Buy J K Cement Ltd for the Target Rs. 7,000 by Motilal Oswal Financial Services Ltd

Earnings in line; capacity expansion on track

Near-term pricing pressure expected to ease going forward

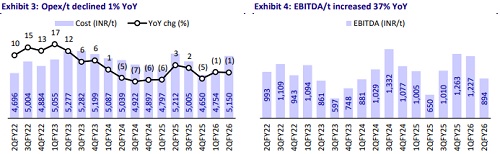

* JK Cement’s (JKCE) 2QFY26 earnings were in line with our estimates, with EBITDA growing ~57% YoY to INR4.5b. EBITDA/t surged ~37% YoY to INR894 (vs. est. INR934). OPM expanded 3.7pp YoY to ~15% (vs. ~16% est.). Adj. PAT surged 4.5x YoY to INR1.6b (in line), albeit on a low base.

* Management highlighted that volume growth in 2Q was led by the central and south markets, while the north region remained flat. Cement prices remain under pressure in the current month; however, this is expected to ease going forward. Further, the company intends to pass on any future cost increases through price adjustments. JKCE is targeting cost savings of INR150-200/t, with INR75-90/t expected in FY26/FY27 (each). The 6mtpa capacity expansion is at an advanced stage and is expected to be commissioned in the coming months. Following the announcement of the Jaisalmer greenfield expansion during the quarter, capex guidance for FY26 has been raised to INR28b (earlier estimated INR20b).

* We cut our EBITDA estimate by ~6%/3% for FY26/FY27, reflecting higher opex/t due to increased spending on dealer networking, branding, and other expenses. EBITDA for FY28 is maintained. We value JKCE at 18x Sep’27E EV/EBITDA to arrive at our revised TP of INR7,000. Reiterate BUY.

Grey cement volume/realization increases ~16%/3% YoY

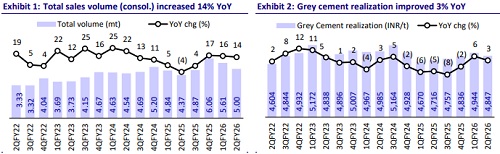

* JKCE’s consolidated revenue/EBITDA/PAT stood at INR30.2b/INR4.5b/ INR1.6b (+18%/+57%/+347% YoY and +3%/-3%/-2% vs. our estimate). Sales volume grew ~14% YoY (in line). Grey/white cement volume rose ~16%/5% YoY.

* Blended realization increased 3%/1% YoY/QoQ. Grey cement realization rose 3% YoY (dipped 2% QoQ). White cement realization increased 8%/3% YoY/QoQ. Other operating income/t stood at INR183 vs. INR161 YoY. Opex/t declined 1% YoY (+2% vs. estimate), led by a 1% decline in variable/freight cost/other expenses (each).

* In 1HFY26, revenue/EBITDA/adj PAT stood at INR63.7b/INR11.3b/INR4.8b, rising ~19%/47%/119% YoY. OPM expanded 3.5pp YoY to ~18%. EBITDA/t grew ~28% YoY to INR1,070. OCF stood at INR5.1b vs. INR3.0b in 1HFY25. Capex stood at INR10.1b vs. INR7.5b. Net cash outflow stood at INR6.5b (including INR1.5b spent on acquiring a stake in Saifco Cements) vs. INR4.4b in 1HFY25.

Highlights from the management commentary

* Major maintenance work on three kilns/cement mills, along with annual dealer conferences and branding initiatives, led to higher other expenses. This resulted in an additional cost impact of INR100/t.

* Incentive is expected to be marginally lower in FY26 due to the new GST reform. Incentives from the Bihar project are expected to start flowing in FY27, and from the Jaisalmer project (partially) in FY28.

* Recently, Toshali Cement received approval for its merger. However, the mining lease has not yet been granted, and the company is pursuing a long-term arrangement (20-25 years) with a mechanized pricing formula.

Valuation & view

* JKCE’s earnings were in line with our estimates. However, the sharp increase in opex/t QoQ due to higher maintenance and branding expenses led to a decline in profitability. We expect normalcy in other expenses in the coming quarters and an improvement in profitability. It is committed to the timely completion of its expansion plans, which are likely to continue driving higher volume growth.

* We expect its revenue/EBITDA/profits to post a CAGR of 13%/21%/30% over FY25-28E. We estimate EBITDA/t at INR1,089/INR1,183/INR1,225 vs. INR1,012 in FY25. We estimate RoE at ~18-19% and ROCE at ~12% in FY27-28. The stock trades at 16x/14x FY27E/FY28E EV/EBITDA. We value JKCE at 18x Sep’27E EV/EBITDA (at a premium to its long-term average) to arrive at our revised TP of INR7,000. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412