Neutral Deepak Nitrite Ltd For Target Rs.1,835 by Motilal Oswal Financial Services Ltd

Subdued quarter; new projects delayed again!

* Deepak Nitrite (DN) reported a disappointing quarter with a miss in 3QFY25, mainly due to underperformance in both the Deepak Phenolics (DPL) and Advanced Intermediates (AI) segments. This lackluster performance was attributed to an idled plant resulting from deferred demand. EBITDA came in 28% below our estimate and stood at INR1.7b (-45% YoY). Adj. PAT was INR981m (estimate of INR1.5b, -51% YoY). EBIT margin contracted 10.8pp YoY for the AI segment, while the same contracted 440bp YoY for DPL.

* The AI segment experienced a decline due to year-end destocking, but demand picked up towards the end of 3QFY25, with margins likely to be better in 4QFY25. DPL faced production loss due to a plant shutdown, while global peers' Phenol utilization remains below DPL’s threshold. The company has not finalized anything on BPA yet but has begun small-scale PC compound production and plans the next DPL shutdown in ~18 months.

* The Nitric Acid project is in pre-commissioning and will be operational by the end of 4QFY25. The MIBK/MIBC and Acetophenone projects are set for commissioning in 1HFY26, while Nitration and Hydrogenation will be ready in 2HFY25. The INR1.2b R&D center at Savli, Vadodara, is 85% complete and on track for completion in Mar’25. The Fluorination block was already commissioned in 4QFY24.

* Management indicated that international demand is showing early signs of recovery, with domestic demand expected to normalize from 4QFY25. The agrochemical intermediates are witnessing a lag-adjusted recovery, while easing raw material prices should drive margin expansion for certain intermediates. Growing polymer demand and upcoming project commissions will enhance value capture across the supply chain.

* Due to the underperformance, we cut our revenue/ EBITDA/EPS estimates by 5%/24%/27% for FY25 by 8%/13%/15% for FY26, and by 9%/14%/16% for FY27. Our EBITDAM stands at 12.1%/16.7%/17.2% for FY25/26/27. There is a risk of further downgrades in our estimate going forward. The stock trades at ~29x FY26E EPS of INR66.2 and at ~19x FY26E EV/EBITDA. We reiterate our Neutral rating, valuing the stock at 25x FY276E EPS to arrive at our TP of INR1,835.

Miss across the board; worst performance since 1QFY21

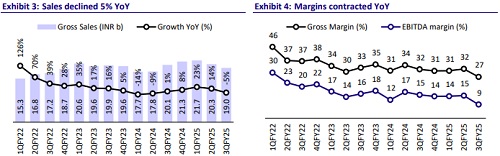

* Revenue came in at INR19b (our est. INR18.6b, down 5% YoY).

* EBITDA was INR1.7b (our est. of INR2.4b, down 45% YoY). Gross margin was at 26.8% (down 490bp YoY), while EBITDAM stood at 8.9% (vs. 15.2% in 3QFY24).

* Reported PAT stood at INR981m (our est. of INR1.5b, down 51% YoY).

* In 9MFY25, revenue was at INR61b (+10% YoY), EBITDA at INR7.8b (-5% YoY), PAT at INR4.9b (-11% YoY), and EBITDAM at 12.7% (-200bp YoY).

Segmental details

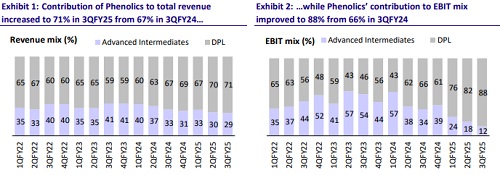

* Phenolics’ EBIT margin stood at 8.9%, with EBIT at INR1.2b. AI’s EBIT margin came in at 3.1%, with EBIT at INR169m.

* The revenue mix of Phenolics stood at 71% in 3QFY25, with AI’s share at 29%. EBIT mix for AI was at 12% (vs. 34% in 3QFY24). Contribution from Phenolics was at 88% (vs. 66% in 3QFY24).

* In 9MFY25, AI revenue was at INR18.7b (-9% YoY) and DPL revenue was at INR42.3b (+21% YoY). AI EBIT was at INR1.3b (-58% YoY), and DPL EBIT was at INR5.4b (+24% YoY). AI’s EBIT margin was 7% (-820bp YoY) and DPL’ EBIT margin was at 12.7% (+30bp YoY).

Valuation and view

* DN aims to become the largest player in the solvents market by focusing on import substitution. It is foraying into PC (165ktpa), Methyl Isobutyl Ketone (MIBK, 40ktpa), Methyl Isobutyl Carbinol (MIBC, 8ktpa), and Sodium Nitrite/ Nitrate, among other products. These products are taking shape and are likely to be commissioned in FY26. Some other previously announced capex projects have already been commissioned (fluorination plant, specialty salts unit).

* DN is aggressively pursuing both backward and forward integration projects to de-risk its business model and expand its product portfolio. However, its entire product portfolio consists of commodities. The stock trades at ~29x FY26E EPS of INR66.2 and ~19x FY26E EV/EBITDA, which we believe is expensive for a commodity chemical company. We reiterate our Neutral rating with a TP of INR1,835 (premised on 25x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412