Neutral Asian Paints Ltd for the Target Rs. 2,500 by Motilal Oswal Financial Services Ltd

Demand concerns persist; weak margin delivery

* Asian Paints (APNT) posted a weak 4QFY25, with consolidated/standalone revenue declining 4%/5% YoY (lower than est). Domestic volume grew 1.8% YoY. Muted demand conditions coupled with downtrading and increased competitive intensity have been adversely impacting revenue performance. International business revenue dipped 1.5% (+6% in CC terms).

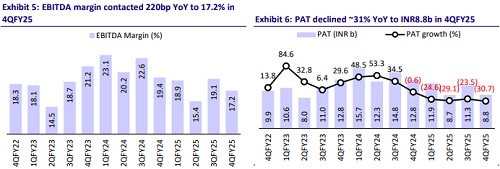

* Gross margin improved 20bp YoY and 150bp QoQ to 43.9%, aided by moderating RM costs. EBITDA margin remained weak and contracted 220bp YoY to 17.2%. EBITDA declined sharply by 15% YoY (est. -10%) to INR14.4b.

* Management expects a gradual demand recovery ahead. APNT is targeting to achieve a single-digit revenue growth in FY26. The company maintains an EBITDA margin guidance of 18-20%.

* The stock has massively underperformed (a 20% fall in the last one year) owing to a sharp cut in earnings. Considering the uncertainty of demand recovery in the near term, the performance worries continue. Moderation in RM prices is a positive for the business; however, growth recovery will remain critical for a rebound in the stock performance. Industry volume recovery and competitive strategy on pricing/incentives will be the key monitorables. Amid the uncertainty, we reiterate our Neutral rating with a TP of INR2,500 (based on 45x FY27E EPS).

Performance below estimates; domestic volume inched up 2% YoY

* Sluggish trends persist: Consol. net sales declined 4% YoY to INR83.6b (est. INR85.3b) impacted by muted demand conditions, downtrading, and increased competitive intensity. The decorative business (India) clocked a volume growth of 1.8% (est. 4%, 1.6% in 3QFY25), while revenue declined 5% YoY during the quarter.

* Margin contraction: Gross margin improved 20bp YoY to 43.9% (est. 42.4%). GP was down 4% YoY. Employee expenses rose 3% YoY, and other expenses were up 6% YoY. EBITDA margin contracted 220bp YoY to 17.2% (est. 17.9%).

* Industrial performance relatively better: The Industrial business recorded a 6.1% growth, driven by strong performance in the General Industrial and Automotive segments. The bath business grew 4% YoY, while the kitchen business revenue declined 16% YoY. White Teak and Weather Seal revenue declined 43% YoY.

* Challenging international macros hurt growth: International business registered a value decline of 1.5% (6% growth in CC terms) with headwinds from challenging macroeconomic conditions in Africa. Key markets in the Middle East and Asia fared well.

* Double-digit decline in profitability: EBITDA declined 15% YoY to INR14.4b (est. INR15.2b). PBT dipped 26% YoY to INR11.8b (est. INR13.9b). Adj. PAT decline of 31% YoY to INR8.8b (est. INR10.4b).

* In FY25, net sales, EBITDA, and APAT dipped 5%, 21%, and 27%, respectively.

Key highlights from the management commentary

* The paint market size would be INR800b with organized players having ~80% value market share.

* 4QFY25 was a tough quarter for APNT, as muted demand conditions and consumer sentiment, coupled with downtrading and increased competitive intensity, hit revenue. The value-volume gap should not be more than 6%, as per the management; however, it exceeded that range in 4Q (~7%). APNT expects the gap to narrow down to their guided levels.

* APNT will focus on providing value to customers and strengthening the brand saliency rather than just discounting or entering a pricing war. Moreover, strengthening backward integration and sourcing efficiencies will aid APNT in investing further in its brands.

* New products contributed to ~14% of overall revenues in Q4FY25. APNT indicated ~60% of NPDs to be in the premium and luxury product range.

* APNT expects demand recovery to take time and to be gradual. It expects T-3/ 4 towns to continue doing better in the near term, as normal monsoon forecasts coupled with continued support from government spending should boost rural demand trends further.

* APNT expects to deliver single-digit value growth in FY26.

Valuation and view

* We cut our EPS by 4% for FY26 to reflect weak volume growth and pressure on margins.

* APNT remains focused on new launches across price segments and packaging revamps to stay competitive against both organized and unorganized players. The entry of deep-pocketed new players with notable investment commitments could drive shifts in market share and cost structures across the industry.

* We remain cautious about both value growth and margin for FY26. Despite a correction in the stock, demand and competitive pressure still hover around earnings. Reiterate Neutral with a TP of INR2,500 (based on 45x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412