Neutral Bajaj Finance Ltd for the Target Rs. 1,160 by Motilal Oswal Financial Services Ltd

Mixed quarter with in-line earnings; minor cut in growth guidance

Weak commentary on MSME continues but credit cost guidance maintained

* Bajaj Finance (BAF)’s PAT grew 23% YoY to ~INR49.5b in 2QFY26 (in line). PAT in 1HFY26 grew at ~23% YoY and we expect PAT in 2HFY26 to grow at ~19% YoY. 2Q NII grew 22% YoY to ~INR107.8b (in line). Non-interest income stood at ~INR23.8b (up 13% YoY). Growth in other operating income moderated as recoveries from the written-off pool plateaued. The company expects noninterest income to grow by 13-15% in FY26.

* Opex rose ~18% YoY to ~INR43b (in line). PPoP stood at INR88.7b (in line), up 21% YoY. 2Q RoA/RoE stood at 4.5%/19.1%.

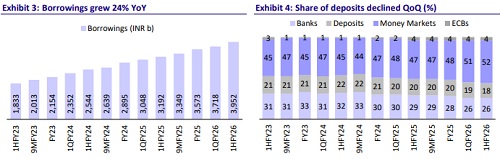

* 2Q NIM was broadly stable QoQ at ~9.55%. Management expects an additional ~5bp reduction in CoF in FY26, with CoF at 7.55-7.6% in FY26. However, NIMs are likely to remain broadly stable, as the company intends to pass on any CoF benefit to customers. We estimate NIM of ~9.7% each in FY26/FY27.

* Management shared that credit costs remained elevated in the captive 2W/3W and MSME portfolios, with the captive 2W/3W business (~1.5% of AUM) contributing ~8% of total loan losses in the quarter. It further shared that BAF has reduced unsecured MSME disbursements by ~25%, and expects MSME AUM growth to moderate to ~10-12% in FY26.

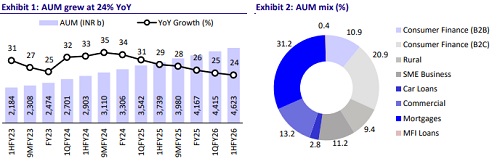

* Management revised its FY26 AUM growth guidance to 22-23% (from 24- 25%) to reflect the growth moderation in the MSME segment and a lower growth guidance in the mortgage (BHFL) portfolio. We model AUM growth of 23%/25% in FY26/FY27E.

* While early bucket trends remain stable with 3MOB, 6MOB and 9MOB cohorts showing improvement and vintage performance progressing positively across segments, the company guided for FY26 credit costs at the upper end of the 1.85-1.95% band. However, as the captive 2W/3W portfolio continues to run down, new businesses become a higher proportion in the AUM mix, and the MSME book stabilizes, management expects credit costs to improve in 2HFY26, with a more significant improvement anticipated in FY27. We model credit costs (as a % of loans) of ~1.95%/1.8% in FY26/FY27E.

* We reduce our FY27/FY28 PAT estimates by 2-3%. We estimate a CAGR of ~24%/25% for AUM/PAT over FY25-FY28E and expect BAF to deliver RoA/RoE of ~4.2%/22% in FY28E.

* The stock trades at 5x FY27E P/BV and ~26x FY27E P/E. Despite a healthy PAT CAGR of ~25% over FY25-28E and RoA/RoE of 4.2%/22% in FY28E, we see limited upside catalysts given the rich valuations and lack of near-term valuation re-rating triggers. Maintain our Neutral rating on the stock with a TP of INR1,160 (premised on 4.8x Sep’27E BVPS).

AUM grew ~24% YoY; captive 2W/3W portfolio continues to decline

* Total customer franchise rose to 106.5m (up 20% YoY/4% QoQ). New customer acquisitions stood at ~4.1m (vs. ~4m YoY and ~4.7m QoQ). New loan bookings rose ~26% YoY to 12.2m.

* Total AUM grew 24% YoY and ~4.7% QoQ to INR4.62t. QoQ AUM growth was driven by gold loans (+18%), LAS (+8%), urban sales finance (+13%), consumer finance (+5%), rural finance (+11% QoQ) and commercial loans (+7%).

* Management shared that new businesses such as gold loans, new car financing, and CV and tractor financing are scaling up well and contributed ~3% of AUM growth in 2Q. These segments, along with LAP, are witnessing healthy momentum and are helping to offset the moderation in MSME and captive auto financing.

Asset quality deteriorates; credit costs to be at upper end of guidance

* Asset quality deteriorated, with GNPA rising ~18bp QoQ to ~1.24% and NS3 rising ~10bp QoQ to ~0.6%. PCR on stage 3 declined ~10bp QoQ to ~51.8%. BAF shared that the captive 2W/3W portfolio contributed ~12bp to the QoQ increase in GS3, while the MSME segment accounted for ~6bp.

* Credit costs stood at ~INR22.7b (in line). Annualized credit costs stood at 205bp (PQ: 202bp and PY: 213bp). Management shared that gold loans and new car finance continue to exhibit structurally lower credit costs. As the share of these products increases and the captive 2W/3W portfolio continues to decline, the company expects a meaningful reduction in overall credit costs in FY27.

Highlights from the management commentary

* Management shared that Mr. Manish Jain (MD of Bajaj Financial Securities) has been elevated as Deputy CEO. With this, the company will have four Deputy CEOs and three COOs forming the core executive committee.

* Even if there are further repo rate cuts, management does not expect any meaningful reduction in CoF in FY26, as such benefits would come too late in the financial year to have any material impact.

* The company targets credit costs in the non-captive 2W/3W business to be about one-third of the credit costs in the captive auto financing portfolio.

Valuation and view

* BAF reported a mixed quarter in 2QFY26. AUM rose 24% YoY and management trimmed its FY26 AUM growth guidance to 22-23%. Asset quality was impacted by stress in MSME and the captive 2W/3W portfolio, with management now expecting credit costs to remain at the upper end of the guided range. NIMs were stable and the company now expects NIMs to broadly remain at the current levels for the remainder of FY26 (vs. the earlier expectation of a ~10bp expansion in 2H).

* The stock trades at 5x FY27E P/BV and ~26x FY27E P/E. Despite a healthy PAT CAGR of ~25% over FY25-FY28E and RoA/RoE of 4.2%/22% in FY28E, we see limited upside catalysts given the rich valuations and lack of near-term valuation re-rating triggers. Consequently, we reiterate our Neutral rating on the stock with a TP of INR1,160 (premised on 4.8x Sep’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412