Neutral SBI Cards Ltd For Target Rs. 975 by Motilal Oswal Financial Services Ltd

NII in line; high provisions drive earnings miss

Revolver mix remains stable at ~24%

* SBI Cards (SBICARD) reported a 5% miss on PAT, which stood at INR5.3b in 4QFY25.

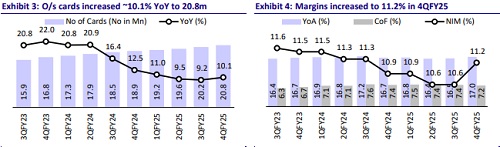

* The share of the revolver mix was flat at 24% and management expects the revolver mix to have a downward bias toward 23%. NIMs improved to 11.2%.

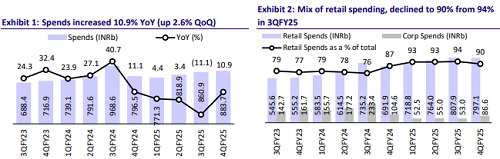

* Spends grew 2.6% QoQ (up 11% YoY), led by 15% YoY growth in retail spends, while corporate spends declined 17% YoY (up 63% QoQ).

* GNPA ratio improved to 3.08% (down 16bp QoQ), while NNPA ratio increased by 28bp QoQ to 1.46% as SBICARD made changes in ECL-3 classification, resulting in a decline in PCR to 53.5% (down 1,089bp QoQ).

* We raise our FY26E/FY27E EPS by 7.4%/9.9%, factoring in improvement in credit cost, rate cuts and improvement in margins. Reiterate Neutral with a revised TP of INR975 (22x FY27E EPS).

Margins to see a calibrated expansion from declining rate cycle

* SBICARD reported 4QFY25 PAT of INR5.37b (down 19% YoY, 5% miss vs. MOFSLe) amid high provisions (8% higher than est.). Gross credit cost for FY25 stood at 9%.

* NII grew 14.5% YoY/3.1% QoQ to INR16.2b (in line). NIMs improved by 60bp QoQ to 11.2%. However, SBICARD guides for calibrated NIM expansion as the benefit of CoF should come at a lag, while the decline in yields shall be passed on marginally. CoF declined by 20bp QoQ to 7.2% amid a decline in the benchmark rate.

* The revolver mix was sticky at 24%, and SBICARD expects to have a slight downward bias amid new vintages having a tilt toward transacting customers. Transactor share increased to 41%, while EMI share declined to 35%.

* Fee income as a proportion of total income stood stable at 52%. PPoP grew 7.2% YoY/7.3% QoQ to INR19.6b (largely in line). The C/I ratio decreased to 51.4% vs. 53.5% in 3QFY25.

* Cards-in-force rose 10.1% YoY/3% QoQ to 20.8m. New card sourcing was largely flat QoQ at 1.11m, with new sourcing tilting highly toward the banca channel at 63% vs. 55% in 3Q and 38% in 2Q, while on O/S basis, sourcing stood at 42% for banca channel.

* Spends grew 2.6% QoQ (up 11% YoY), led by 15% YoY growth in retail spends, while corporate spends declined 17% YoY (up 63% QoQ). SBICARD expects corporate spends to gain pace over the next few quarters.

* GNPA ratio decreased to 3.08% (down by 16bp QoQ), while NNPA ratio increased by 28bp QoQ to 1.46% as SBICARD made changes in ECL-3 reporting, resulting in a decline in PCR to 53.5% (down 1,089bp QoQ).

Highlights from the management commentary

* NIMs are influenced by two key factors — yields and interest rates. With rates trending lower, NIMs will see a calibrated expansion.

* The shift in ECL is primarily driven by changes in Stage 1 and Stage 2 assets, while Stage 3 changes are attributed to recoveries — all contributing to the ECL reduction.

* Receivables grew 10% last year and are expected to grow by 12-14% YoY this year.

* The mix of revolvers and EMI remains largely unchanged, with a slight downward bias in revolvers for new customers. As newer vintages are added, the revolver mix is likely to lean closer to 23%, given a stronger tilt towards transactors in the new portfolio.

Valuation and view

SBICARD reported a broadly in-line quarter, though provisions were higher, with management expecting further easing in the coming quarters. The revolver mix is likely to see a downward trend, and EMI yields remain under pressure. However, spends growth is expected to pick up, supported by a recovery in corporate spends and sustained traction in retail spends. Asset quality is projected to improve, aided by a reduction in forward flows. NIMs are expected to improve in a calibrated manner as the benefit from lower cost of funds will get partially offset by the yield pressure. We raise our FY26E/FY27E EPS by 7.4%/9.9%, factoring in improvement in credit cost, contained opex growth and improvement in margins. Reiterate Neutral with a revised TP of INR975 (22x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)