Neutral Siemens Ltd for the Target Rs. 3,200 by Motilal Oswal Financial Services Ltd

Strong inflows amid weak execution

Siemens results were below our estimates for the combined company as well as the non-energy entity in 2QFY25. For the combined entity, revenue was 6% below our estimate and PAT was 10% above our estimate. For the non-energy entity too, growth was impacted by weak execution and margin across segments, except Smart Infrastructure. Digital Industries segment continued to see demand slowdown. Order inflows for the non-energy entity were healthy during the quarter and were up by 44% YoY, which provides good revenue visibility for future. We cut our estimates to bake in weak performance seen during 1HFY25. Our TP of INR3,200 is based on 45x Mar’27E earnings on proforma financials of the non-energy entity Siemens Limited. We will revisit our estimates once we have detailed financials of both the entities. We maintain Neutral rating on the stock.

Revenue/PAT (combined entity) 10%/3% below our estimates

* Combined revenue for Siemens was down 6% at INR53.9b vs. our expectation of INR57.3b. Combined entity PAT was down 27% YoY, 10% below our estimate, mainly due to weakness across segments (other than Smart Infra). For energy business, revenue took a hit and was down 29% YoY, though the margin profile stood out, with EBIT margin standing at 20.6% for 2QFY25 vs. our est. of 15.0%. This was also because the energy segment was consolidated for two months in the quarter.

* Revenue for non-energy business was up 3% YoY/19% QoQ in 2QFY25. Execution was impacted by the ongoing normalization of demand in Digital Industries and due to project delivery schedules in the Mobility business. EBITDA margin for non-energy business stood at 11.0%, down 430bp YoY/20bp QoQ, while net profit was down by 37% YoY. This was due to a weaker-than-expected margin profile of all non-energy segments other than smart infrastructure. Profitability for non-energy segments was also affected by under-absorption of fixed costs and higher costs of material in the Digital Industries business. 2QFY24 also had a one-time gain of INR1.9b from the sale of property. Order inflow for non-energy business was up 44% YoY

Segmental performance

Energy segment financials were reported separately by the company, with revenue declining 29% YoY and implied PBIT margin expanding YoY to 20.5%. The company has demerged the Energy business, effective 25th Mar’25. Digital Industries continued to be impacted by muted private capex spending. Revenue declined 2% YoY, while margin further declined to 4.6% in 2QFY25 vs. 6.1% in 1QFY25 and 16.5% in 2QFY24. Order inflows will start picking up once a broadbased revival in private capex fructifies, which is yet to see some momentum. Mobility revenue was down 3% YoY, while margins contracted ~290bp YoY to 6.3% vs. our estimate of 8.7%. Smart Infra revenue grew 5% YoY, while margins expanded ~90bp YoY to 15.2%.

Outlook across segments

Smart infra segment is expected to benefit from continued spending in public infrastructure (especially in power distribution, grid automation, and building technologies), data centers, EV charging infra, and industrial investments. Siemens continues to face challenges in Digital industries due to muted private capex spending and higher costs of materials in the segment. Hence, near- to mediumterm growth may remain impacted. For mobility segment, ordering has started to pick up momentum in the quarter, providing a positive picture on future execution. Continued focus on ‘Make in India’ for rail and transport augments Siemens’ growth prospects in rolling stock and rail automation. During the quarter, excl. energy business, order inflows grew by 44% YoY. However, execution saw only 3% YoY growth due to weak inflows in FY24.

Financial outlook

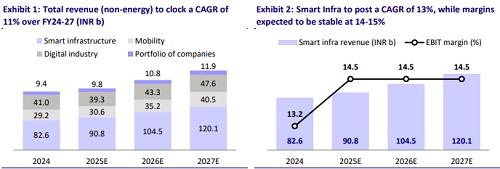

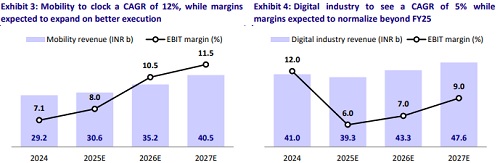

We lower our estimates for the combined entity on account of lower growth in all segments. We expect execution to ramp up in FY26/27 as order inflows have been quite healthy in 1HFY25 for the non-energy segment. For the non-energy business, Siemens Limited, we arrived at a pro forma P&L and expect a CAGR of 11%/13%/10% in revenue/EBITDA/PAT over FY24-27E. For Siemens Energy (yet to be listed), we expect a CAGR of 13%/18%/19% in revenue/EBITDA/PAT over FY24- 27E.

Valuation and view

Based on proforma financials of non-energy business Siemens Limited, the stock is currently trading at a P/E of 54x/44x/38x on FY25E/FY26E/FY27E EPS. We value the stock at 45x on Mar’27E EPS and maintain our Neutral rating with a TP of INR3,200. Valuation multiples for non-energy segment are lower than the energy segment due to lower growth profile vs. energy segment.

Key risks and concerns

1) Slowdown in order inflows from key government-focused segments such as transmission and railways, 2) aggression in bids to procure large-sized projects would adversely impact margins, 3) related-party transactions with parent group entities at lower-than-market valuations to weigh on the stock performance.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)