Buy Tata Consumer Products Ltd for the Target Rs.1,270 by Motilal Oswal Financial Services Ltd

Moderating tea prices to aid margin expansion going forward

Operating performance in line with estimates

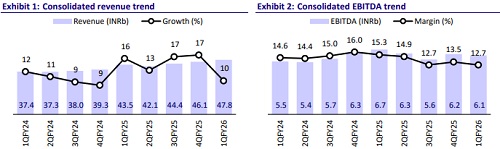

* Tata Consumer Products (TATACONS) reported 10% revenue growth in 1QFY26, while EBIT declined 12% YoY. EBIT was affected by higher input costs in the Branded business (India/international business EBIT down 11%/12% YoY) and declining coffee prices in the non-branded business (EBIT down 33%).

* However, with moderating tea prices and improving product mix (higher sales of premium tea), consol margins are expected to expand from 2QFY26, led by better gross margins in the tea business, as indicated by management. The company has guided for consolidated EBITDA margin to gradually reach ~16% by 3Q.

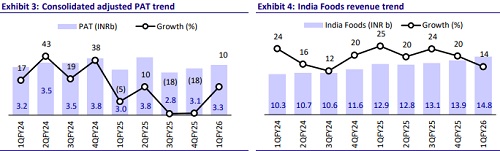

* Factoring in the improving margin trajectory, we increase our FY26/FY27 EBITDA estimates by 7%/3%. We reiterate BUY with an SoTP-based TP of INR1,270.

Operating profitability muted across businesses this quarter

* Consolidated revenue in 1Q grew 10% YoY to ~INR48b (est. in line). EBITDA margin contracted 260bp YoY to 12.7% (est. 13%), led by lower gross margins (down 480bp YoY) at 40.1%. EBITDA declined 9% YoY to INR6.1b (est. in line).

* The Indian branded business grew 11% YoY to INR31b, led by revenue growth of 8%/14% YoY in the Indian branded beverage/Indian food businesses to INR16.5b/INR15.3b. EBIT declined 11% YoY to INR2.9b.

* The core India business saw double-digit growth in both tea and salt. The salt segment’s revenue grew 13% YoY, with 5% growth in volume. The Tata Sampann portfolio grew 27% YoY, led by new launches.

* The RTD segment (NourishCo) witnessed a ~3% YoY decline to ~INR2.7b, driven by trade price corrections, while volumes recorded a moderate growth of 3%, impacted by unfavorable weather conditions. The premium business reported a healthy volume growth of 20% in 1QFY26.

* Growth businesses (including RTD, Capital Foods, and Organic India) reported weak growth this quarter (7% YoY), led by muted growth in RTD and Capital Foods (up 1% YoY), while Organic India grew 31% YoY.

* International branded beverages revenue grew 9% YoY to ~INR11.5b, EBIT declined 12% YoY to INR1.5b, and EBIT margins stood at 13%, down 330bp YoY. The non-branded business revenue increased 7% YoY to ~INR5.4b, while EBIT declined 33% YoY to INR645m.

* Adj. PAT grew 10% YoY to INR3.3b (in line), led by a decrease in finance cost by 64% YoY.

Highlights from the management commentary

* Tea pricing: The tea segment is expected to operate at gross margins of 34-37%, though it currently lags by approximately 10pp. Tea prices declined 13% YoY this quarter and are expected to moderate further, supporting margin expansion. In May, tea production rose 25-30% YoY, and with a normal monsoon expected, the company anticipates further softening in tea prices.

* India branded beverage business: Management expects realization growth to moderate going forward, while volume is likely to pick up to mid-single digit YoY. For FY26, the company maintains its total value growth guidance of 6-8% YoY.

* Growth business: The company expects growth to exceed 30% for growth businesses starting Q2. Stability is already visible in the Capital Foods business, with full normalization anticipated from Q2 onwards.

Valuation and view

* We expect margin to recover in the Indian beverage business due to increasing gross margins in the tea business (led by moderating tea prices) and signs of a decent tea crop growth this harvest season. Further, Growth businesses are expected to show strong traction from Q2 onwards. The International business is expected to maintain a similar performance in FY26.

* The continued synergy benefits from the integration of Capital Foods and Organic India are expected to be a key driver of growth for the Indian food business.

* We expect TATACONS to clock a CAGR of 10%/12%/13% in revenue/EBITDA/PAT during FY25-27. Reiterate BUY with an SoTP-based TP of INR1,270.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)