Sell India Cements Ltd for the Target Rs. 300 by Motilal Oswal Financial Services Ltd

EBITDA above est.; steady progress in brand transition

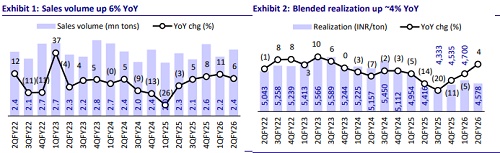

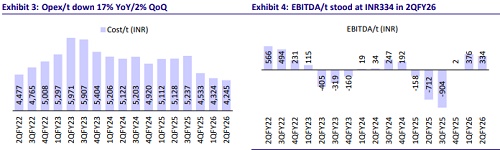

* India Cements (ICEM) reported an EBITDA of INR814m (24% beat) in 2QFY26 vs. an operating loss of INR1.6b in 2QFY25. The improvement in profitability was led by strong cost-control measures, as opex/t dipped ~17% YoY in 2Q. Sales volume grew ~6% YoY to 2.4mt (~6% beat). The company reported a net loss of INR69m (est. loss of INR257m) vs. a loss of INR2.5b in 2QFY25.

* Management highlighted that the brand transition from ICEM to UTCEM is progressing well, with 31% of volumes under the UTCEM brand, which is likely to increase to 40% by the end of Dec’25. It reiterated that the company would achieve an EBITDA/t of INR1,000 and a net debt-to-EBITDA ratio of ~0.5x by FY28E.

* Recently, ICEM exited the coal assets held in Indonesia, and the proceeds will help to reduce its debt level. The company raised ICEM’s capacity through debottlenecking by 0.3mtpa, and it will further increase capacity by 2.8mtpa by FY27E through debottlenecking and brownfield expansions.

* We maintain our EBITDA estimates for FY26-FY28. We value ICEM at an EV/t of USD80 to arrive at our TP of INR320. Reiterate Sell.

Opex/t dips 17% YoY/2% QoQ; EBITDA/t at INR334 (est. INR283)

* ICEM’s revenue increased ~10% YoY to INR11.2b in 2QFY26 (~5% beat). Sales volume increased ~6% YoY/12% QoQ to 2.4mt. Realization improved ~4% YoY (down ~3% QoQ; 1% below our estimates). It reported EBITDA of INR814m vs. an operating loss of INR1.6b in 2QFY26.

* ICEM’s opex/t dipped 17%/2% YoY/QoQ (~2% below our est.), due to cost reduction initiatives across parameters. Variable cost/other expenses/freight cost per ton declined 9%/24%/23% YoY. Employee costs declined 39%/7% YoY/QoQ. EBITDA/t stood at INR334 vs. our estimate of INR292.

* In 1HFY26, ICEM’s revenue grew ~8% YoY. It posted EBITDA of INR1.6b vs. an operating loss of INR1.9b in 1HFY25. Net loss stood at INR206m vs. INR4.0b in 1HFY25. Operating cash outflow was at INR1.95b (due to a rise in working capital) vs. OCF of INR602m in 1HFY25. Capex was INR571m vs. INR465m in 1HFY25. Net cash outflow was INR2.5b vs. FCF of INR140m in 1HFY25.

Key highlights from the management commentary

* The company’s average capacity utilization stood at ~65% in 2QFY26 vs. ~61% in 1QFY26. The trade mix improved to ~68% vs. ~55% in 1QFY26, and direct sales increased to ~70% from ~66% in 1QFY26.

* The Board approved a capex of INR20b over the next two years, of which INR15.7b is towards modernization works and INR4.4b towards a capacity expansion of 2.8mpta in a high-performance market. It is likely to deliver an IRR of +20%. Capex will be funded through a mix of debt and internal accruals.

* It is investing heavily in renewable energy (WHRS + other RE) and targeting RE power share to 80% by FY28 from 5% currently. It is targeting to increase WHRS capacity to 30MW by FY27-28E vs. 9MW currently and other renewable power capacity to 212MW by FY27-28E from 20MW at present.

Valuation and view

* Following its acquisition by UTCEM in 4QFY25, ICEM implemented significant cost control measures, reducing opex/t QoQ over the past three consecutive quarters (down ~19% and INR992/t in the last quarters) through savings across key cost heads. The company is investing in enhancing productivity and energy efficiency, increasing the green power share, and digitization initiatives.

* We estimate the company’s revenue CAGR at ~10% over FY25-28, led by a volume/realization CAGR of ~8%/2%. We expect the company to achieve EBITDA/t of INR344/517/746 in FY26/27/FY28. We value ICEM at an EV/t of USD80 and arrive at our TP of INR320. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412