Neutral Indian Energy Exchange Ltd For Target Rs.193 by Motilal Oswal Financial Services Ltd

Strong 3Q; slower volume growth and high base to be key challenges in FY26

* Indian Energy Exchange (IEX) reported standalone revenue for 3QFY25 at INR1,313m (+14% YoY), surpassing our estimate by 7%. Reported standalone PAT was 16% above our est. at INR1,031m (+28% YoY), primarily due to a 15.9% YoY rise in electricity volumes and other income.

* IEX’s overall volumes rose ~17% YoY in 3QFY25, with electricity volumes rising 15.9% YoY and renewable (RE) volumes surging 31% YoY.

* IEX holds a dominant market position, with a combined market share of 85% in 9MFY25. Pending approvals for an 11-month contract and the Green RTM market are expected to enhance volume growth opportunities.

* We believe FY26 volume growth could fall short of expectations, given the high base in 9MFY25 and the recent deceleration in power demand growth. Clarity on long-dated contracts, a key catalyst, has been pending for some time. While concerns around market coupling have subsided somewhat, it remains a risk. We reiterate our Neutral rating on the stock with a TP of INR193

Robust 3Q; outperforming expectations

* IEX reported standalone revenue for 3QFY25 at INR1,313m (+14% YoY), surpassing our estimate by 7%.

* Reported standalone PAT was 16% above our est. at INR1,031m (+16% YoY), driven by higher revenue from increased electricity volumes and other income.

* For 9MFY25, India's electricity demand stood at 1,279 BUs, a 5% increase YoY.

* Operational performance:

* In 3QFY25, electricity volumes were up 15.9% at 30.5 BUs. This was supported by robust coal availability, with inventories standing at 19 days.

* Within the electricity volume segment, Day Ahead Market (DAM) was up 14% YoY. DAM prices declined 26% YoY to INR3.71/unit, offering Distribution Companies (Discoms) and Commercial & Industrial (C&I) consumers a costeffective alternative to meet demand and replace more expensive power sources.

* Term Ahead Market (TAM) volumes were down 49% YoY in 3QFY25.

* Renewable Energy Certificates (RECs) traded in 3QFY25 stood at 2.65m (+31% YoY).

* Within the Green Market segment, G-DAM delivered a strong performance, with volumes up 319%.

* In the Gas market, the Indian Gas Exchange (IGX) witnessed a 93% increase in traded volumes in 3QFY25, reaching 16.2m MMBtu. Reported PAT for 3QFY25 grew 13% YoY INR83m.

* The board declared an interim dividend of INR1.50/share for FY25 (record date: 31st Jan’25).

Highlights of 3QFY25 performance

* Performance highlights and market developments

* Standalone profit increased 15.5% YoY to INR1,030m; consolidated profit grew 17% to INR1,070m.

* Electricity volumes grew 16% YoY in 3QFY25; 9MFY25 volumes rose 19% to 89BUs. RECs traded grew 31% YoY in 3QFY25 to 2.65m; RTM volumes rose 30% YoY to 9.3BUs.

* IGX trading volumes almost doubled YoY to 16.2m MMBTU in 3QFY25; cumulative 9MFY25 volumes reached 39.8m MMBTU (+24%). Other highlights:

* IEX holds an 83-84% market share in the electricity segment and 60-65% in RECs.

* Market share for TAM and DAM is 40%, whereas for RTM and the collective market, it is nearly 100%.

* India’s first coal exchange is expected to launch by 2025 under a regulatory framework.

* CERC is finalizing orders on long-duration contracts and has sought public feedback for Green RTM.

Valuation and view

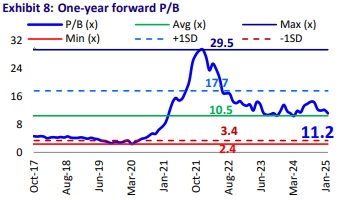

* Our TP of INR193 for IEX is based on the following:

* We value the business at Dec-26E EPS of 6.0 with a PE multiple of 32x. This compares with the mean one-year forward P/E of 28x.

* We have not assumed any value for IGX stake in our valuation.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412