~INR1.25b.

* MFI collection efficiency (0-90dpd) stood at ~98.2% in Sep’25 (vs. 97.8% in Jun’25). Only ~3.6% (PQ: ~5.2%) of LTF customers have loans from four or more lenders (including LTF). Collection efficiency in Karnataka stood at 99.05% in Aug’25 and ~99.2% in Sep’25 (compared to ~98.5% in Jun’25).

* Management indicated that various government initiatives are already translating into higher sales volumes during the festive season. Additionally, the MFI sector has also shown early signs of recovery, with steady improvement in disbursement volumes and collection efficiencies.

* Management indicated a clear growth bias, expecting business volumes to be significantly stronger in 2H. It highlighted that disbursement momentum in the 2W and farm segments has sharply improved in Oct’25, significantly surpassing Sep’25 levels.

* LTF shared that it aims to achieve credit costs of ~2% over the medium term, with its credit models designed to minimize cyclicality in asset quality and credit costs. We expect credit costs of 2.7%/2.6% in FY26/FY27E. (vs. 2.8% in FY25).

* We estimate a CAGR of ~22% in loan book and ~24% in PAT over FY25- FY28E, with consolidated RoA/RoE of 2.7%/~15.2% in FY28E. For LTF, FY26 will be a year of transitioning towards the targeted loan mix and implementing Cyclops across all key business segments. We expect LTF to deliver a structural improvement in profitability and RoA from FY27 onwards. Reiterate BUY with a TP of INR320 (based on 2.4x Sep’27E BVPS).

Reported NIM + fees stable QoQ; CoB (reported) declines ~35bp QoQ

* Reported NIM expanded ~20bp QoQ to 8.4%. However, consol. NIM and fees were stable QoQ at ~10.2%, driven by lower fee income.

* Management highlighted that NIMs have moderated in recent quarters, mainly due to a lower share of the MFI portfolio. However, with disbursements gaining traction and the loan book expanding, the yield pressure is expected to gradually ease in the coming quarters.

* Management continued to guide for NIMs + fees of 10.0-10.5% over the medium term. We expect NIMs (as a % of loans) of 9.3%/9.5% in FY26/FY27.

* Spreads (calc.) remained stable QoQ at ~8.6%. Yields (calc.) declined ~20bp QoQ to ~15.4%, while CoF (calc.) declined ~20bp QoQ to 6.8%.

* Consol. RoA/RoE in 2QFY26 stood at ~2.4%/11.3%.

Asset quality broadly stable; retail GS3 stands at ~2.9%

* Consol. GS3 was stable QoQ at ~3.3%; NS3 was also stable QoQ at ~1%. PCR declined ~50bp QoQ to ~70.3%. Retail GS3 was broadly stable QoQ at 2.9%.

* LTF shared that it plans to rebuild its macro-prudential provisions, primarily using realizations/resolutions from its ARC portfolio, which are expected over the next 18-24 months.

* Management stated that Stage 1 and Stage 2 provisions have declined mainly due to the utilization of existing macro-prudential provisions, resulting in a corresponding reduction in the PCR for these stages.

Key highlights from the management commentary

* Management shared that it is working on expanding its geo-presence with the addition of over 200 Sampoorna branches in FY26, as it aspires to become a pan-India player in gold loans.

* Management highlighted that nearly 40% of PL disbursements have been driven by Big Tech partnerships, which offer significantly lower origination costs compared to the traditional DSA channel. Additionally, the customer quality through these digital partnerships is superior, with the majority being salaried individuals who would typically also qualify for bank loans.

* Management stated that, within its home loans business, it is deliberately avoiding an interest rate war, focusing growth only in pockets/segments with limited yield pressure. As a result, home loan disbursement volumes are expected to remain subdued over the next few quarters.

Valuation and view

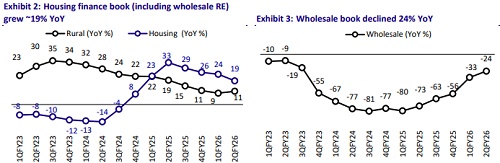

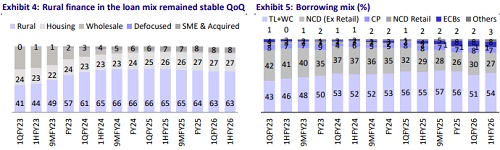

* LTF’s 2QFY26 earnings were in line with expectations, with healthy disbursement volumes driving ~18% retail loan growth. Asset quality remained largely stable, resulting in sequentially lower credit costs (before macro provision utilization). The company also benefited from lower borrowing costs, aided by policy rate cuts, which contributed to a modest expansion in core NIM.

* We expect LTF to continue capitalizing on robust growth in retail segments, supported by festive season demand, GST-driven consumer demand, and improved rural cash flows following a healthy monsoon. The company is also likely to steadily move toward a normalized credit cost trajectory.

* LTF has invested in process automation, security, and customer journeys. This, along with large partnerships in products like PL, should lead to stronger and more sustainable retail loan growth. We expect the broad-based improvement in collection efficiency across product segments to sustain, which should translate into stronger profitability for the company.

* We estimate a PAT CAGR of 24% over FY25-28E, with consolidated RoA/RoE of 2.7%/~15% in FY27. Reiterate our BUY rating on the stock with a TP of INR320 (based on 2.4x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412