Neutral Bharat Forge Ltd For Target Rs.1,155 by Motilal Oswal Financial Services Ltd

Disappointing performance

Demand outlook for most businesses remains weak

* Bharat Forge (BHFC)’s 3QFY25 performance lagged our estimates, driven by slower growth across key segments as also a slower ramp-up of defense. Outlook for CV demand (both domestic and exports), PV exports and domestic non-auto remains weak. Even overseas subs are taking lot longer to turnaround. Its key growth drivers are likely to be defense and JSA.

* We sharply cut our FY25E/FY26E EPS by 25/17% to factor in the weak outlook in major segments, including CVs, slower-than-expected defense ramp up and also continued weakness in overseas subsidiary performance. The stock appears fairly valued at the current valuations of 33.9x/25.0x FY26E/FY27E consolidated EPS. We reiterate our Neutral rating with a TP of INR1,155 (based on 28x Dec’26E consolidated EPS)

Weak performance overall but margins steer ahead

* BHFC’s 3QFY25 standalone revenue/EBITDA/adj. PAT declined 7.0%/5.5%/ 5.0% YoY at INR21b/INR6.1b/INR3.5b (est. INR24b/INR6.7b/INR3.9b). Its 9MFY25 revenue/EBITDA/adj. PAT grew 1%/4%/4% YoY to INR66.8b/ INR18.9b/INR10.7b.

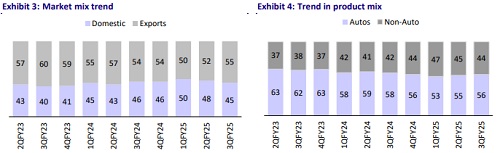

* While domestic revenue declined ~10% YoY to INR9.2b, exports declined 5% YoY to INR11.5b. The primary factor for the decline in performance is the anemic economic condition in the EU and the lumpy nature of the defense business during the quarter.

* Key growth drivers in Q3 includes defense/JS Auto businesses, which posted revenue of INR3.37b/INR1.66b, with growth of 87%/20% YoY.

* Gross margin expanded 180bp YoY/70bp QoQ to 59.9% (est. 58%).

* This was offset by higher other operating expenses, resulting in an EBITDA decline of 6% YoY to INR6.1b (est. 6.7b).

* However, the EBITDA margin was better at 29.1% (+60bp YoY/130bp QoQ; est. 27.8%), due to a favorable product mix (exports at 55% of revenues).

* Adj. PAT declined 5% YoY to INR3.5b (est. INR3.9b).

* The BOD declared an interim dividend of INR2.50 per share.

Highlights from the management interaction

* CVs: The Indian CV market is expected to post slightly better growth in 4Q QoQ while FY26 is likely to be flat. The US Class-8 CV demand is projected to grow 10% in FY26, largely back-ended. Uncertainty remains regarding potential tariff changes.

* Global demand: Weak demand in the EU and the US persists due to the industry transition to EVs and economic uncertainty. EU operations posted INR100m EBITDA, while US operations reduced losses to INR60m (with 60% utilization). Margin improvements in the US have been driven by cost reductions and efficiency. The company is conducting a comprehensive review of its European manufacturing footprint, with a clearer direction expected in six months.

* Its aerospace segment continues to be a key growth driver with a quarterly revenue run rate at INR5-6b currently and is likely to surpass triple digits per quarter in FY26. BHFC has approved new investments in landing gear machining and high-precision ring mill forgings. This facility is likely to commence production by FY27-end, and the segmental revenue can potentially double from there after this.

* JSA continues to see strong ramp-up and management expects this business to hit annualised run-rate of INR 10b in the next 6-8 quarters. They are also confident of margin expansion in this business by 250-300bp over next 2 years.

* Defense revenue stood at INR3.4b and the slower ramp-up was due to the lumpy nature of the business. For 9MFY25, defense revenue grew 49% YoY to INR14.9b. This segment has seen order wins of INR1b in 3Q with outstanding orders of INR57b. The domestic ATAG order is likely to be awarded in the next 3- 4 months. However, serial production will commence 15-18 months from now

Valuation and view

* The bulk of BHFC’s core segments, including CVs (both domestic and export), PV exports and domestic non-auto are currently witnessing a demand slowdown. Further, the ongoing slowdown in the European PV segment has hurt the ramp-up of its overseas subsidiaries. However, its Defense, JS Auto Cast, and Aerospace segments are anticipated to be the growth pillars in the near term.

* We cut our FY25E/FY26E EPS by 25/17% to factor in the weak outlook in major segments (including CVs) and a slower-than-expected defense ramp-up. We estimate a CAGR of 15%/20%/46% in consolidated revenue/EBITDA/PAT over FY25-27. The stock appears fairly valued at the current valuations of 33.9x/25x FY26E/FY27E consolidated EPS. Reiterate Neutral with a TP of INR1,155 (based on 28x Dec’26E consolidated EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412