Neutral One 97 Communications Ltd for the Target Rs. 870 by Motilal Oswal Financial Services Ltd

GMV in line; path to EBITDA positive by FY27 on track

Revenue misses estimates; contribution margin in line

* One 97 Communications (PAYTM) reported a net loss of INR5.45b (vs our estimated loss of INR1.1b), driven by higher charges toward accelerated ESOP expenses. Revenue from payments increased 4% QoQ to INR10.5b, while revenue from financial services increased 9% QoQ to INR5.5b, driven by improved take rates from DLG loans.

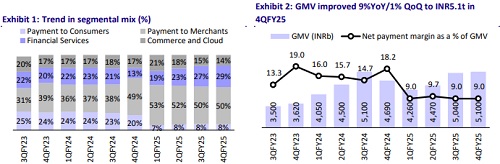

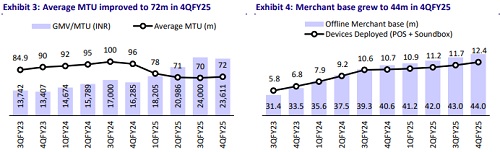

* As a result, total revenue increased 5% QoQ (down 16% YoY) to INR19.1b (9% miss on MOFSLe), while GMV stood in line at INR5.1t (9% YoY/1% QoQ). Payment devices grew 6% QoQ, which should have led to better subscription revenue. Merchant loan disbursements saw a 13% QoQ increase, while PL disbursements declined 19% QoQ. As a result, total disbursements were up 3% QoQ/flat YoY.

* Net payment margin expanded 18% QoQ (down 32% YoY) to INR5.8b/ 11bp of GMV vs 11bp in 3QFY25, while contribution margin expanded to 56.1% (54.4%, excluding UPI incentive), driven by lower payment processing charges.

* We maintain our contribution profit estimates and anticipate PAYTM to turn EBITDA positive by FY27. We value PAYTM at INR870 based on 18x FY30E EBITDA discounted to FY26E, which corresponds to 5.2x FY26E sales. We reiterate our NEUTRAL rating on the stock.

Merchant expansion on track; DLG loans to lead to better take rates

* PAYTM reported a net loss of INR5.45b (vs our estimated loss of INR1.1b), driven by higher charges toward accelerated ESOP expenses. GMV stood broadly in line at INR5.1t, while PL disbursements declined 19% QoQ, leading to a slower 3% QoQ growth in overall disbursements in 4QFY25.

* For FY26E, we expect EBITDA loss to reduce to INR~570m and PAT to stand at INR1.9b. Additionally, we expect EBITDA to turn positive by FY27.

* Total revenue increased 5% QoQ (down 16% YoY) to INR19.1b (9% miss on MOFSLe) due to slower growth from payments revenue, while financial services revenue was broadly in line (up 9% QoQ). As a result, payment and financial services revenue grew 6% QoQ (down 14% YoY).

* Revenue from marketing services (erstwhile commerce and cloud) stood flat QoQ at INR2.7b, while the number of credit cards grew 3% QoQ to 1.43m, as issuers adopted a cautious stance on the credit cycle.

* Payment processing margin (ex UPI incentive) was over 3bp (in line with guidance). Net payment margin expanded 18% QoQ to INR5.8b/11bp of GMV, (INR5.1b, ex UPI incentive/10bp of GMV). As the DLG model continues to gain traction, driving healthy disbursement growth, overall take rates are expected to further improve.

* Direct expenses declined 14% YoY and 3% QoQ due to a reduction in payment processing charges. Contribution profit increased to INR10.7b, with contribution margin at 56.1% (54.4% contribution margin, ex UPI). Adjusted EBITDA profit stood at INR0.8b. An exceptional charge of INR5.2b toward accelerated ESOP expenses led to a net loss at INR5.4b (vs our estimated net loss of INR1.1b).

Highlights from the management commentary

* Payment processing charges declined QoQ, as Q3 included the festive season. Better cost terms with partners also contributed to the reduction. The company remains focused on further improving payment processing margins.

* Discussions around MDR on UPI are gaining momentum and are expected to materialize within the current financial year. This should enable monetization on both the QR and consumer fronts. PAYTM is likely to capture around 7-8 bp of the total MDR implemented.

* The financial services customer base has declined, mainly due to adjustments in PL loan and reduced activity on PAYTM Money, driven by regulatory changes. A recovery is expected, with stronger prospects on the ML side.

Valuation and view: Reiterate NEUTRAL with a TP of INR870

* PAYTM reported a year of recovery in business metrics during FY25. Disbursement recovery is well on track, led by healthy disbursements in merchant loans. GMV also demonstrated steady state recovery.

* Most business metrics continue to improve as recovery progresses. We expect a steady business recovery, leading to a 29% revenue CAGR over FY25-27.

* Contribution margin expanded to 56.1% (54.4% excluding UPI incentives) due to cost control. The company’s exploration of global markets, though with limited capital commitment, and its strong cash position further provide comfort.

* The potential introduction of MDR on UPI is expected to significantly boost PAYTM’s revenue and incentivize the company to drive market share gains in consumer payments.

* We estimate a 29% CAGR in disbursements over FY25-27, with healthy take rates expected as the company forays into DLG arrangements.

* We maintain our contribution profit estimates and project PAYTM to turn EBITDA positive by FY27. We value PAYTM at INR870 based on 18x FY30E EBITDA discounted to FY26E, which corresponds to 5.2x FY26E sales. We reiterate our NEUTRAL rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)