Neutral Nestle India Ltd for the Target Rs.2,400 by Motilal Oswal Financial Services Ltd

Similar revenue print; miss on margin

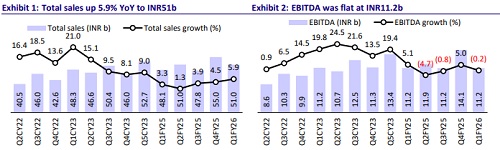

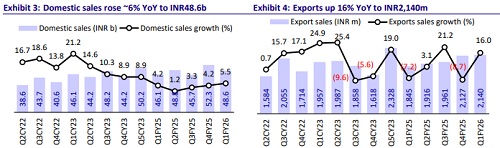

* Nestle India (Nestle) reported a 5.9% YoY revenue growth in 1QFY26, in line with our expectations. Domestic sales grew 5.5% YoY. We believe volume growth was in the low single digits. Nestle highlighted that, except for the Milk Products and Nutrition category, all other categories recorded volumeled growth. Export revenue grew 16% YoY, driven by strong performance in Foods, Coffee, Instant Tea, and Breakfast Cereals.

* GM contracted 250bp YoY/100bp QoQ to 55.2% (est. 57%), given the inflationary commodity prices. Management indicated that Coffee, Cocoa, and Edible Oil prices are expected to remain range-bound, while milk prices will likely cool off. EBITDA margin contracted 130bp YoY to 21.9%, the lowest in the past 12 quarters, due to elevated operating costs. We model an EBITDA margin of 23.6% for FY26 and 24.5% for FY27.

* In 1QFY26, the Powdered and Liquid Beverages category remained one of the key growth drivers, delivering strong double-digit growth. Confectionery also recorded high double-digit growth. The Prepared Dishes and Cooking Aids category returned to volume growth, led by double-digit growth in Maggi noodles. The Pet Food business witnessed a strong performance, primarily driven by the Cat portfolio. The Milk Products and Nutrition category delivered a mixed performance, with certain segments growing while others remaining muted.

* Mr Manish Tiwary will assume the role of Chairman and Managing Director of Nestlé India from 1st August, 2025.

* Nestle had a weak start to FY26 on the profitability front due to RM inflation and higher operating costs, driven by investments in manufacturing capabilities. While the enhanced capacity is expected to support long-term demands, it will weigh on margins and return ratios in the near term. Moreover, moderating urban consumption and high food inflation continue to pose risks to near-term recovery. The stock is trading at 69x/60x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR2,400 (based on 60x P/E Jun'27E).

* Nestle India (Nestle) reported a 5.9% YoY revenue growth in 1QFY26, in line with our expectations. Domestic sales grew 5.5% YoY. We believe volume growth was in the low single digits. Nestle highlighted that, except for the Milk Products and Nutrition category, all other categories recorded volumeled growth. Export revenue grew 16% YoY, driven by strong performance in Foods, Coffee, Instant Tea, and Breakfast Cereals.

* GM contracted 250bp YoY/100bp QoQ to 55.2% (est. 57%), given the inflationary commodity prices. Management indicated that Coffee, Cocoa, and Edible Oil prices are expected to remain range-bound, while milk prices will likely cool off. EBITDA margin contracted 130bp YoY to 21.9%, the lowest in the past 12 quarters, due to elevated operating costs. We model an EBITDA margin of 23.6% for FY26 and 24.5% for FY27.

* In 1QFY26, the Powdered and Liquid Beverages category remained one of the key growth drivers, delivering strong double-digit growth. Confectionery also recorded high double-digit growth. The Prepared Dishes and Cooking Aids category returned to volume growth, led by double-digit growth in Maggi noodles. The Pet Food business witnessed a strong performance, primarily driven by the Cat portfolio. The Milk Products and Nutrition category delivered a mixed performance, with certain segments growing while others remaining muted.

* Mr Manish Tiwary will assume the role of Chairman and Managing Director of Nestlé India from 1st August, 2025.

* Nestle had a weak start to FY26 on the profitability front due to RM inflation and higher operating costs, driven by investments in manufacturing capabilities. While the enhanced capacity is expected to support long-term demands, it will weigh on margins and return ratios in the near term. Moreover, moderating urban consumption and high food inflation continue to pose risks to near-term recovery. The stock is trading at 69x/60x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR2,400 (based on 60x P/E Jun'27E).

In-line revenue; margins lower than expected

* In-line sales: Nestle’s total revenue rose 5.9% YoY to INR51b (est. INR50.9b) in 1QFY26. Domestic sales witnessed 5.5% YoY growth to INR48.6b, while exports posted 16% YoY growth to INR2.1b, driven by Foods, Coffee, Instant Tea, and Breakfast Cereals, despite commodity headwinds. ? Witnessed volume-led growth in most categories: Nestle indicated that the Prepared Dishes and Cooking Aids, Powdered and Liquid Beverages, and Confectionery categories have returned to volume-led growth, with seven of its top 12 brands recording double-digit growth.

* Commodity weighs on margin: The company mentioned that 1QFY26 was impacted by elevated consumption prices across the commodity portfolio. This resulted in gross margin contracting 250bp YoY to 55.2% (est. 57%). Management indicated that Coffee prices are expected to remain range-bound at current lower levels, while Cocoa and Edible Oil prices have stabilized and are likely to remain range-bound. Milk prices are anticipated to decrease with the onset of a favorable monsoon and flush season.

* Miss on profitability: Employee and other expenses rose 2% YoY each. EBITDA margin contracted 130bp YoY to 21.9%, the lowest in the last 12 quarters (est. 23.3%, 25.6% in 4QFY25). EBITDA remained flat YoY at INR11.1b (est. INR 11.8b). The company incurred higher operational costs due to significant manufacturing expansion over the past seven to eight months. Moreover, borrowings to fund temporary operational cash-flow requirements resulted in higher finance costs during the quarter. Thus, higher depreciation (+39% YoY) and interest (+48% YoY), coupled with lower other income (-90% YoY), hurt profitability. PBT declined 10% YoY to INR9.2b (est. INR10.2b) and Adj. PAT declined 13% YoY to INR6.5b (est. INR7.5b).

Valuation and view

* We cut our EPS estimates for FY26 and FY27 by 4% and 1%, respectively.

* The company’s focus on its RURBAN strategy drove stronger growth in RURBAN markets, with most categories benefiting from improved distribution penetration. Packaged food adoption has increased in tier-2 and rural markets. The company continues to enhance its portfolio through ongoing innovation and premiumization initiatives.

* Nestle’s portfolio remains relatively safe from local competition, requiring limited overhead costs to protect market share. The company has invested ~INR39b in strengthening its manufacturing capabilities to cater to anticipated future demand. However, this will weigh on margins and return ratios in the near term. We model 23.6%/24.5% EBITDA margins for FY26/FY27.

* The stock is trading at 69x/60x FY26/FY27 EPS. Given its expensive valuation, we reiterate our Neutral rating with a TP of INR2,400 (based on 60x P/E Jun'27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)