Neutral Havells India Ltd for the Target Rs.1,680 by Motilal Oswal Financial Services Ltd

Subdued start to FY26; C&W offers support

Volume growth stands at ~20-21% YoY in C&W

* Havells India’s (HAVL) 1QFY26 revenue declined ~6% YoY to INR54.6b (~7% miss), driven by lower-than-expected growth in the Lloyd/ECD/lighting segments. Its EBITDA declined ~10% YoY to INR5.2b (~8% miss) due to margin contraction across segments except cables and wires (C&W), which saw margin expansion. OPM stood at 9.5% (down 40bp YoY; 20bp below est.). PAT declined ~15% YoY to INR3.5b (11% miss).

* Management highlighted that 1QFY26 was a challenging quarter, largely due to an unexpected weak summer and continued muted consumer demand, which impacted cooling products revenue, further compounded by a high base in the previous year. However, the C&W segment remained a bright spot, delivering strong growth supported by healthy infrastructure and industrial demand. It believes that the current challenges are transitory and remains optimistic about achieving revenue growth and margin expansion in the upcoming quarters.

* We cut our EPS estimate by ~8%/7% each for FY26/FY27E as we cut revenue and margin estimates for the Lloyd/ECD/Lighting segments. We have introduced FY28 estimates in this note. HAVL’s valuations at 60x/48x FY26/27E EPS remain expensive. We reiterate our Neutral rating with a TP of INR1,680 (based on 50x Jun’27E EPS).

OPM contracts 40bp to 9.5%; C&W margin expands 1.3pp to 12.6%

* HAVL’s consolidated revenue/EBITDA/PAT stood at INR54.6b/INR5.2b/INR3.5b (-6%/-10%/-15% YoY and -7%/-8%/-11% vs. our estimates). Gross margin stood at ~33% (+1.6pp YoY). OPM contracted 40bp YoY to 9.5%. Ad spending was at 2.6% of revenue vs. 3.0%/2.2% in 1QFY25/4QFY25.

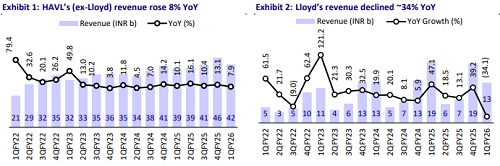

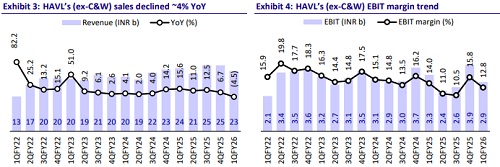

* Segmental highlights: 1) HAVL’s revenue (excl. Lloyd) increased ~8% YoY to INR41.8b. C&W revenue grew ~27% YoY to INR19.3b, and EBIT margin expanded 1.3pp YoY to ~13%. Switchgear revenue rose ~9% YoY to INR6.3b, while EBIT margin contracted 1.2pp YoY to ~23%. Lighting revenue declined ~2% YoY to INR3.8b, while EBIT margin contracted 4.3pp YoY to ~12%. ECD revenue declined ~14% YoY to INR9.1b, and EBIT margin contracted 2.2pp YoY to ~9%. Lloyd’s revenue declined ~34% YoY to INR12.7b. Operating loss stood at INR209m vs an operating profit of INR636m in Q1FY25.

Key highlights from the management commentary

* In Lloyd, inventories remained high at both channel and company levels, and it will take some time for the supply chain to normalize. However, this inventory adjustment is not expected to impact margins over the next two quarters.

* The C&W segment recorded 20-21% YoY volume growth, with wires growing slightly faster than cables. The company aims to maintain a contribution margin of 14% in this segment, although margins were higher in 1QFY26.

* The company expects growth in the Lighting segment, driven by a focus on premium and solution-oriented products over lower-value items. It also believes it has maintained market share across all product categories.

Valuation and view

* HAVL’s 1QFY26 performance was below estimates due to unfavorable weather conditions and weak consumer demand. The company’s key business segments—ECD, Lloyd, and Lighting—reported revenue decline as well as margin contraction YoY in 1QFY26. C&W performance improved, led by strong underlying demand and continued positive traction in the industry. We remain watchful for a recovery in consumer demand in the coming quarters.

* We expect HAVL to report a revenue/EBITDA/PAT CAGR of 12%/18%/18% over FY25-28. We estimate OPM to expand 11.1%/11.5% in FY27/FY28 vs. 10.3% in FY26. RoIC is expected to improve to ~29% by FY28 from 23% in FY26, and RoE is estimated at ~20% in FY28 vs. ~17% in FY26.

* The stock trades at rich valuations of 60x/48x FY26/27E EPS and, hence, we reiterate our Neutral rating with a TP of INR1,680 (based on 50x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)