Buy Max Financial Services Ltd for the Target Rs. 2,100 by Motilal Oswal Financial Services Ltd

Product mix shift drives VNB margin expansion; guidance intact

* Axis Max Life Insurance (MAXLIFE) reported an APE growth of 16% YoY to INR25.1b (in line). For 1HFY26, APE grew 15% YoY to INR41.8b.

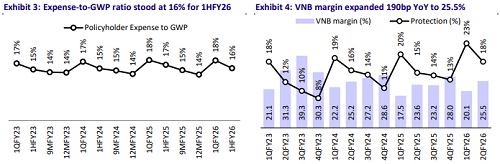

* MAXLIFE’s VNB grew 25% YoY to INR 6.4b (7% beat), resulting in a VNB margin of 25.5% (150bp beat) vs 23.6% in 2QFY25. For 1HFY26, VNB grew 27% YoY to INR9.7b, resulting in a VNB margin of 23.3%.

* At the end of 1HFY26, the company reported an EV of ~INR269b, reflecting an RoEV of 15% and an operating RoEV of 16.3% (16.8% in 1HFY25).

* The loss of ITC led to a 60bp impact on VNB margin in 1HFY26, and the company expects a 300–350bp drag without any changes to commissions or any other actions. However, the negotiations on commissions are ongoing, and other operating efficiencies would help offset the impact. Management maintained its VNB margin guidance of 24–25% for FY26.

* We retain our APE estimates and slightly raise our VNB margin estimates by 50bp to 25%/26%/26.5% in FY26/FY27/FY28. We reiterate our BUY rating with a TP of INR2,100, premised on 2.3x Sep’27E EV.

Rising contributions from protection, annuity, and non-par savings

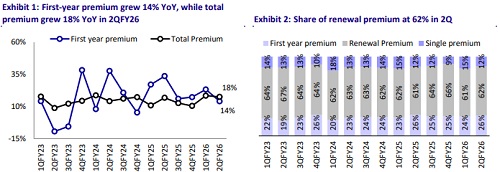

* Gross premium income grew 18% YoY to INR91b (in-line). Renewal premium grew 19% YoY to INR56.3b (in-line). For 1HFY26, the premium grew 18% YoY to INR154.9b.

* The maintained growth momentum drove market share expansion to 10.1% during 1HFY26 from 9.3% in 1HFY25.

* VNB margin expansion of 190bp YoY was largely driven by a product mix shift in 2QFY26, with non-par savings contribution increasing to 35% (30% in 2QFY25) and protection contribution rising to 18% (15% in 2QFY25), while ULIP contribution declined to 35% (44% in 2QFY25).

* The high-margin segments, such as protection, witnessed an APE growth of 36% YoY in 1HFY26 to INR5.4b, with rider APE rising 80% YoY. Annuity APE posted 85% YoY growth to INR3.4b in 1HFY26. Group credit life has started to recoup from 2QFY26, witnessing a growth of 24% YoY during 2Q.

* MAXLIFE launched the Group Smart Health Insurance Plan, a comprehensive fixed-benefit health solution that offers the benefit of choosing from multiple benefit options.

* On the distribution front, the proprietary channel maintains strong growth momentum, growing 22% YoY during 2QFY26, aided by a 26% YoY growth in the offline channel and 14% YoY growth in the online channel. The partnership channel grew 9% YoY in 2Q, driven by a 6% YoY growth in the Axis Bank channel and a 31% YoY growth in other partner channels.

* The opex-to-GWP ratio improved 100bp YoY to 15.5% in 1HFY26.

* Persistency on the premium basis improved across long-term cohorts, especially in the 25th-month (+500bp YoY to 76%) and 61st-month (+200bp YoY to 54%). However, the 13th-month persistency dipped 200bp YoY to 85%.

* AUM grew 9% YoY to INR1.85t. The solvency ratio stood at 208% in 1HFY26 vs. 198% in 1HFY25.

Key highlights from the management commentary

* Early signs of a strong demand are visible, particularly in protection products, and management expects the impact to deepen over the medium term. About 75% of Sep’25 sales were completed after 22nd Sep’25.

* MAXLIFE now holds the highest market share in retail protection, reflecting its strong franchise in the segment. Pure protection sales grew 34% YoY, with momentum improving week-on-week post-GST exemption. The credit life business also started recovering in 2Q and is expected to sustain traction in the coming quarters.

* Within Axis Bank, MAXLIFE continues to maintain a 65-66% counter share in individual business and ~60% share in credit life. Management expects these shares to improve to 65-70% over time.

Valuation and view

* MAXLIFE maintains a better-than-industry APE growth trajectory. VNB margin witnessed a strong expansion owing to strong growth and a rise in the contribution of protection, non-par, and annuity businesses during 2QFY26. The proprietary channel continues to drive growth across offline and online channels, while the bancassurance channel posted strong growth in non-Axis partnerships. The persistency trends improved across long-term cohorts. While the GST exemption is expected to improve the growth momentum, the efforts to mitigate the impact of the loss of input tax credit will be key.

* We retain our APE estimates and slightly raise our VNB margin estimates by 50bp to 25%/26%/26.5% in FY26/FY27/FY28. We reiterate our BUY rating with a TP of INR2,100, premised on 2.3x Sep’27E EV.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412