Buy AU Small Finance Bank Ltd for the Target Rs. 925 by Motilal Oswal Financial Services Ltd

Headwinds receding; earnings growth set to accelerate

NIMs expand 5bp QoQ

* AU Small Finance Bank (AUBANK) reported a healthy PAT of INR5.6b (13% beat), aided by NIM expansion and healthy business growth.

* NII expanded 4.9% QoQ to INR21.4b (up 8.6% YoY/ 4.9% QoQ, 6% beat on MOFSLe), aided by 5bp NIM expansion to 5.5%.

* PPoP grew 6.9% YoY (down 7.8% QoQ) to INR12.1b (8% beat).

* Provisions stood at INR4.8b (4% higher than MOFSLe, down 10% QoQ). The bank reported 30bp of credit cost in 2Q and 64bp in 1H on total assets. AUBANK reiterated its full-year credit cost guidance of 1% for FY26E.

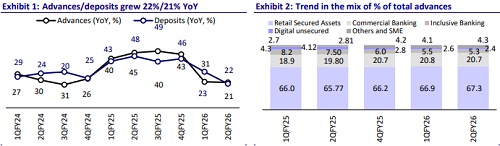

* Business growth was robust, with advances growing 22% YoY/5.3% QoQ to INR1.16t; deposits also stood strong at 20.8% YoY/3.8% QoQ.

* Slippages declined to INR9.1b vs INR10.3b in 1QFY26. GNPA/NNPA ratio declined 6bp/flat QoQ to 2.41%/0.88%. PCR declined to 64.2%.

* We fine-tune our estimates and project FY27E RoA/RoE at 1.7%/16.7%. We estimate AUBANK to deliver 30% earnings CAGR over FY25-28E, led by an improvement in business growth, credit cost, and margins. We reiterate BUY with a TP of INR925 (3.0x FY27E BV).

Growth outlook healthy; asset quality ratios stable

* AUBANK reported 2QFY26 PAT of INR5.6b (13% beat on MOFSLe, down 3.4% QoQ), led by a 5bp NIM expansion, robust growth, and a sequential decline in credit cost. We expect FY26 earnings to grow 24.4% YoY to INR26.2b.

* NII grew 8.6% YoY/4.9% QoQ to INR21.4b (6% beat) amid positive NIMs, led by a reduction in CoF as well as surplus liquidity utilization.

* Provisions came in at INR4.8b (4% higher than MOFSLe); however, 2H credit costs are expected to improve amid easing stress in the unsecured and card portfolios. PCR stood at 64.2% vs 64.7% in 1QFY26.

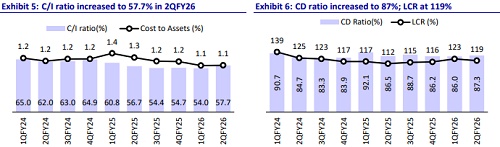

* Other income came in at INR7.1b (in line, down 12.1% QoQ), amid lower treasury gains. Opex grew 6.8% QoQ to INR16.5b.

* Advances grew 22% YoY/5.3% QoQ, led by growth in retail secured assets as well as commercial banking, while unsecured book declined sharply in 2Q. Deposits also stood strong at 20.8% YoY/3.8% QoQ. CD ratio, thus, increased to 87% vs 86%. CASA mix improved to 29.4% vs 29.2% in 1QFY26. CoF declined 25bp QoQ to 6.83% in 2QFY26.

* Slippages declined to INR9.1b vs INR10.3b in 1QFY26. GNPA/NNPA ratio declined 6bp/flat QoQ to 2.41%/0.88%. PCR stood at 64.2%.

Highlights from the management commentary

* NIMs are likely to improve further, with 2Q marking the inflection point amid a better asset mix and deposit repricing.

* At the GLP level, the company has maintained growth guidance of 2-2.5x GDP, with an expected pickup from 2H onwards, supported by a recovery in unsecured growth.

* The unsecured book constitutes less than 10% of total loans. Management reiterated that credit card delinquencies peaked last quarter, and it expects credit costs to reduce going forward.

* It is too early to comment on the impact of the ECL transition, but it is expected to be a neutral to positive event for the bank.

Valuation and view: Reiterate BUY with a revised TP of INR925

AUBANK ticked all boxes in its 2Q performance. NIMs surprised the street with an uptick of 5bp, and are expected to continue their upward momentum. Growth stood healthy, led by the retail and commercial segments, while credit costs are expected to witness a sharp improvement in 2H. Other income and opex largely stood in line, but are expected to inch up marginally as the bank continues to invest in the business in preparation for stronger growth ahead. On the business front, both advances and deposits grew at a healthy rate, and we expect AUBANK to maintain its growth leadership in the sector. Asset quality is expected to witness an improvement amid easing stress in the unsecured business. Multiple levers are aligning for AUBANK—margin expansion from lower CoF, credit cost normalization, and renewed traction in the unsecured segment. Supported by consistent balance sheet growth, we expect a robust FY25-28E PAT CAGR of ~30%. We fine-tune our estimates and project FY27E RoA/RoE at 1.7%/16.7%. We estimate AUBANK to deliver a 30% earnings CAGR over FY25-28E, led by an improvement in business growth, credit cost, and margins. We reiterate BUY with a TP of INR925 (3.0x FY27E BV)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412