Buy Brigade Enterprises Ltd for the Target Rs. 1,583 by Motilal Oswal Financial Services Ltd

Revenue beats est.; margin improvement on cards

Bangalore and Chennai to drive growth; 12msf launch pipeline creates near-term growth visibility

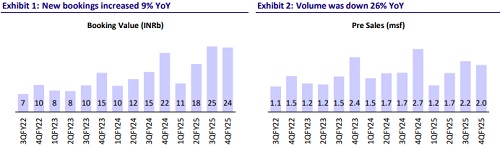

* In 4QFY25, Brigade Enterprises (BRGD) reported a pre-sales growth of 9% YoY to INR24.5b (22% below our estimate), due to a 26% YoY decline in volumes to 2.0msf (50% below our estimate).

* With launches of projects of ~4msf across Chennai and Bengaluru, BRGD recorded its highest-ever quarterly realization of INR12,083/sft, up 47% YoY.

* The company intends to launch ~12msf of residential projects in Bangalore (eight projects), Chennai (five projects), Hyderabad (one project), and Mysuru (two projects) in the next four quarters.

* In light of this growth, we expect BRGD to deliver a 21% pre-sales CAGR over FY25-27 to INR115b.

* Its consolidated collections rose 5% YoY to INR19.3b (33% below our est.).

* For FY25, BRGD achieved a pre-sales of INR78.5b, up 31% YoY (8% below our estimate). Collections improved 23% YoY to INR72.5b.

* BRGD's gross debt was INR44.4b, while net debt stood at INR9.6b. Its net debt-to-equity stood at 0.14x by the end of 4QFY25 (vs. 0.18x in 3QFY24); the cost of debt was 8.67% for the quarter.

* The Board recommended a final dividend of INR2.5/sh of FV INR10 each.

* BRGD has signed a definitive agreement for a prime land parcel located on Whitefield-Hoskote Road, Bengaluru, to develop a residential project having a total saleable area of ~2.5msf with a GDV of about INR27b and a total land cost of about INR6.3b through its subsidiary, Ananthay Properties.

* The company also acquired 4.4 acres of land in Whitefield, East Bengaluru, for developing a premium residential project with a GDV of INR9.5b, having 0.6msf area.

* BRGD signed two JDAs in Mysore: 1) with a GDV of INR3b (0.45msf area), which would include 25% senior living spaces and 75% luxury apartments, and 2) with a GDV of INR2.3b (0.37msf) towards premium residential development.

* Post-4QFY25, BRGD acquired a prime land parcel on Velachery Road, Chennai, for premium residential development with a total potential of 0.8msf, resulting in a GDV of INR16b. BRGD acquired this land for INR4.4b.

P&L performance

* Revenue declined 14% YoY to INR14.6b (8% above our est.). For FY25, BRGD achieved a revenue of INR50.7b, up 4% YoY (in line).

* EBITDA stood at INR4.1b, down 4% YoY (28% below estimates). EBITDA margin came in at 28.5%, up 307bp YoY, while it was 14pp below our estimate. For FY25, the company reported an EBITDA of INR14.1b, up 18% YoY (10% below our estimate). Its EBITDA margin stood at 28%.

* For 4QFY25, the company’s adj. PAT jumped 20% YoY to INR2.5b (24% below), clocking a margin of 17%. During FY25, it reported an adj. PAT of INR6.9b, up 52% YoY (10% below our estimate).

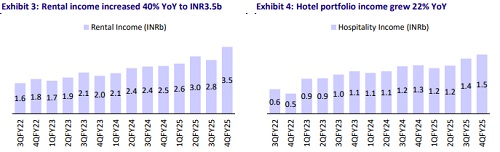

Annuity business reports healthy growth

* Leasing revenue grew 40% YoY to INR3.5b, and the hotel business reported a revenue of INR1.5b, which rose 22% YoY.

* The company has made good progress in the commercial portfolio’s occupancy, which rose to 92% in FY25 from 83% in FY24.

* The company has 2.01msf of office and retail area under construction. BRGD has a balance capex commitment of INR7.1b out of a total ongoing capex of INR12.5b for commercial assets.

Valuation and view

* BRGD reported a flattish revenue growth on a QoQ basis even after launching ~2x of residential area in 4QFY25. Although it has a strong launch pipeline of ~12msf, which should enable it to sustain the growth traction going ahead.

* Management intends to keep assessing growth opportunities in the residential segment and expects to spend more on business development over the next two years. This will provide growth visibility in the residential segment and lead to a further re-rating. We reiterate our BUY rating with a revised TP of INR1,583 (vs. INR1,415), implying a 49% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)